Answered step by step

Verified Expert Solution

Question

1 Approved Answer

give me aswer as soon as possible Santosh Plasales inc purchased a new machine one year ago at a cost of 560,000 . Althagh the

give me aswer as soon as possible

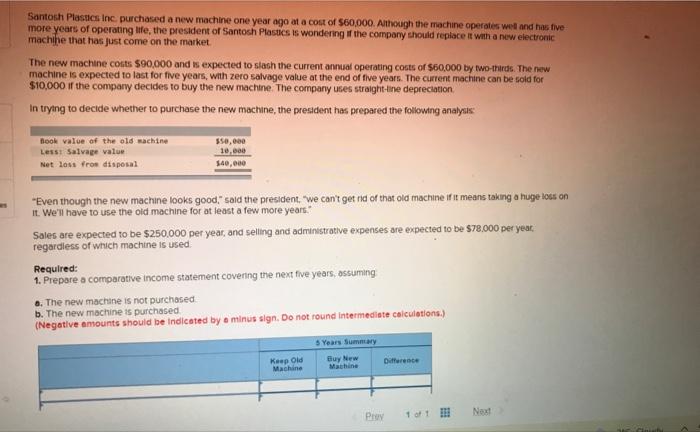

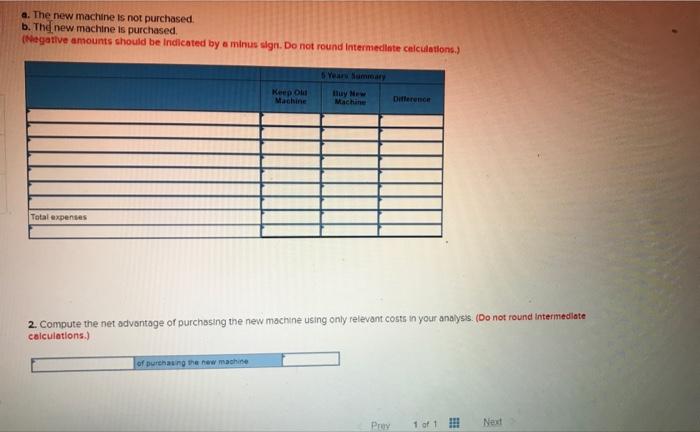

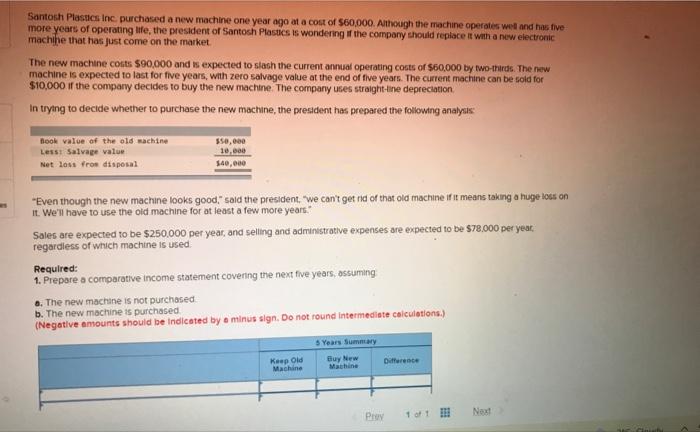

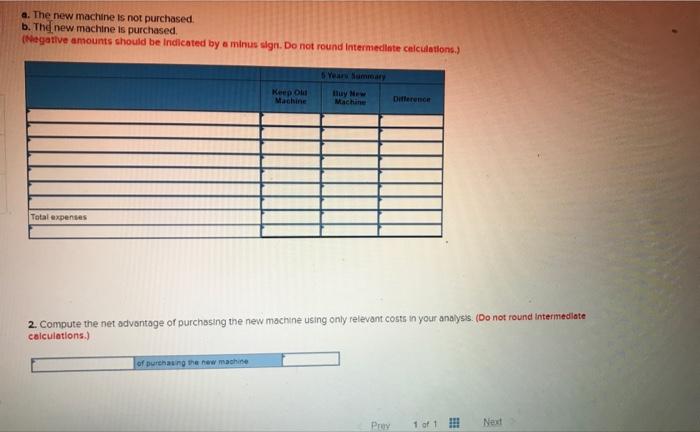

Santosh Plasales inc purchased a new machine one year ago at a cost of 560,000 . Althagh the machine operates well and has five more years of operatung life, the president of Santosh Plasucs is wondering if the company should replace it with a new electronic machibe that has just come on the market. The new machine coits $90,000 and s expected to slash the current annual operating costs of $60,000 by twothirds. The new machine is expected to last for five years, with zero salvage value at the end of five years. The current machine can be sold for $10,000 if the compary decides to buy the new machine. The company uses straightithe depreciation. In tryang to decide whether to purchase the new machine, the president has prepared the following analyas: "Even though the new machine looks good," said the president, "we can' get na of that old machine if it means taking a huge loss on it. Weil have to use the old machine for at least a few more years." Sales are expected to be $250.000 per year, and selling and administrative expenses are expected to be $78.000 per year; regardless of which machine is used. Required: 1. Prepare a comparative income statement covening the next five years; assuming a. The new machane is not purchased b. The new machine is purchased (Necgatlve enounts should be Indicated by o minus sign. Do not round intermediate calculations.) a. The new machine is not purchased. b. Thd new machine is purchased. (hegative amounts should be Indicated by a minus sign. Do not round intermedlite caiculations.) 2. Compute the net advontage of purchasing the new machine using only relevant costs in your analysis. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started