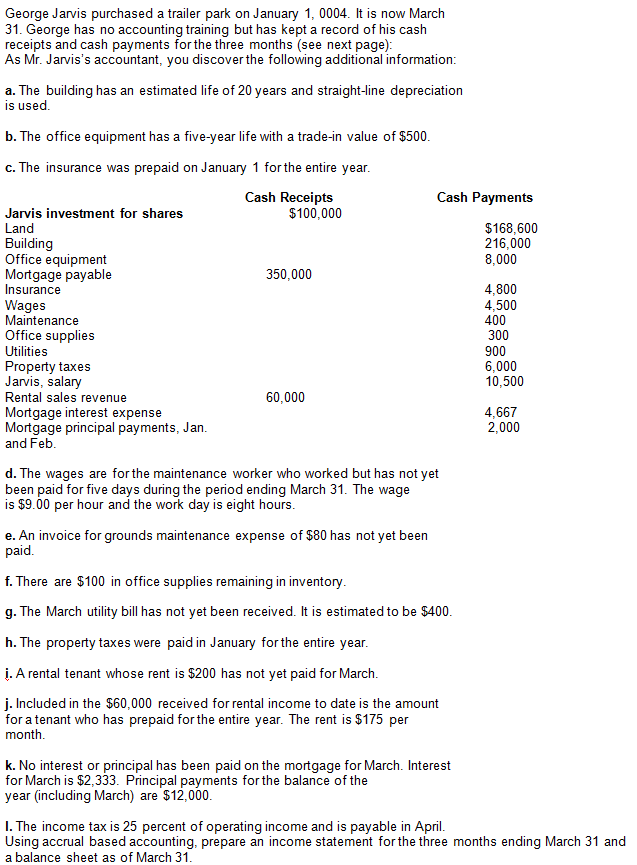

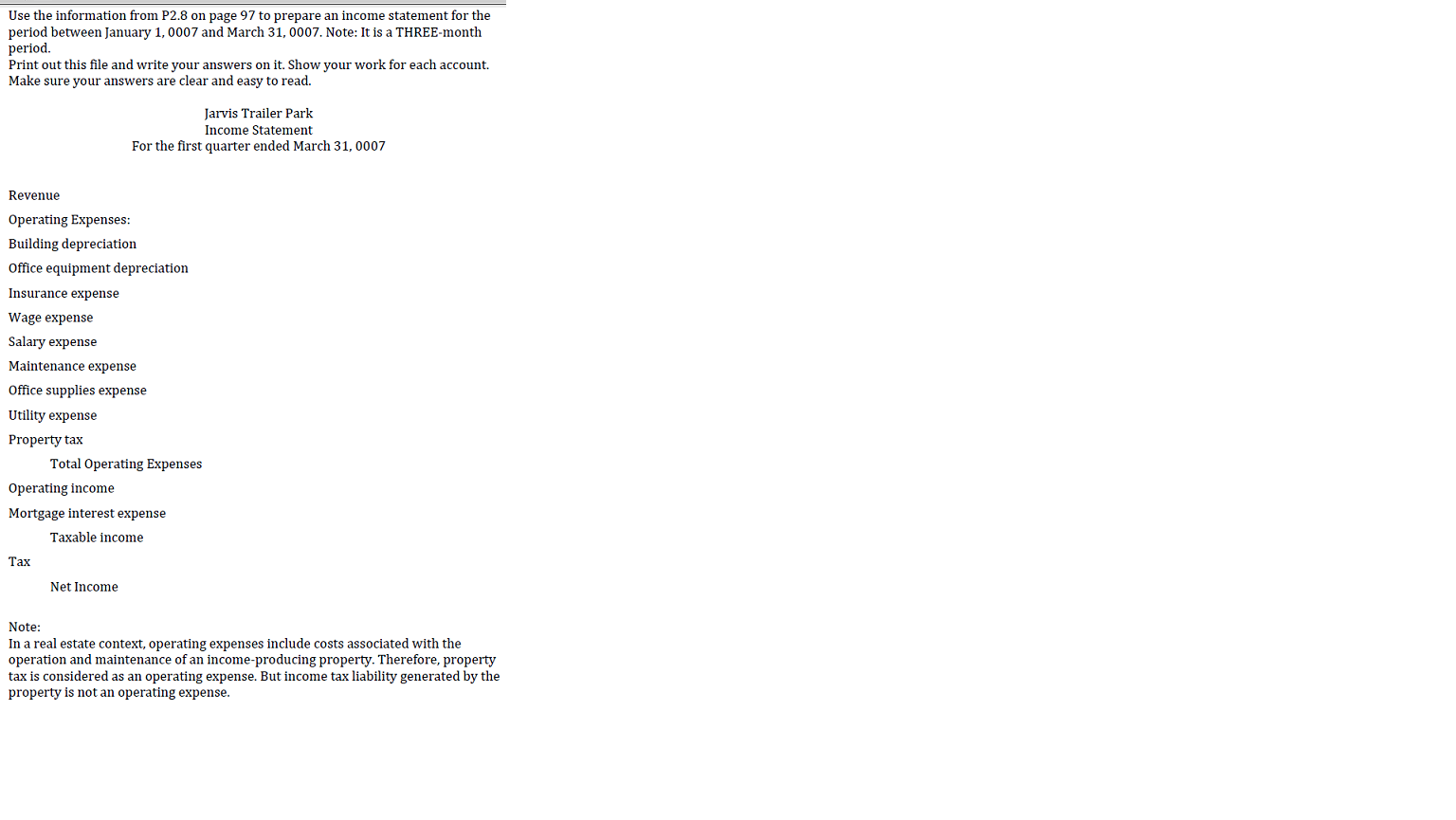

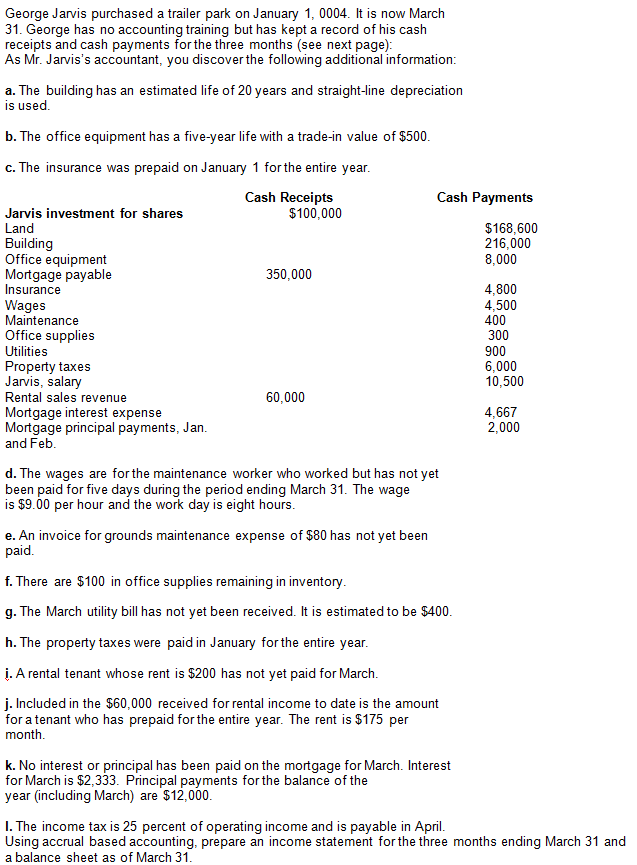

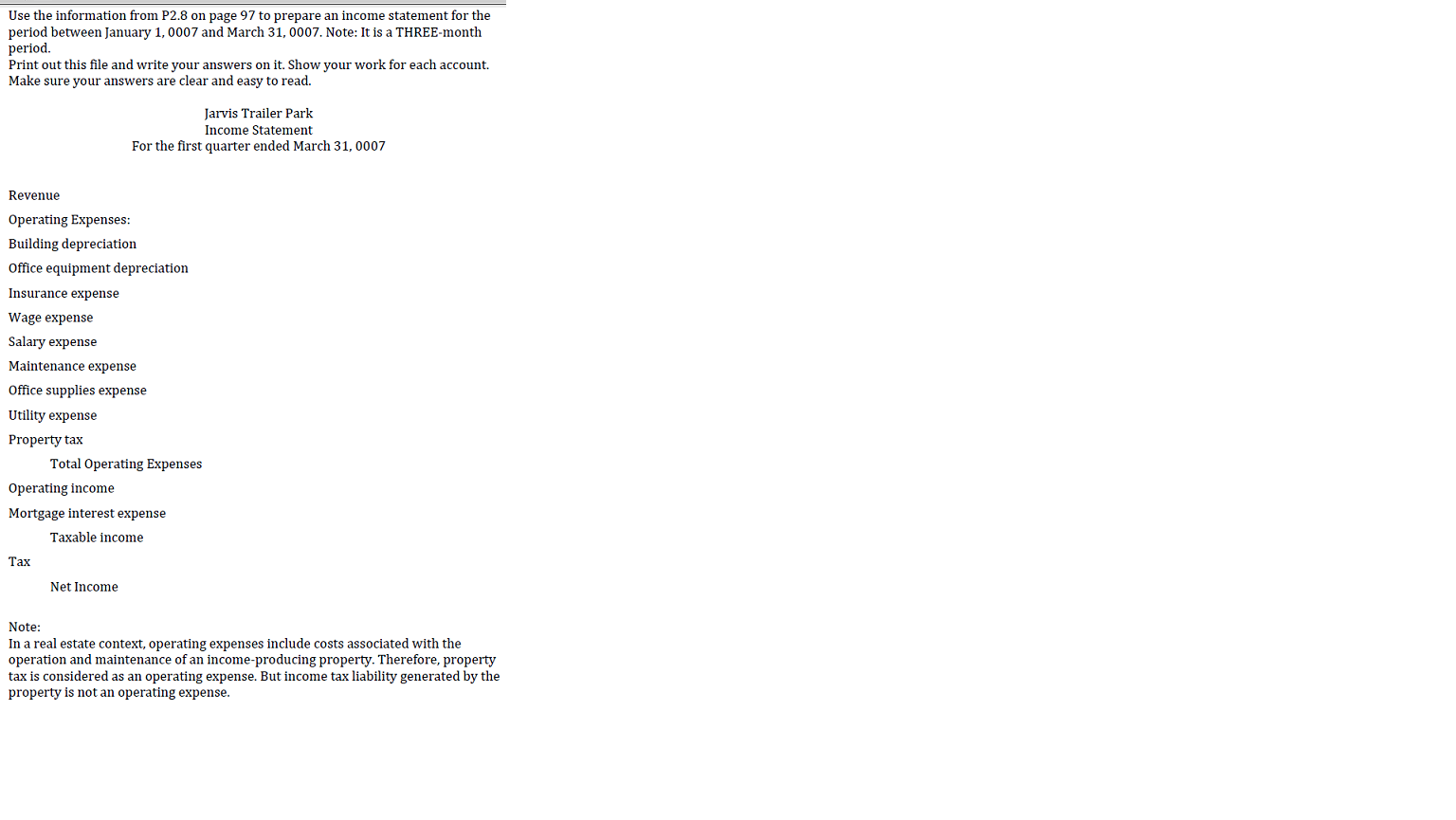

George Jarvis purchased a trailer park on January 1, 0004. It is now March 31. George has no accounting training but has kept a record of his cash receipts and cash payments for the three months (see next page): As Mr. Jarvis's accountant, you discover the following additional information: The building has an estimated life of 20 years and straight-line depreciation is used. The office equipment has a five-year life with a trade-in value of $500. The insurance was prepaid on January 1 for the entire year. The wages are for the maintenance worker who worked but has not yet been paid for five days during the period ending March 31. The wage is $9.00 per hour and the work day is eight hours. An