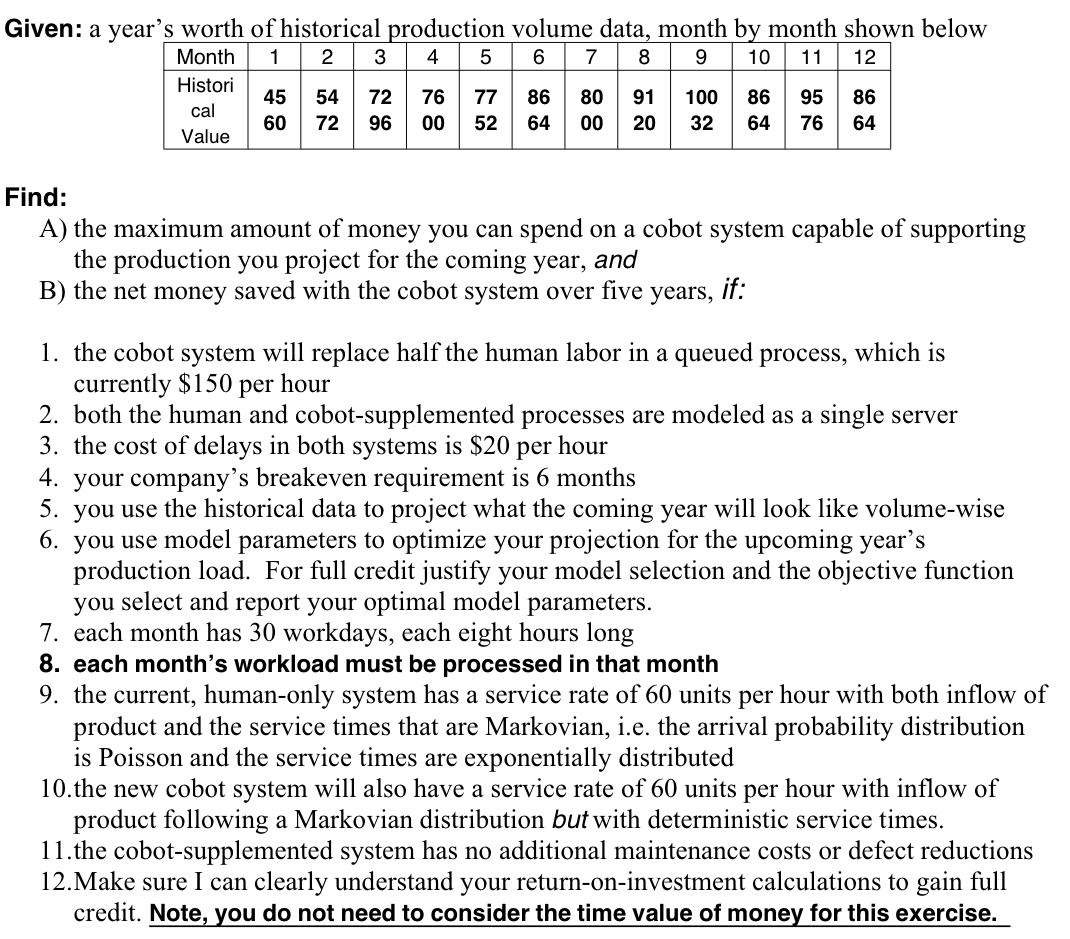

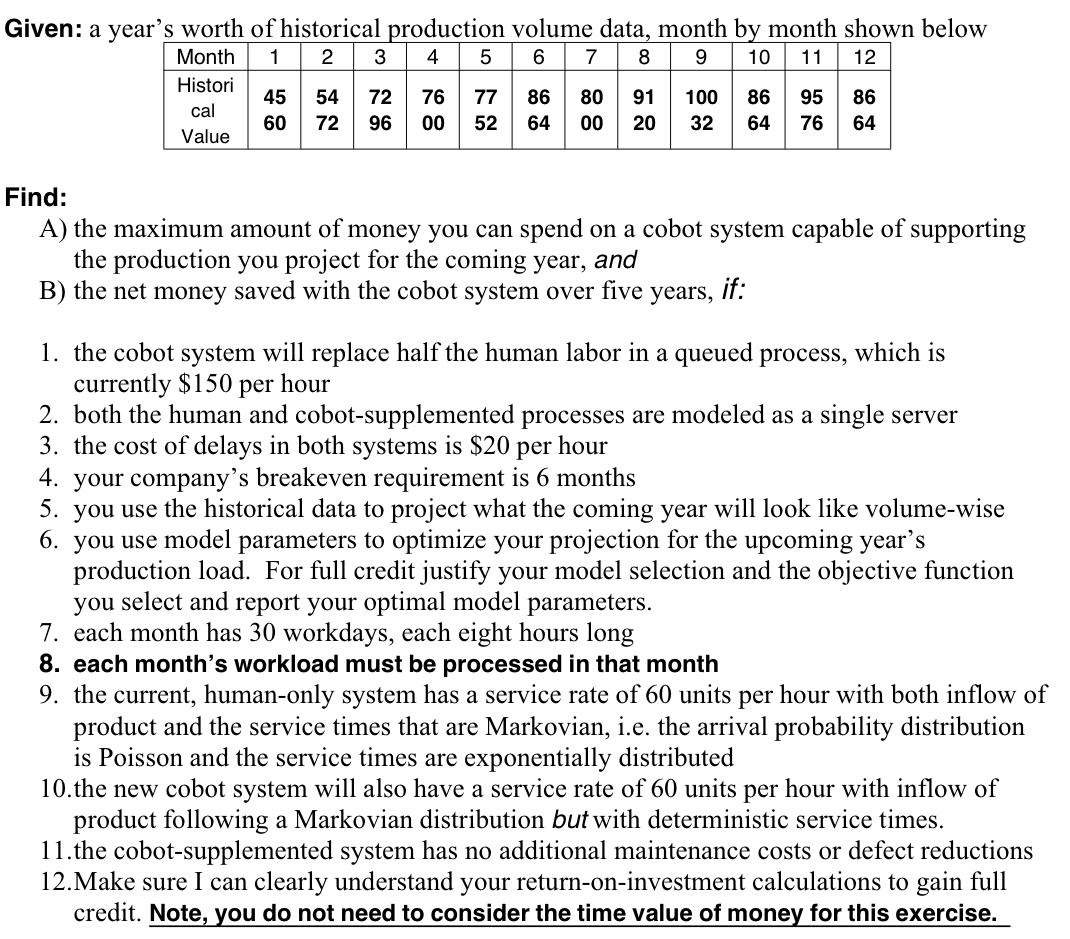

Given: a year's worth of historical production volume data, month by month shown below Month 12 3 4 5 6 7 8 9 10 11 12 Histori 45 54 72 76 77 86 80 91 100 86 95 86 cal 60 72 96 00 52 64 00 20 32 64 76 64 Value Find: A) the maximum amount of money you can spend on a cobot system capable of supporting the production you project for the coming year, and B) the net money saved with the cobot system over five years, if: 1. the cobot system will replace half the human labor in a queued process, which is currently $150 per hour 2. both the human and cobot-supplemented processes are modeled as a single server 3. the cost of delays in both systems is $20 per hour 4. your company's breakeven requirement is 6 months 5. you use the historical data to project what the coming year will look like volume-wise 6. you use model parameters to optimize your projection for the upcoming year's production load. For full credit justify your model selection and the objective function you select and report your optimal model parameters. 7. each month has 30 workdays, each eight hours long 8. each month's workload must be processed in that month 9. the current, human-only system has a service rate of 60 units per hour with both inflow of product and the service times that are Markovian, i.e. the arrival probability distribution is Poisson and the service times are exponentially distributed 10.the new cobot system will also have a service rate of 60 units per hour with inflow of product following a Markovian distribution but with deterministic service times. 