Answered step by step

Verified Expert Solution

Question

1 Approved Answer

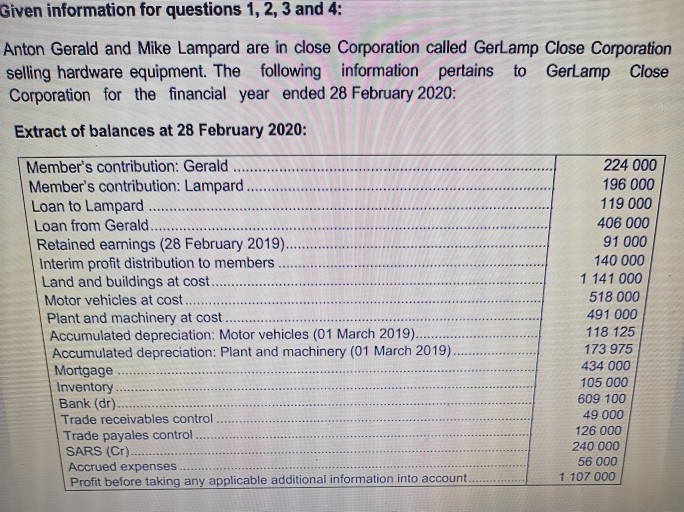

Given information for questions 1, 2, 3 and 4: Anton Gerald and Mike Lampard are in close Corporation called Gerlamp Close Corporation selling hardware equipment.