invoice for grounds maintenance expense of $80 has not yet been paid. There are $100 in office supplies remaining in inventory. The March utility bill has not yet been received. It is estimated to be $400. The property taxes were paid in January for the entire year. A rental tenant whose rent is $200 has not yet paid for March. Included in the $60,000 received for rental income to date is the amount for a tenant who has prepaid for the entire year. The rent is $175 per month. No interest or principal has been paid on the mortgage for March. Interest for March is $2,333. Principal payments for the balance of the year (including March) are $12,000. The income tax is 25 percent of operating income and is payable in April. Using accrual based accounting, prepare an income statement for the three months ending March 31 and a balance sheet as of March 31. Use the information from P2.8 on page 97 to prepare an income statement for the period between January 1, 0007 and March 31, 0007. Note: It is a THREE-month period. Print out this file and write your answers on it. Show your work for each account. Make sure your answers are clear and easy to read. Revenue Operating Expenses: Building depreciation Office equipment depreciation Insurance expense Wage expense Salary expense Maintenance expense Office supplies expense Utility expense Property tax Total Operating Expenses Operating income Mortgage interest expense Taxable income Tax Net Income Note: In a real estate context, operating expenses include costs associated with the operation and maintenance of an income-producing property. Therefore, property tax is considered as an operating expense. But income tax liability generated by the property is not an operating expense