Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Firm is completing the accounting process for the year just ended, December 31, Year 1. The following data with respect to adjusting entries

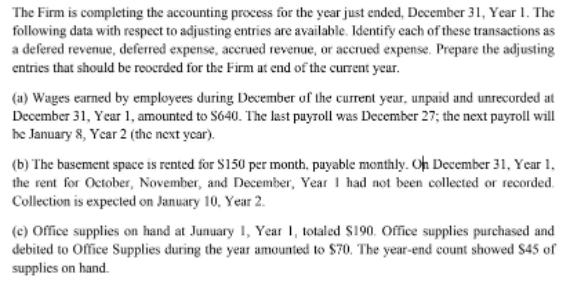

The Firm is completing the accounting process for the year just ended, December 31, Year 1. The following data with respect to adjusting entries are available. Identify each of these transactions as a defered revenue, deferred expense, accrued revenue, or accrued expense. Prepare the adjusting entries that should be reocrded for the Firm at end of the current year. (a) Wages earned by employees during December of the current year, unpaid and unrecorded at December 31, Year 1, amounted to S640. The last payroll was December 27; the next payroll will he January 8, Ycar 2 (the next ycar). (b) The basement space is rented for $150 per month, payable monthly. Oh December 31, Year 1, the rent for October, November, and December, Year I had not been collected or recorded. Collection is expected on January 10, Year 2. (e) Office supplies on hand at Junuary 1, Year I, totaled S190, Office supplies purchased and debited to Office Supplies during the year amounted to S70. The year-end count showed $45 of supplies on hand. Problem 4 (20 points) Fill in boxes highlighted. If you want, include how you get each in the optional explanation space below. (a) Type of transaction = Adjusting entry: Enter account names next to debit (Dr.)/credit (Cr.), and dollar, Dr. Cr Include here if you want to further explain your work (optional): (b) Type of transaction = Adjusting entry: Enter account names next to debit (Dr.)/credit (Cr.), and dollar. Dr. Cr. Include here if you want to further explain your work (optional): (c) Type of transaction = Adjusting entry: Enter account names next to debit (Dr.)/credit (Cr.), and dollar, Dr. 2$ Cr. Include here if you want to further explain your work (optional):

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Type of transaction Accrued expense Journal entry December 31 Year 1 Debit Wages expense AC Dr ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started