11.the cobot-supplemented system has no additional maintenance costs or defect reductions 12. Make sure I can clearly understand your return-on-investment calculations to gain full credit. Note, you do not need to consider the time value of money for this exercise. Given: a year's worth of historical production volume data, month by month shown below Month 12 3 4 5 6 7 8 9 10 11 12 Histori 45 54 72 76 77 86 80 91 100 86 95 86 cal 60 72 96 00 52 64 00 20 32 64 76 64 Value Find: A) the maximum amount of money you can spend on a cobot system capable of supporting the production you project for the coming year, and B) the net money saved with the cobot system over five years, if: 1. the cobot system will replace half the human labor in a queued process, which is currently $150 per hour 2. both the human and cobot-supplemented processes are modeled as a single server 3. the cost of delays in both systems is $20 per hour 4. your company's breakeven requirement is 6 months 5. you use the historical data to project what the coming year will look like volume-wise 6. you use model parameters to optimize your projection for the upcoming year's production load. For full credit justify your model selection and the objective function you select and report your optimal model parameters. 7. each month has 30 workdays, each eight hours long 8. each month's workload must be processed in that month 9. the current, human-only system has a service rate of 60 units per hour with both inflow of product and the service times that are Markovian, i.e. the arrival probability distribution is Poisson and the service times are exponentially distributed 10.the new cobot system will also have a service rate of 60 units per hour with inflow of product following a Markovian distribution but with deterministic service times. 11.the cobot-supplemented system has no additional maintenance costs or defect reductions 12. Make sure I can clearly understand your return-on-investment calculations to gain full credit. Note, you do not need to consider the time value of money for this exercise