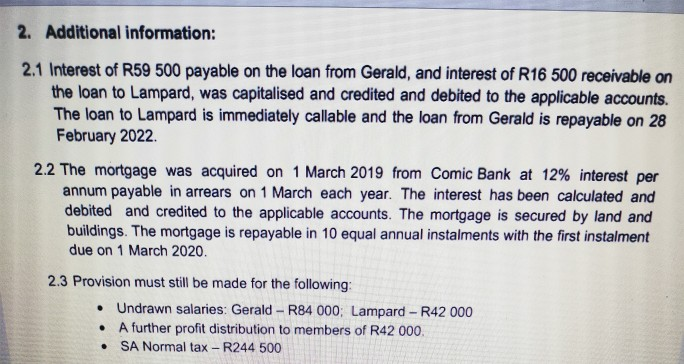

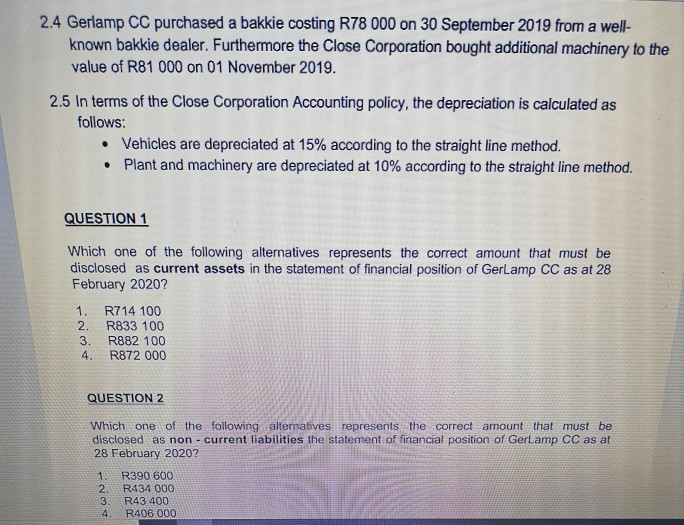

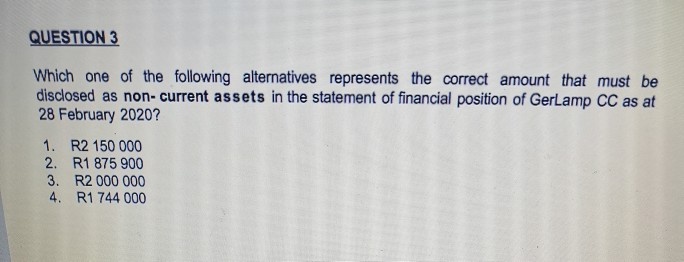

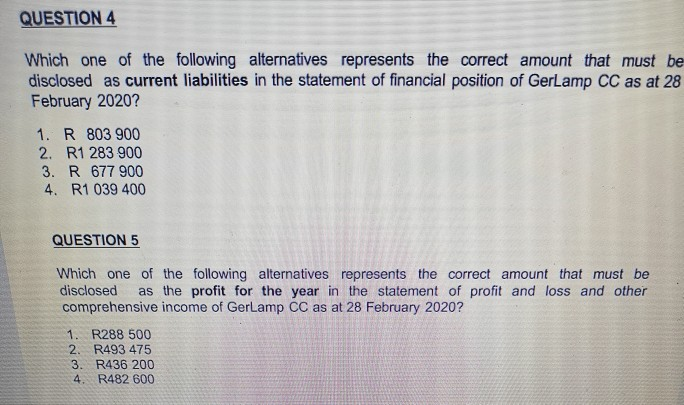

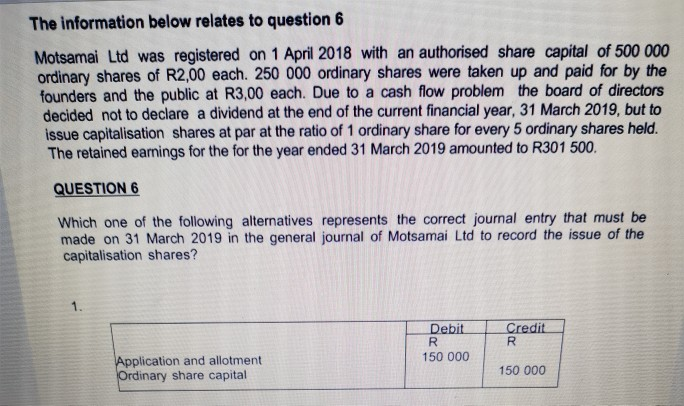

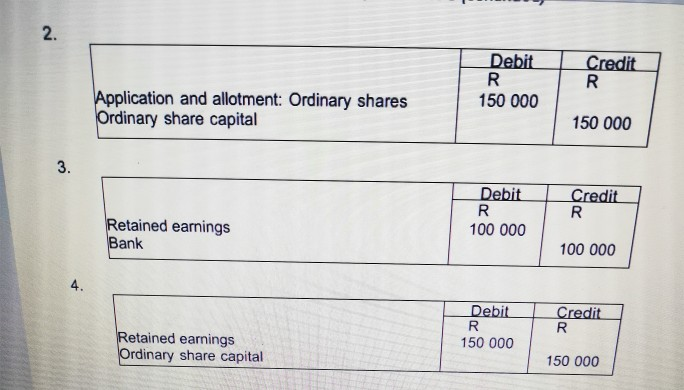

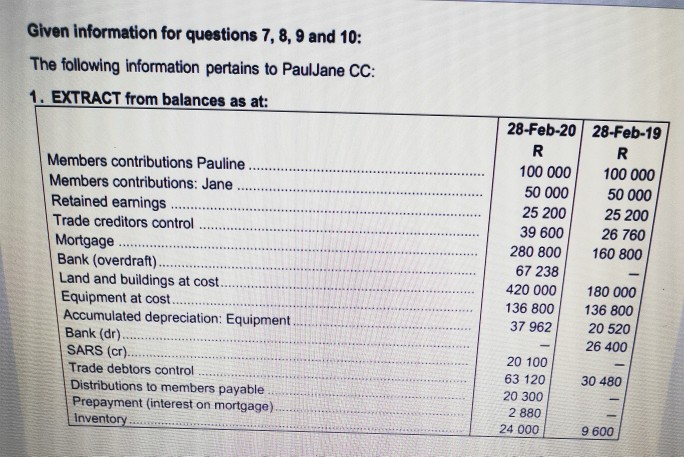

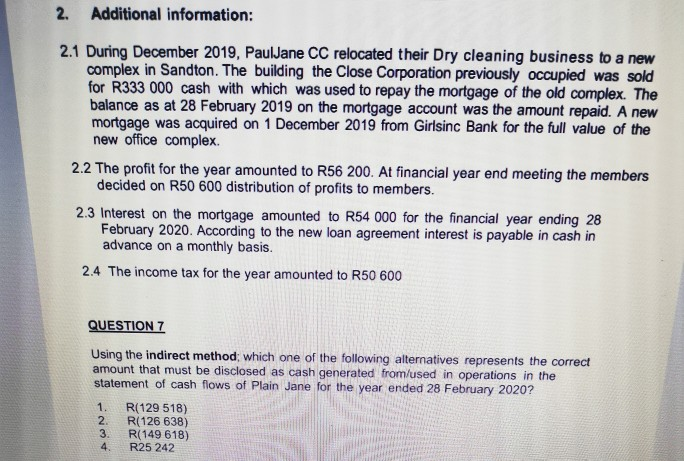

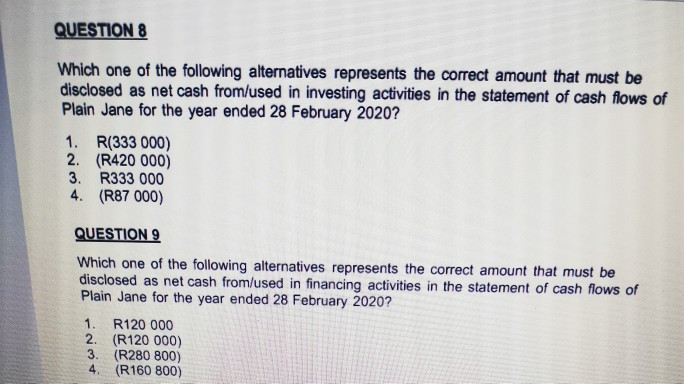

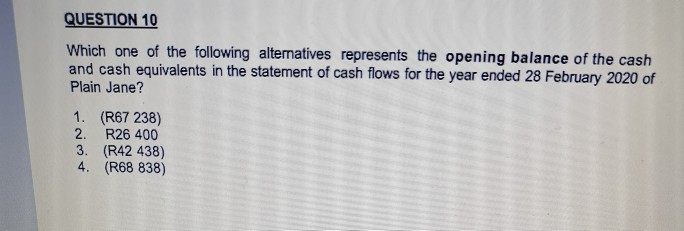

Given information for questions 1, 2, 3 and 4: Anton Gerald and Mike Lampard are in close Corporation called Gerlamp Close Corporation selling hardware equipment. The following information pertains to Gerlamp Close Corporation for the financial year ended 28 February 2020: Extract of balances at 28 February 2020: Member's contribution: Gerald Member's contribution: Lampard... Loan to Lampard. Loan from Gerald.... Retained earnings (28 February 2019)... Interim profit distribution to members Land and buildings at cost..... Motor vehicles at cost Plant and machinery at cost. Accumulated depreciation: Motor vehicles (01 March 2019). Accumulated depreciation: Plant and machinery (01 March 2019). Mortgage .... Inventory.... Bank (dr)..... Trade receivables control..... Trade payales control...... SARS (Cr). Accrued expenses.. Profit before taking any applicable additional information into account.............. 224 000 196 000 119 000 406 000 91 000 140 000 1 141 000 518 000 491 000 118 125 173 975 434 000 105 000 609 100 49 000 126 000 240 000 56 000 1 107 000 2. Additional information: 2.1 Interest of R59 500 payable on the loan from Gerald, and interest of R16 500 receivable on the loan to Lampard, was capitalised and credited and debited to the applicable accounts. The loan to Lampard is immediately callable and the loan from Gerald is repayable on 28 February 2022 2.2 The mortgage was acquired on 1 March 2019 from Comic Bank at 12% interest per annum payable in arrears on 1 March each year. The interest has been calculated and debited and credited to the applicable accounts. The mortgage is secured by land and buildings. The mortgage is repayable in 10 equal annual instalments with the first instalment due on 1 March 2020. 2.3 Provision must still be made for the following Undrawn salaries: Gerald - R84 000Lampard -R42 000 A further profit distribution to members of R42 000 SA Normal tax - R244 500 2.4 Gerlamp CC purchased a bakkie costing R78 000 on 30 September 2019 from a well- known bakkie dealer. Furthermore the Close Corporation bought additional machinery to the value of R81 000 on 01 November 2019. 2.5 In terms of the Close Corporation Accounting policy, the depreciation is calculated as follows: Vehicles are depreciated at 15% according to the straight line method. Plant and machinery are depreciated at 10% according to the straight line method. QUESTION 1 Which one of the following alternatives represents the correct amount that must be disclosed as current assets in the statement of financial position of Gerlamp CC as at 28 February 2020? 1. R714 100 2. R833 100 3. R882 100 4. R872 000 QUESTION 2 Which one of the following alternatives represents the correct amount that must be disclosed as non-current liabilities the statement of financial position of Gerlamp CC as at 28 February 2020? 