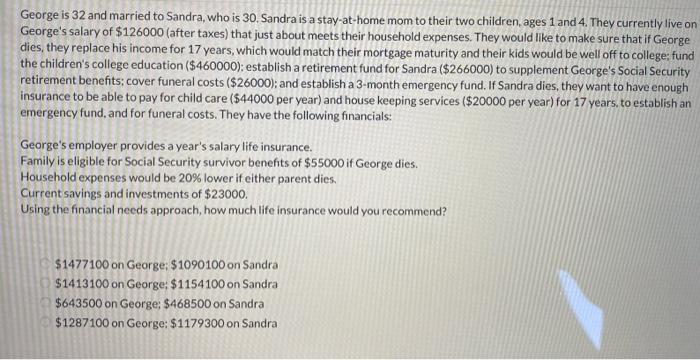

George is 32 and married to Sandra, who is 30. Sandra is a stay-at-home mom to their two children ages 1 and 4. They currently live on George's salary of $126000 (after taxes) that just about meets their household expenses. They would like to make sure that if George dies, they replace his income for 17 years, which would match their mortgage maturity and their kids would be well off to college: fund the children's college education ($460000): establish a retirement fund for Sandra ($266000) to supplement George's Social Security retirement benefits; cover funeral costs ($26000); and establish a 3-month emergency fund. If Sandra dies, they want to have enough insurance to be able to pay for child care (544000 per year) and house keeping services ($20000 per year) for 17 years, to establish an emergency fund, and for funeral costs. They have the following financials: George's employer provides a year's salary life insurance. Family is eligible for Social Security survivor benefits of $55000 if George dies. Household expenses would be 20% lower if either parent dies Current savings and investments of $23000. Using the financial needs approach, how much life insurance would you recommend? $1477100 on George: $1090100 on Sandra $1413100 on George: $1154100 on Sandra $643500 on George: $468500 on Sandra $1287100 on George: $1179300 on Sandra George is 32 and married to Sandra, who is 30. Sandra is a stay-at-home mom to their two children ages 1 and 4. They currently live on George's salary of $126000 (after taxes) that just about meets their household expenses. They would like to make sure that if George dies, they replace his income for 17 years, which would match their mortgage maturity and their kids would be well off to college: fund the children's college education ($460000): establish a retirement fund for Sandra ($266000) to supplement George's Social Security retirement benefits; cover funeral costs ($26000); and establish a 3-month emergency fund. If Sandra dies, they want to have enough insurance to be able to pay for child care (544000 per year) and house keeping services ($20000 per year) for 17 years, to establish an emergency fund, and for funeral costs. They have the following financials: George's employer provides a year's salary life insurance. Family is eligible for Social Security survivor benefits of $55000 if George dies. Household expenses would be 20% lower if either parent dies Current savings and investments of $23000. Using the financial needs approach, how much life insurance would you recommend? $1477100 on George: $1090100 on Sandra $1413100 on George: $1154100 on Sandra $643500 on George: $468500 on Sandra $1287100 on George: $1179300 on Sandra