Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Georgia owns all of Peach Corporation's stock. Peach pays her a $70,000 salary, which reduces its before-tax profit to $30,000. Peach distributes all of its

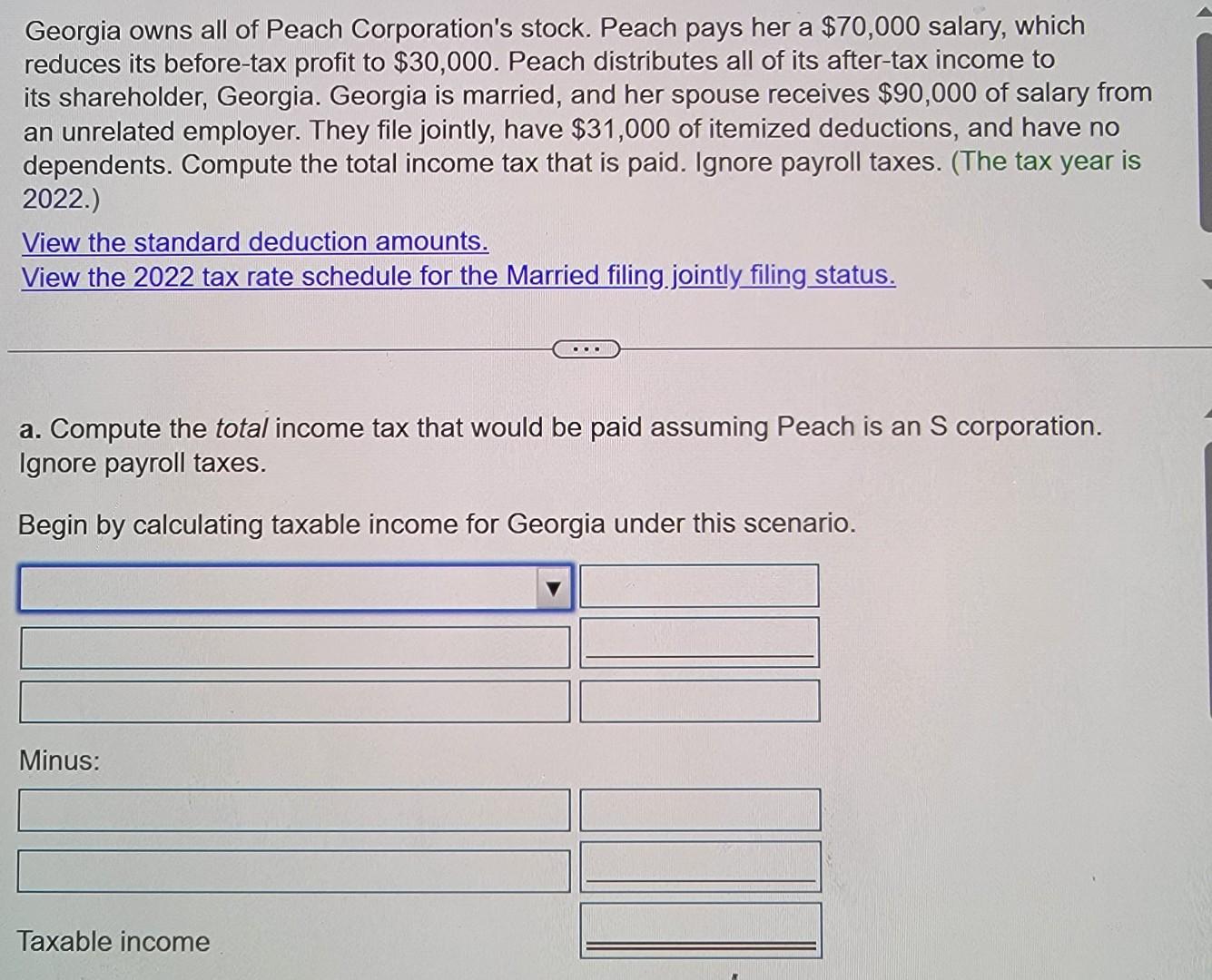

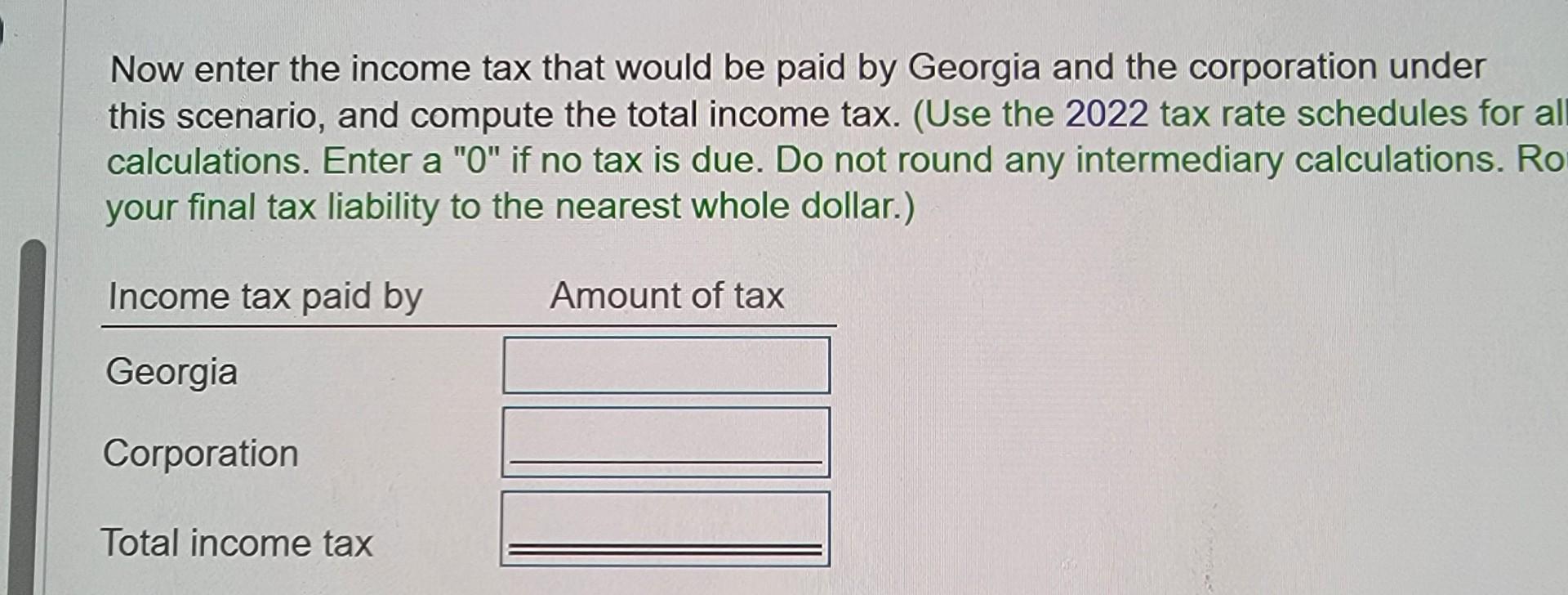

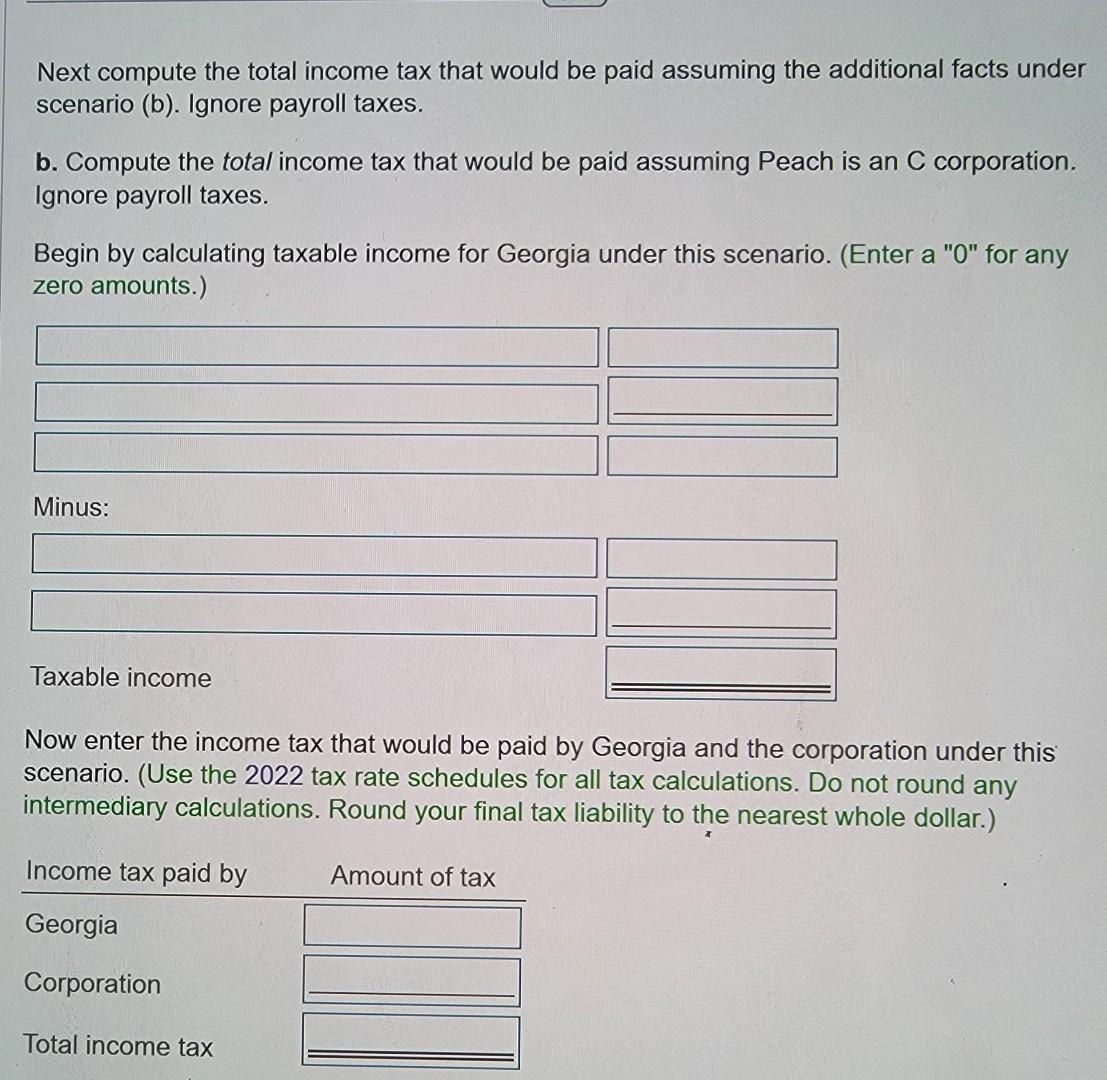

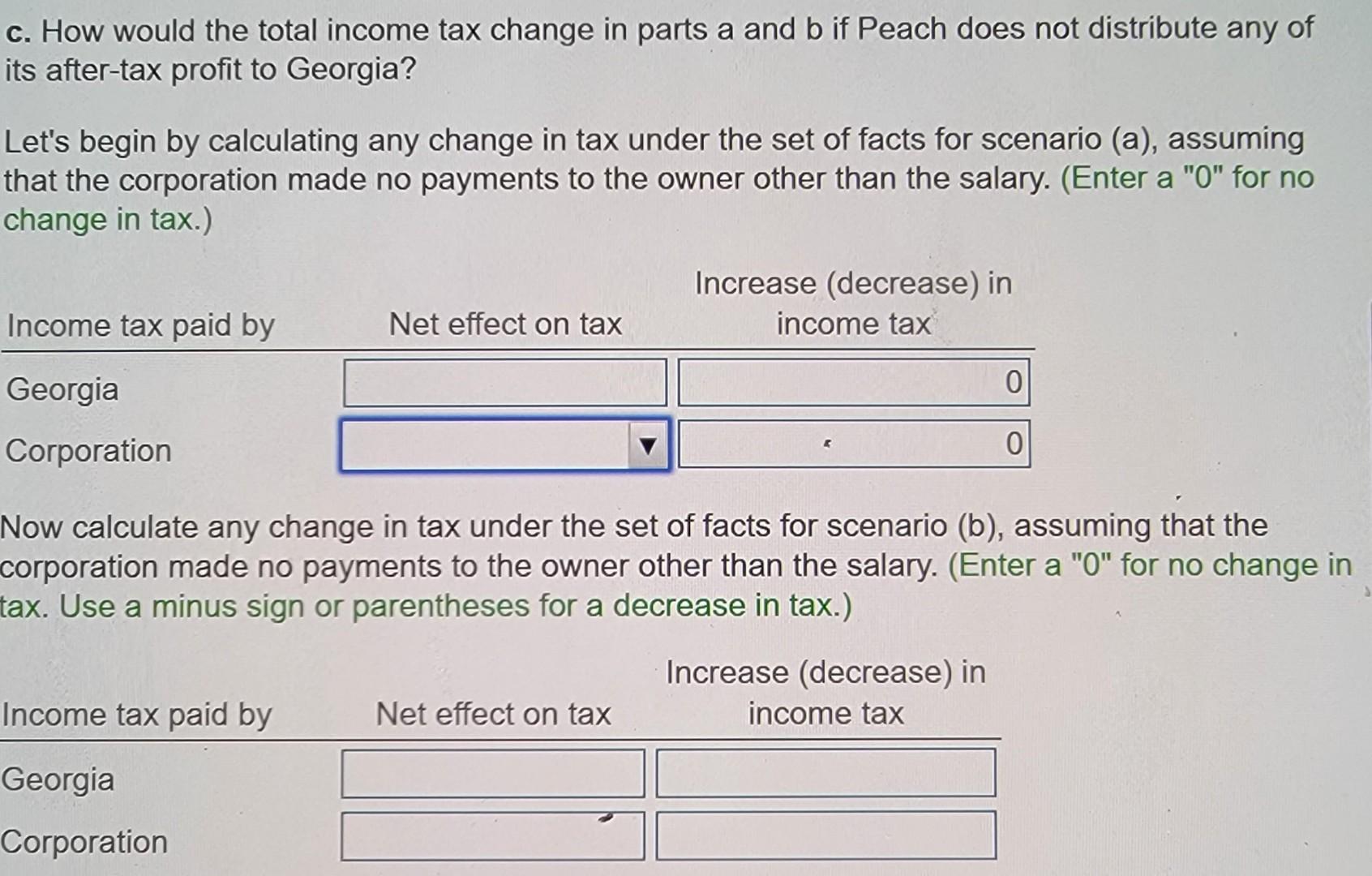

Georgia owns all of Peach Corporation's stock. Peach pays her a $70,000 salary, which reduces its before-tax profit to $30,000. Peach distributes all of its after-tax income to its shareholder, Georgia. Georgia is married, and her spouse receives $90,000 of salary from an unrelated