Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Geoff aged 54 runs a business solely in his own name with $3 million net assets and a $500,000 aggregated annual turnover. Geoff has

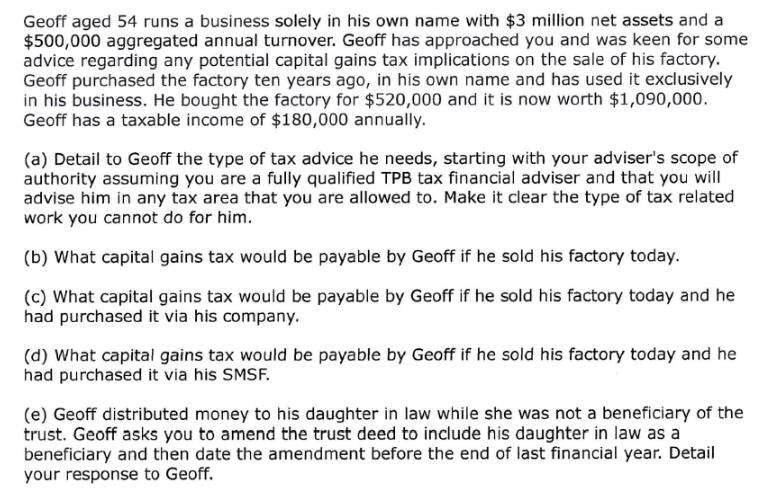

Geoff aged 54 runs a business solely in his own name with $3 million net assets and a $500,000 aggregated annual turnover. Geoff has approached you and was keen for some advice regarding any potential capital gains tax implications on the sale of his factory. Geoff purchased the factory ten years ago, in his own name and has used it exclusively in his business. He bought the factory for $520,000 and it is now worth $1,090,000. Geoff has a taxable income of $180,000 annually. (a) Detail to Geoff the type of tax advice he needs, starting with your adviser's scope of authority assuming you are a fully qualified TPB tax financial adviser and that you will advise him in any tax area that you are allowed to. Make it clear the type of tax related work you cannot do for him. (b) What capital gains tax would be payable by Geoff if he sold his factory today. (c) What capital gains tax would be payable by Geoff if he sold his factory today and he had purchased it via his company. (d) What capital gains tax would be payable by Geoff if he sold his factory today and he had purchased it via his SMSF. (e) Geoff distributed money to his daughter in law while she was not a beneficiary of the trust. Geoff asks you to amend the trust deed to include his daughter in law as a beneficiary and then date the amendment before the end of last financial year. Detail your response to Geoff.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Tax Advice Scope As a fully qualified TPB Tax Practitioners Board tax financial adviser I can prov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started