Answered step by step

Verified Expert Solution

Question

1 Approved Answer

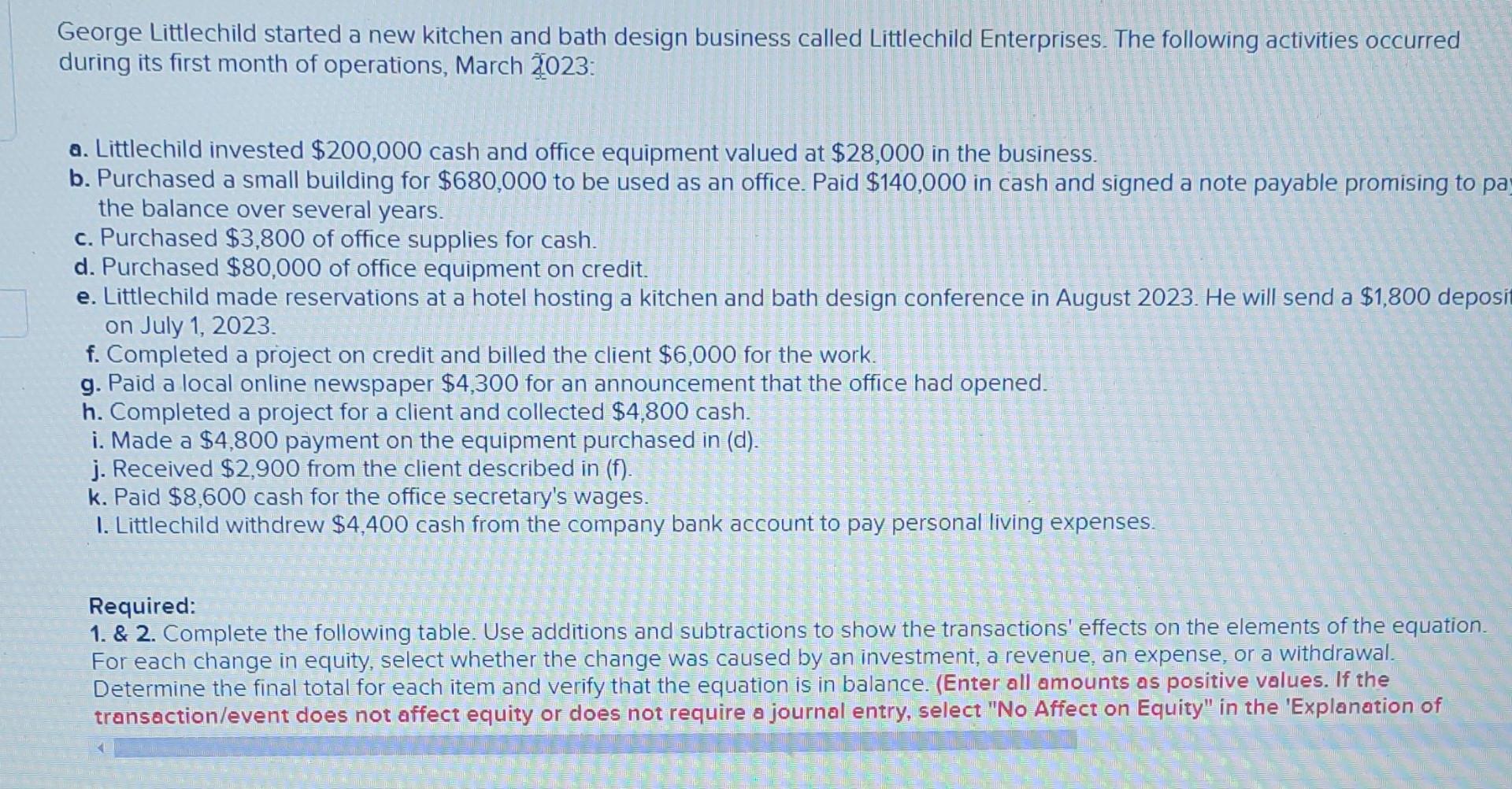

George Littlechild started a new kitchen and bath design business called Littlechild Enterprises. The following activities occurred during its first month of operations, March 2023

George Littlechild started a new kitchen and bath design business called Littlechild Enterprises. The following activities occurred during its first month of operations, March 2023 : a. Littlechild invested $200,000 cash and office equipment valued at $28,000 in the business. b. Purchased a small building for $680,000 to be used as an office. Paid $140,000 in cash and signed a note payable promising to the balance over several years. c. Purchased $3,800 of office supplies for cash. d. Purchased $80,000 of office equipment on credit. e. Littlechild made reservations at a hotel hosting a kitchen and bath design conference in August 2023 . He will send a $1,800 depos on July 1, 2023. f. Completed a project on credit and billed the client $6,000 for the work. g. Paid a local online newspaper $4,300 for an announcement that the office had opened. h. Completed a project for a client and collected $4,800 cash. i. Made a $4,800 payment on the equipment purchased in (d). j. Received $2,900 from the client described in (f). k. Paid $8,600 cash for the office secretary's wages. I. Littlechild withdrew $4,400 cash from the company bank account to pay personal living expenses. Required: 1. \& 2. Complete the following table. Use additions and subtractions to show the transactions' effects on the elements of the equation. For each change in equity, select whether the change was caused by an investment, a revenue, an expense, or a withdrawal. Determine the final total for each item and verify that the equation is in balance. (Enter all amounts as positive values. If the transaction/event does not affect equity or does not require a journal entry, select "No Affect on Equity" in the 'Explanation of George Littlechild started a new kitchen and bath design business called Littlechild Enterprises. The following activities occurred during its first month of operations, March 2023 : a. Littlechild invested $200,000 cash and office equipment valued at $28,000 in the business. b. Purchased a small building for $680,000 to be used as an office. Paid $140,000 in cash and signed a note payable promising to the balance over several years. c. Purchased $3,800 of office supplies for cash. d. Purchased $80,000 of office equipment on credit. e. Littlechild made reservations at a hotel hosting a kitchen and bath design conference in August 2023 . He will send a $1,800 depos on July 1, 2023. f. Completed a project on credit and billed the client $6,000 for the work. g. Paid a local online newspaper $4,300 for an announcement that the office had opened. h. Completed a project for a client and collected $4,800 cash. i. Made a $4,800 payment on the equipment purchased in (d). j. Received $2,900 from the client described in (f). k. Paid $8,600 cash for the office secretary's wages. I. Littlechild withdrew $4,400 cash from the company bank account to pay personal living expenses. Required: 1. \& 2. Complete the following table. Use additions and subtractions to show the transactions' effects on the elements of the equation. For each change in equity, select whether the change was caused by an investment, a revenue, an expense, or a withdrawal. Determine the final total for each item and verify that the equation is in balance. (Enter all amounts as positive values. If the transaction/event does not affect equity or does not require a journal entry, select "No Affect on Equity" in the 'Explanation of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started