Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gibson Company's income statement information follows: Net sales Income before interest and taxes Net income after taxes Interest expense Stockholders' equity, December 31 (Year

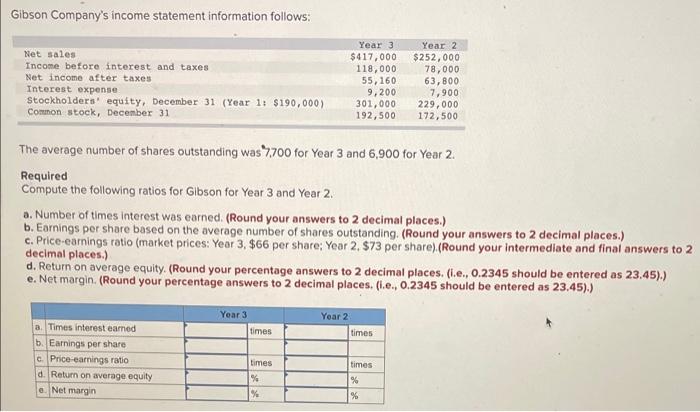

Gibson Company's income statement information follows: Net sales Income before interest and taxes Net income after taxes Interest expense Stockholders' equity, December 31 (Year 1: $190,000) Common stock, December 31 Year 3 $417,000 118,000 55,160 9,200 301,000 192,500 Year 2 $252,000 78,000 63,800 7,900 229,000 172,500 The average number of shares outstanding was 7,700 for Year 3 and 6,900 for Year 2. Required Compute the following ratios for Gibson for Year 3 and Year 2. a. Number of times interest was earned. (Round your answers to 2 decimal places.) b. Earnings per share based on the average number of shares outstanding. (Round your answers to 2 decimal places.) c. Price-earnings ratio (market prices: Year 3, $66 per share; Year 2, $73 per share).(Round your intermediate and final answers to 2 decimal places.) d. Return on average equity. (Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) e. Net margin. (Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Year 3 Year 2 a. Times interest eamed times times b. Earnings per share c Price-earnings ratio d. Return on average equity times times e. Net margin

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Year 3 Year 2 a Times interest earned b Earnings per share c Priceearning ratio d Retu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started