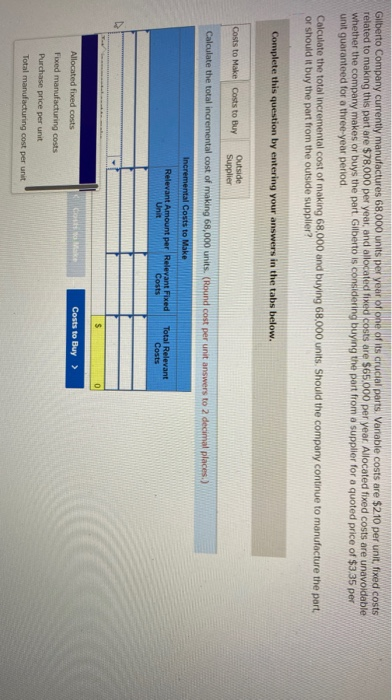

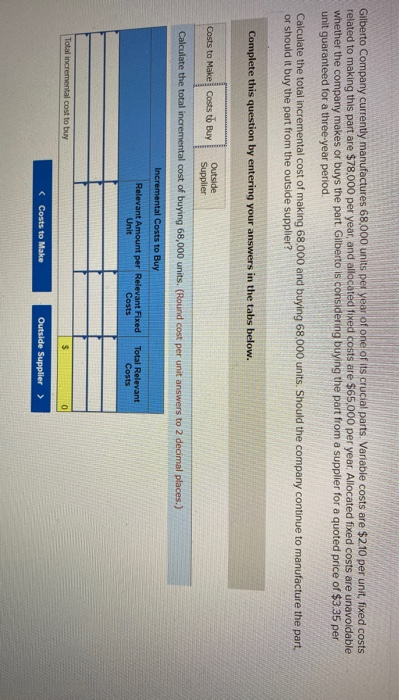

Gilberto Company currently manufactures 68,000 units per year of one of its crucial parts, Variable costs are $2.10 per unit, fixed costs related to making this part are $78,000 per year, and allocated fixed costs are $65.000 per year. Allocated fixed costs are unavoidable whether the company makes or buys the part. Gilberto is considering buying the part from a supplier for a quoted price of $335 per unit guaranteed for a three-year period Calculate the total incremental cost of making 68,000 and buying 68,000 units. Should the company continue to manufacture the part. or should it buy the part from the outside supplier? Complete this question by entering your answers in the tabs below. Costs to Make Costs to Buy Outside Supplier Calculate the total incremental cost of making 68,000 units. (Round cost per unit answers to 2 decimal places) Incremental Costs to Make Relevant Amount per Relevant Fixed Unit costs Total Relevant Costs Costs to Buy > Allocated fixed costs Foxed manufacturing costs Purchase price per unit Total manufacturing cost per unit Gilberto Company currently manufactures 68.000 units per year of one of its crucial parts. Variable costs are $2.10 per unit, fixed costs related to making this part are $78,000 per year, and allocated fixed costs are $65,000 per year Allocated fixed costs are unavoidable whether the company makes or buys the part Gilberto is considering buying the part from a supplier for a quoted price of $3.35 per unit guaranteed for a three-year period Calculate the total incremental cost of making 68,000 and buying 68,000 units. Should the company continue to manufacture the part, or should it buy the part from the outside supplier? Complete this question by entering your answers in the tabs below. Costs to Make Costs to Buy Outside Supplier Calculate the total incremental cost of buying 68,000 units. (Round cost per unit answers to 2 decimal places.) Incremental Costs to Buy Relevant Amount per Relevant Fixed Costs Total Relevant Costs Unit PL Total incremental cost to buy

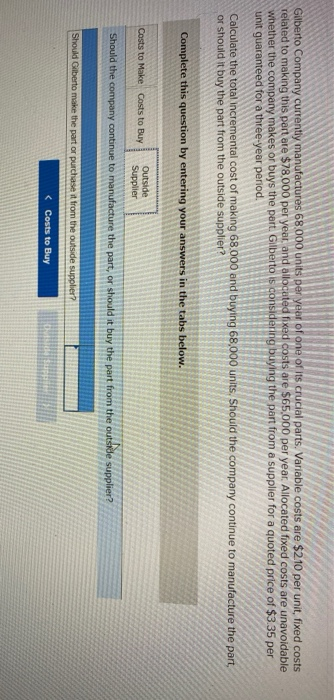

Gilberto Company currently manufactures 68 000 units per year of one of its crucial parts. Variable costs are $2.10 per unit, fixed costs related to making this part are $78,000 per year, and allocated fixed costs are $65,000 per year. Allocated fixed costs are unavoidable whether the company makes or buys the part. Gilberto is considering buying the part from a supplier for a quoted price of $3.35 per unit guaranteed for a three-year period. Calculate the total incremental cost of making 68.000 and buying 68,000 units. Should the company continue to manufacture the part, or should it buy the part from the outside supplier? Complete this question by entering your answers in the tabs below. Costs to Make Costs to Buy Outside Supplier Should the company continue to manufacture the part, or should it buy the part from the outside supplier? Should Gilberto make the part or purchase it from the outside supplier?