employer. They file jointly, have $31,000 of itemized deductions, and have no dependents. Compute the total income tax that is paid. Ignore payroll taxes. (The tax year is 2022.) View the standard deduction amounts. View the 2022 tax rate schedule for the Married filing. jointly filing status. a. Compute the total income tax that would be paid assuming Peach is an S corporation. lgnore payroll taxes. Now enter the income tax that would be paid by Georgia and the corporation under this scenario, and compute the total income tax. (Use the 2022 tax rate schedules for a calculations. Enter a "0" if no tax is due. Do not round any intermediary calculations. Ro your final tax liability to the nearest whole dollar.) Next compute the total income tax that would be paid assuming the additional facts under scenario (b). Ignore payroll taxes. b. Compute the total income tax that would be paid assuming Peach is an C corporation. Ignore payroll taxes. Begin by calculating taxable income for Georgia under this scenario. (Enter a "0" for any zero amounts.) Minus: Taxable income Now enter the income tax that would be paid by Georgia and the corporation under this scenario. (Use the 2022 tax rate schedules for all tax calculations. Do not round any intermediary calculations. Round your final tax liability to the nearest whole dollar.) c. How would the total income tax change in parts a and b if Peach does not distribute any of its after-tax profit to Georgia? Let's begin by calculating any change in tax under the set of facts for scenario (a), assuming that the corporation made no payments to the owner other than the salary. (Enter a "0" for no change in tax.) Now calculate any change in tax under the set of facts for scenario (b), assuming that the corporation made no payments to the owner other than the salary. (Enter a "0" for no change in tax. Use a minus sign or parentheses for a decrease in tax.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started