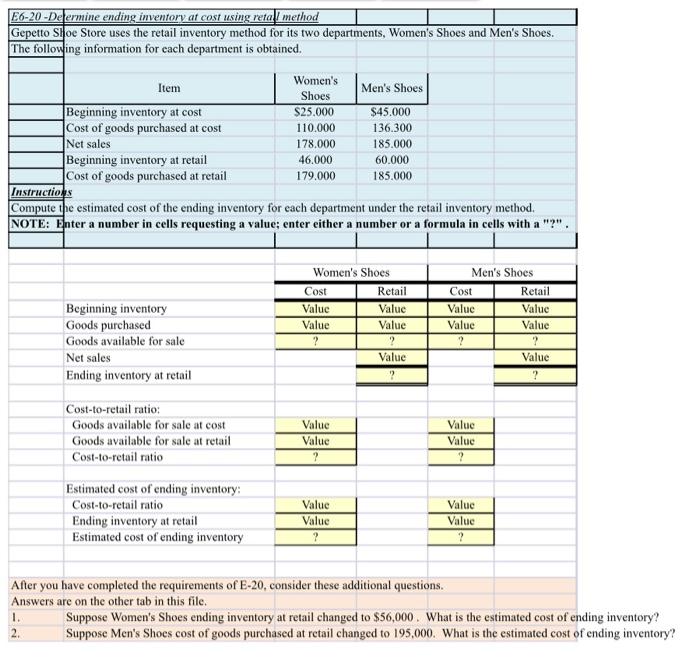

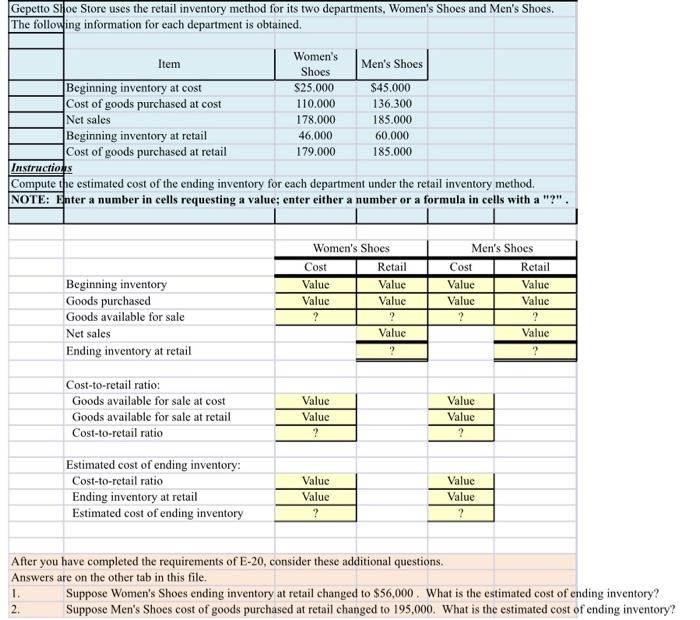

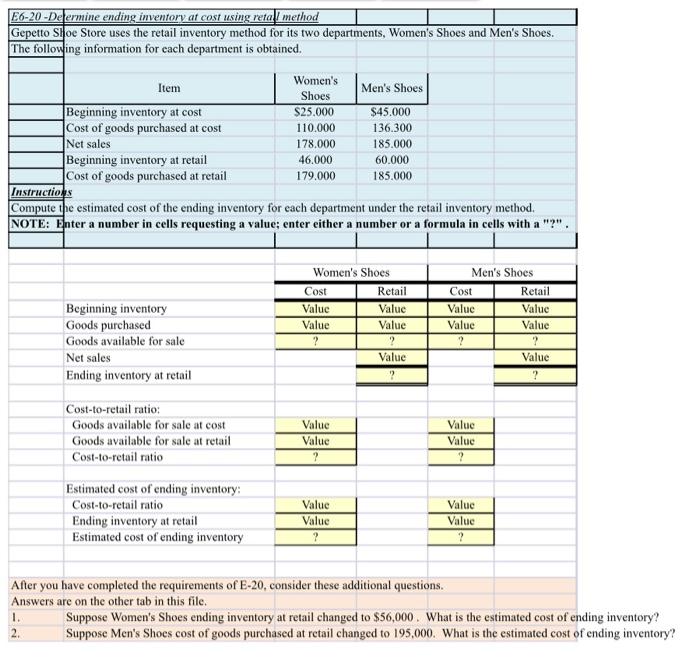

Gepetto Shoe Store uses the retail inventory method for its two departments, Women's Shoes and Men's Shoes | The following information for each department is obtained. | |

. | | | | | |

E6-20-Deermine ending inventory at cost using retall method Gepetto Shoe Store uses the retail inventory method for its two departments, Women's Shoes and Men's Shoes. The following information for each department is obtained. Women's Item Men's Shoes Shoes Beginning inventory at cost S25.000 $45.000 Cost of goods purchased at cost 110.000 136.300 Net sales 178,000 185.000 Beginning inventory at retail 46.000 60.000 Cost of goods purchased at retail 179.000 185.000 Instructies Compute the estimated cost of the ending inventory for each department under the retail inventory method. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". Beginning inventory Goods purchased Goods available for sale Net sales Ending inventory at retail Women's Shoes Cost Retail Value Value Value Value 2 Value Men's Shoes Cost Retail Value Value Value Value ? Value Cost-to-retail ratio: Goods available for sale at cost Goods available for sale at retail Cost-to-retail ratio Value Value ? Value Value Estimated cost of ending inventory: Cost-to-retail ratio Ending inventory at retail Estimated cost of ending inventory Value Value ? Value Value After you have completed the requirements of E-20, consider these additional questions. Answers are on the other tab in this file. Suppose Women's Shoes ending inventory at retail changed to $56,000. What is the estimated cost of ending inventory? 2. Suppose Men's Shoes cost of goods purchased at retail changed to 195,000. What is the estimated cost of ending inventory? 1. Gepetto Shoe Store uses the retail inventory method for its two departments, Women's Shoes and Men's Shoes. The following information for each department is obtained. Women's Item Men's Shoes Shoes Beginning inventory at cost $25.000 $45.000 Cost of goods purchased at cost 110.000 136.300 Net sales 178.000 185.000 Beginning inventory at retail 46,000 60.000 Cost of goods purchased at retail 179.000 185.000 Instructions Compute the estimated cost of the ending inventory for each department under the retail inventory method. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?" Beginning inventory Goods purchased Goods available for sale Net sales Ending inventory at retail Women's Shoes Cost Retail Value Value Value Value 2 ? Value Men's Shoes Cost Retail Value Value Value Value ? ? Value Cost-to-retail ratio: Goods available for sale at cost Goods available for sale at retail Cost-to-retail ratio Value Value ? Value Value ? Estimated cost of ending inventory: Cost-to-retail ratio Ending inventory at retail Estimated cost of ending inventory Value Value ? Value Value After you have completed the requirements of E-20, consider these additional questions. Answers are on the other tab in this file. 1. Suppose Women's Shoes ending inventory at retail changed to $56,000. What is the estimated cost of ending inventory? 2. Suppose Men's Shoes cost of goods purchased at retail changed to 195,000. What is the estimated cost of ending inventory