1. R390 600 2. R434 000 3. R43 400 4. R406 000 QUESTION 3 Which one of the following alternatives represents the correct amount that must be disclosed as non-current assets in the statement of financial position of GerLamp CC as at 28 February 2020? 1. R2 150 000 2. R1 875 900 3. R2 000 000 4. R1 744 000 QUESTION 4 Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of GerLamp CC as at 28 February 2020? 1. R 803 900 2. R1 283 900 3. R 677 900 4. R1 039 400 QUESTION 5 Which one of the following alternatives represents the correct amount that must be disclosed as the profit for the year in the statement of profit and loss and other comprehensive income of GerLamp CC as at 28 February 2020? 1. R288 500 2. R493 475 3. R436 200 4. R482 600 The information below relates to question 6 Motsamai Ltd was registered on 1 April 2018 with an authorised share capital of 500 000 ordinary shares of R2,00 each. 250 000 ordinary shares were taken up and paid for by the founders and the public at R3,00 each. Due to a cash flow problem the board of directors decided not to declare a dividend at the end of the current financial year, 31 March 2019, but to issue capitalisation shares at par at the ratio of 1 ordinary share for every 5 ordinary shares held. The retained eamings for the for the year ended 31 March 2019 amounted to R301 500. QUESTION 6 Which one of the following alternatives represents the correct journal entry that must be made on 31 March 2019 in the general journal of Motsamai Ltd to record the issue of the capitalisation shares? Debit 1.000 Rebit Credit credit 150 000 Application and allotment Ordinary share capital 150000 150 000 Debit Credit 150 000 Application and allotment: Ordinary shares Ordinary share capital 150 000 Debit Credit 100 000 Retained earnings Bank 100 000 Debit Credit 150 000 Retained earnings Ordinary share capital 150 000 Given information for questions 7, 8, 9 and 10: The following information pertains to PaulJane CC: 1. EXTRACT from balances as at: 28-Feb-20 28-Feb-19 R Members contributions Pauline Members contributions: Jane Retained earnings .... Trade creditors control ................ Mortgage Bank (overdraft)... Land and buildings at cost.. Equipment at cost. Accumulated depreciation: Equipment Bank (dr)............ SARS (cr). Trade debtors control Distributions to members payable Prepayment interest on mortgage) Inventory 100 000 50 000 25 200 39 600 280 800 67 238 420 000 136 800 37 962 100 000 50 000 25 200 26 760 160 800 180 000 136 800 20 520 26 400 30 480 20 100 63 120 20 300 2 880 24 000 9 600 2. Additional information: 2.1 During December 2019, PaulJane CC relocated their Dry cleaning business to a new complex in Sandton. The building the Close Corporation previously occupied was sold for R333 000 cash with which was used to repay the mortgage of the old complex. The balance as at 28 February 2019 on the mortgage account was the amount repaid. A new mortgage was acquired on 1 December 2019 from Girlsinc Bank for the full value of the new office complex 2.2 The profit for the year amounted to R56 200. At financial year end meeting the members decided on R50 600 distribution of profits to members. 2.3 Interest on the mortgage amounted to R54 000 for the financial year ending 28 February 2020. According to the new loan agreement interest is payable in cash in advance on a monthly basis. 