Answered step by step

Verified Expert Solution

Question

1 Approved Answer

given assumptions project out the appropriate line items for the inclme statement abs balance sheet projection using the modified precent of sales method ch Predagle

given assumptions project out the appropriate line items for the inclme statement abs balance sheet projection using the modified precent of sales method

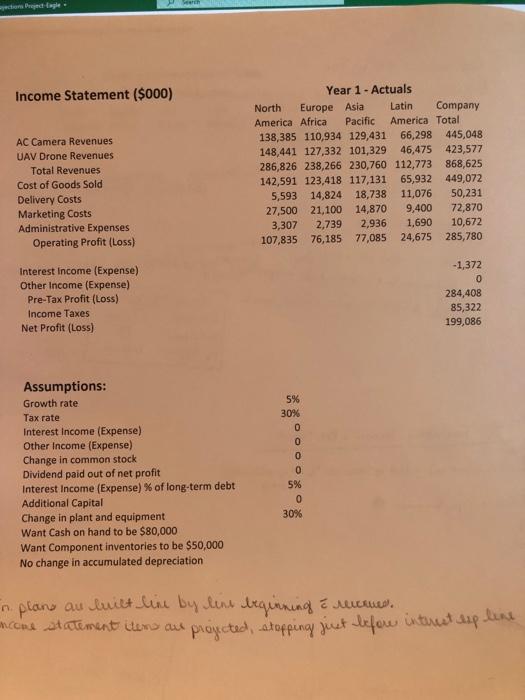

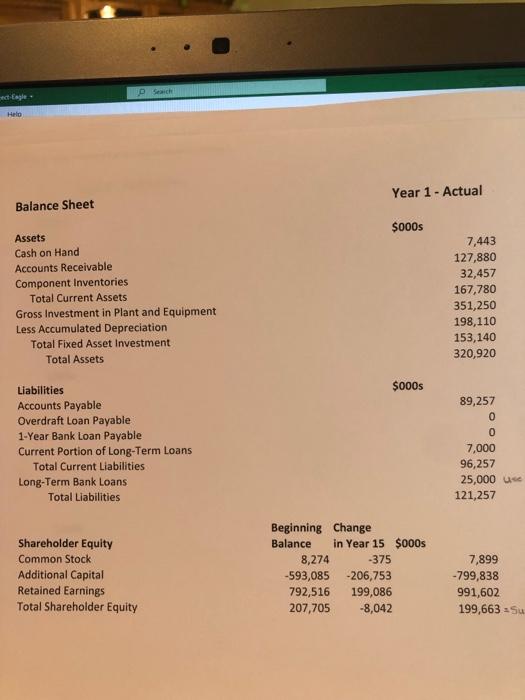

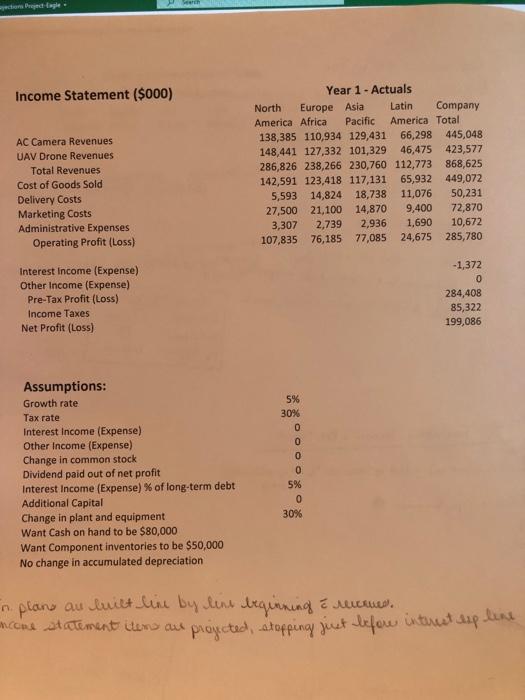

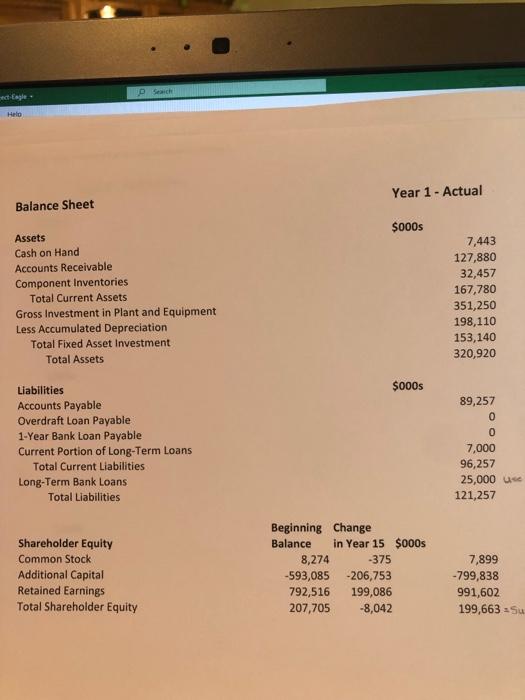

ch Predagle Income Statement ($000) AC Camera Revenues UAV Drone Revenues Total Revenues Cost of Goods Sold Delivery Costs Marketing Costs Administrative Expenses Operating Profit (Loss) Year 1 - Actuals North Europe Asia Latin Company America Africa Pacific America Total 138,385 110,934 129,431 66,298 445,048 148,441 127,332 101,329 46,475 423,577 286,826 238,266 230,760 112,773 868,625 142,591 123,418 117,131 65,932 449,072 5,593 14,824 18,738 11,076 50,231 27,500 21,100 14,870 9,400 72,870 3,307 2,739 2,936 1,690 10,672 107,835 76,185 77,085 24,675 285,780 Interest Income (Expense) Other Income (Expense) Pre-Tax Profit (Loss) Income Taxes Net Profit (Loss) -1,372 0 284,408 85,322 199,086 Assumptions: Growth rate Tax rate Interest Income (Expense) Other Income (Expense) Change in common stock Dividend paid out of net profit Interest Income (Expense) % of long-term debt Additional Capital Change in plant and equipment Want Cash on hand to be $80,000 Want Component inventories to be $50,000 No change in accumulated depreciation 5% 30% 0 0 0 0 5% 0 30% in plans au luilt line by lens beginning & revenues. ancie statement items au proyected, stopping ziet befow intercet cup line dagle Helo Year 1 - Actual Balance Sheet $000s Assets Cash on Hand Accounts Receivable Component Inventories Total Current Assets Gross Investment in Plant and Equipment Less Accumulated Depreciation Total Fixed Asset Investment Total Assets 7,443 127,880 32,457 167,780 351,250 198,110 153,140 320,920 $000s Liabilities Accounts Payable Overdraft Loan Payable 1-Year Bank Loan Payable Current Portion of Long-Term Loans Total Current Liabilities Long-Term Bank Loans Total Liabilities 89,257 0 0 7,000 