Question

Give explanation also. Sebb Co runs a unit that suffers a massive drop in income due to the failure of its technology on 1 January

Give explanation also.

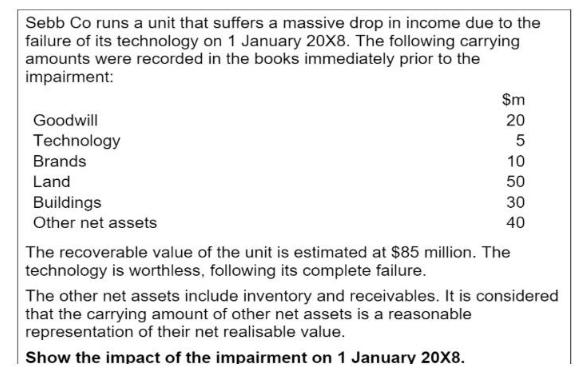

Give explanation also. Sebb Co runs a unit that suffers a massive drop in income due to the failure of its technology on 1 January 20X8. The following carrying amounts were recorded in the books immediately prior to the impairment: Goodwill Technology Brands Land Buildings Other net assets Sm 20 5 10 50 30 40 The recoverable value of the unit is estimated at $85 million. The technology is worthless, following its complete failure. The other net assets include inventory and receivables. It is considered that the carrying amount of other net assets is a reasonable representation of their net realisable value. Show the impact of the impairment on 1 January 20X8.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Impairment occurs when the carrying amount of an asset or a cashgenerating unit exceeds its recoverable amount In this case Sebb Cos technology is now ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Accounting

Authors: Timothy Doupnik, Hector Perera

3rd Edition

978-0078110955, 0078110955

Students also viewed these Business Communication questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App