2.4 The income tax for the year amounted to R50 600 QUESTION 7 Using the indirect method, which one of the following alternatives represents the correct amount that must be disclosed as cash generated from/used in operations in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. R(129 518) 2. R(126 638) 3. R(149 618) R25 242 QUESTION 8 Which one of the following alternatives represents the correct amount that must be disclosed as net cash from/used in investing activities in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. R(333 000) 2. (R420 000) 3. R333 000 4. (R87 000) QUESTION 9 Which one of the following alternatives represents the correct amount that must be disclosed as net cash from/used in financing activities in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. R120 000 2. (R120 000) 3. (R280 800) 4. (R160 800) QUESTION 10 Which one of the following alternatives represents the opening balance of the cash and cash equivalents in the statement of cash flows for the year ended 28 February 2020 of Plain Jane? 1. (R67 238) 2. R26 400 3. (R42 438) 4. (R68 838) Given information for questions 1, 2, 3 and 4: Anton Gerald and Mike Lampard are in close Corporation called Gerlamp Close Corporation selling hardware equipment. The following information pertains to Gerlamp Close Corporation for the financial year ended 28 February 2020: Extract of balances at 28 February 2020: Member's contribution: Gerald Member's contribution: Lampard... Loan to Lampard. Loan from Gerald.... Retained earnings (28 February 2019)... Interim profit distribution to members Land and buildings at cost..... Motor vehicles at cost Plant and machinery at cost. Accumulated depreciation: Motor vehicles (01 March 2019). Accumulated depreciation: Plant and machinery (01 March 2019). Mortgage .... Inventory.... Bank (dr)..... Trade receivables control..... Trade payales control...... SARS (Cr). Accrued expenses.. Profit before taking any applicable additional information into account.............. 224 000 196 000 119 000 406 000 91 000 140 000 1 141 000 518 000 491 000 118 125 173 975 434 000 105 000 609 100 49 000 126 000 240 000 56 000 1 107 000 2. Additional information: 2.1 Interest of R59 500 payable on the loan from Gerald, and interest of R16 500 receivable on the loan to Lampard, was capitalised and credited and debited to the applicable accounts. The loan to Lampard is immediately callable and the loan from Gerald is repayable on 28 February 2022 2.2 The mortgage was acquired on 1 March 2019 from Comic Bank at 12% interest per annum payable in arrears on 1 March each year. The interest has been calculated and debited and credited to the applicable accounts. The mortgage is secured by land and buildings. The mortgage is repayable in 10 equal annual instalments with the first instalment due on 1 March 2020. 2.3 Provision must still be made for the following Undrawn salaries: Gerald - R84 000Lampard -R42 000 A further profit distribution to members of R42 000 SA Normal tax - R244 500 2.4 Gerlamp CC purchased a bakkie costing R78 000 on 30 September 2019 from a well- known bakkie dealer. Furthermore the Close Corporation bought additional machinery to the value of R81 000 on 01 November 2019. 2.5 In terms of the Close Corporation Accounting policy, the depreciation is calculated as follows: Vehicles are depreciated at 15% according to the straight line method. Plant and machinery are depreciated at 10% according to the straight line method. QUESTION 1 Which one of the following alternatives represents the correct amount that must be disclosed as current assets in the statement of financial position of Gerlamp CC as at 28 February 2020? 