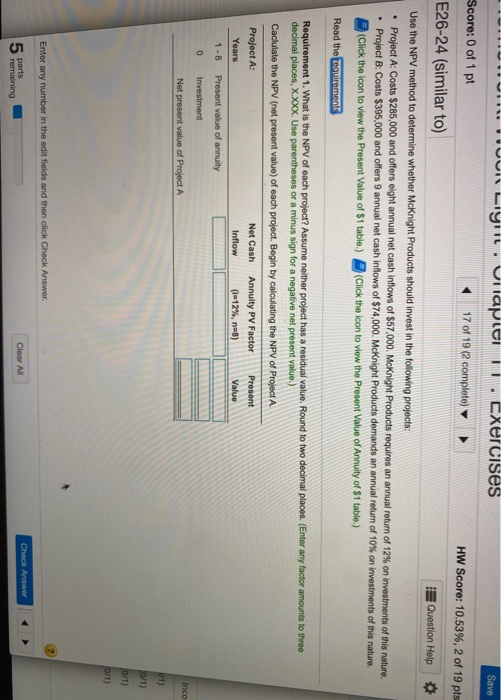

ght annual net cash inflows of $57,000. McKnight Products requires an annual retu annual net cash inflows of $74,000. Mcknight Products demands an annual return lue of $1 table.) (Click the icon to view the Present Value of Annuity of $1 table. ch project? Assume neither project has a residual value. Round to two decimal places. (E s or minus sian for a negative natnresant value 0 Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places. Print Done fields and then click Check Answer Clear All c --UUN Lyriu. Unaple. cxercises Save Score: 0 of 1 pt 17 of 19 (2 complete) HW Score: 10.53%, 2 of 19 pts E26-24 (similar to) Question Help Use the NPV method to determine whether Mcknight Products should invest in the following projects: Project A: Costs $285,000 and offers eight annual net cash inflows of $57,000. McKnight Products requires an annual return of 12% on investments of this nature. Project B: Costs $395,000 and offers 9 annual net cash inflows of $74,000. McKnight Products demands an annual return of 10% on investments of this nature. (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of Annuity of $1 table.) Read the requirements Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caciulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Net Cash Annuity PV Factor Present Years Inflow (i=12%, neB) Value Present value of annuity 0 Investment Net present value of Project A 1-8 Inco 1) 0/1) 0/1) 0/1) Enter any number in the edit fields and then click Check Answer Check Answer Clear All 5 parts remaining