96,257 25,000 - 121,257 Shareholder Equity Common Stock Additional Capital Retained Earnings Total Shareholder Equity Beginning Change Balance in Year 15 $000s 8,274 -375 -593,085 -206,753 792,516 199,086 207,705 -8,042 7,899 -799,838 991,602 199,663 Su ch Predagle Income Statement ($000) AC Camera Revenues UAV Drone Revenues Total Revenues Cost of Goods Sold Delivery Costs Marketing Costs Administrative Expenses Operating Profit (Loss) Year 1 - Actuals North Europe Asia Latin Company America Africa Pacific America Total 138,385 110,934 129,431 66,298 445,048 148,441 127,332 101,329 46,475 423,577 286,826 238,266 230,760 112,773 868,625 142,591 123,418 117,131 65,932 449,072 5,593 14,824 18,738 11,076 50,231 27,500 21,100 14,870 9,400 72,870 3,307 2,739 2,936 1,690 10,672 107,835 76,185 77,085 24,675 285,780 Interest Income (Expense) Other Income (Expense) Pre-Tax Profit (Loss) Income Taxes Net Profit (Loss) -1,372 0 284,408 85,322 199,086 Assumptions: Growth rate Tax rate Interest Income (Expense) Other Income (Expense) Change in common stock Dividend paid out of net profit Interest Income (Expense) % of long-term debt Additional Capital Change in plant and equipment Want Cash on hand to be $80,000 Want Component inventories to be $50,000 No change in accumulated depreciation 5% 30% 0 0 0 0 5% 0 30% in plans au luilt line by lens beginning & revenues. ancie statement items au proyected, stopping ziet befow intercet cup line dagle Helo Year 1 - Actual Balance Sheet $000s Assets Cash on Hand Accounts Receivable Component Inventories Total Current Assets Gross Investment in Plant and Equipment Less Accumulated Depreciation Total Fixed Asset Investment Total Assets 7,443 127,880 32,457 167,780 351,250 198,110 153,140 320,920 $000s Liabilities Accounts Payable Overdraft Loan Payable 1-Year Bank Loan Payable Current Portion of Long-Term Loans Total Current Liabilities Long-Term Bank Loans Total Liabilities 89,257 0 0 7,000 96,257 25,000 - 121,257 Shareholder Equity Common Stock Additional Capital Retained Earnings Total Shareholder Equity Beginning Change Balance in Year 15 $000s 8,274 -375 -593,085 -206,753 792,516 199,086 207,705 -8,042 7,899 -799,838 991,602 199,663 Su

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started