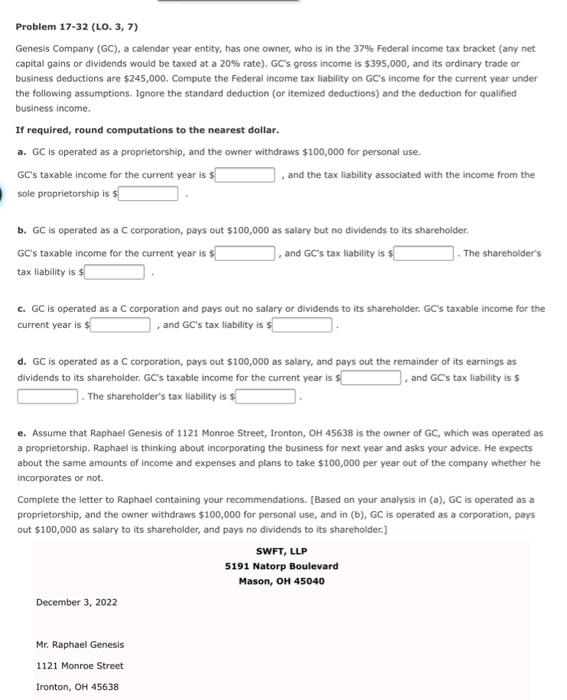

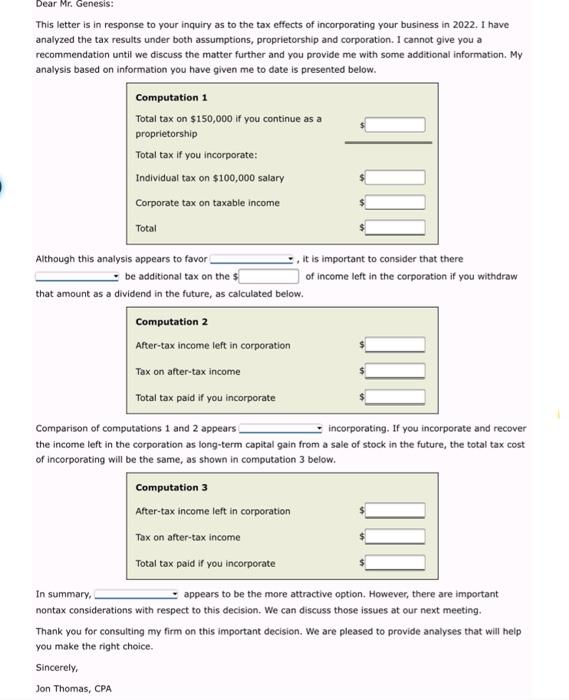

Genesis Company (GC), a calendar year entity, has one owner, who is in the 37% Federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). GCs gross income is $395,000, and its ordinary trade or business deductions are $245,000. Compute the Federal income tax liability an GC's income for the current year under the following assumptions. Ignore the standard deduction (or itemized deductions) and the deduction for qualified business income. If required, round computations to the nearest doltar. a. GC is operated as a proprietorship, and the owner withdraws $100,000 for personal use. GC's taxable income for the current year is $ , and the tax liability associated with the income from the sole proprietorship is $ b. GC is operated as a C corporation, pays out $100,000 as salary but no dividends to its shareholder. GC's taxable income for the current year is $, and GC's tax liability is $. The shareholder's tax liability is I c. GC is operated as a C corporation and pays out no salary or dividends to its shareholder. GC's taxable income for the current year is 5 , and GC's tax liability is $ d. GC is operated as a C corporation, pays out $100,000 as salary, and pays out the remainder of its earnings as dividends to its shareholder. GC's taxable income for the current year is $, and GC's tax liability is $. The shareholder's tax liability is $ e. Assume that Raphael Genesis of 1121 Monroe Street, Ironton, OH45638 is the owner of GC, which was operated as a proprietorship. Raphael is thinking about incorporating the business for next year and asks your advice. He expects about the same amounts of income and expenses and plans to take $100,000 per year out of the company whether he incorporates or not. Complete the letter to Raphael containing your recommendations. [Based on your analysis in (a), GC is operated as a proprietorship, and the owner withdraws $100,000 for personal use, and in (b), GC is operated as a corporation, pays out $100,000 as salary to its shareholder, and pays no dividends to its shareholder.] Dear Mr. Genesis: This letter is in response to your inquiry as to the tax effects of incorporating your business in 2022. I have analyzed the tax results under both assumptions, proprietorship and corporation. I cannot give you a recommendation until we discuss the matter further and you provide me with some additional information. My analysis based on information you have given me to date is presented below. Although this analysis appears to favor , it is important to consider that there be additional tax on the 5 of income left in the corporation if you withdraw that amount as dividend in the future, as calculated below. Comparison of computations 1 and 2 appears incorporating. If you incorporate and recover the income left in the corporation as long-term capital gain from a sale of stock in the future, the total tax cost of incorporating will be the same, as shown in computation 3 below. In summary, appears to be the more attractive option. However, there are important nontax considerations with respect to this decision. We can discuss those issues at our next meeting. Thank you for consulting my firm on this important decision. We are pleased to provide analyses that will help you make the right choice. Sincerely, Jon Thomas, CPA