1. R714 100 2. R833 100 3. R882 100 4. R872 000 QUESTION 2 Which one of the following alternatives represents the correct amount that must be disclosed as non-current liabilities the statement of financial position of Gerlamp CC as at 28 February 2020? 1. R390 600 2. R434 000 3. R43 400 4. R406 000 QUESTION 3 Which one of the following alternatives represents the correct amount that must be disclosed as non-current assets in the statement of financial position of GerLamp CC as at 28 February 2020? 1. R2 150 000 2. R1 875 900 3. R2 000 000 4. R1 744 000 QUESTION 4 Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of GerLamp CC as at 28 February 2020? 1. R 803 900 2. R1 283 900 3. R 677 900 4. R1 039 400 QUESTION 5 Which one of the following alternatives represents the correct amount that must be disclosed as the profit for the year in the statement of profit and loss and other comprehensive income of GerLamp CC as at 28 February 2020? 1. R288 500 2. R493 475 3. R436 200 4. R482 600 The information below relates to question 6 Motsamai Ltd was registered on 1 April 2018 with an authorised share capital of 500 000 ordinary shares of R2,00 each. 250 000 ordinary shares were taken up and paid for by the founders and the public at R3,00 each. Due to a cash flow problem the board of directors decided not to declare a dividend at the end of the current financial year, 31 March 2019, but to issue capitalisation shares at par at the ratio of 1 ordinary share for every 5 ordinary shares held. The retained eamings for the for the year ended 31 March 2019 amounted to R301 500. QUESTION 6 Which one of the following alternatives represents the correct journal entry that must be made on 31 March 2019 in the general journal of Motsamai Ltd to record the issue of the capitalisation shares? Debit 1.000 Rebit Credit credit 150 000 Application and allotment Ordinary share capital 150000 150 000 Debit Credit 150 000 Application and allotment: Ordinary shares Ordinary share capital 150 000 Debit Credit 100 000 Retained earnings Bank 100 000 Debit Credit 150 000 Retained earnings Ordinary share capital 150 000 Given information for questions 7, 8, 9 and 10: The following information pertains to PaulJane CC: 1. EXTRACT from balances as at: 28-Feb-20 28-Feb-19 R Members contributions Pauline Members contributions: Jane Retained earnings .... Trade creditors control ................ Mortgage Bank (overdraft)... Land and buildings at cost.. Equipment at cost. Accumulated depreciation: Equipment Bank (dr)............ SARS (cr). Trade debtors control Distributions to members payable Prepayment interest on mortgage) Inventory 100 000 50 000 25 200 39 600 280 800 67 238 420 000 136 800 37 962 100 000 50 000 25 200 26 760 160 800 180 000 136 800 20 520 26 400 30 480 20 100 63 120 20 300 2 880 24 000 9 600 2. Additional information: 2.1 During December 2019, PaulJane CC relocated their Dry cleaning business to a new complex in Sandton. The building the Close Corporation previously occupied was sold for R333 000 cash with which was used to repay the mortgage of the old complex. The balance as at 28 February 2019 on the mortgage account was the amount repaid. A new mortgage was acquired on 1 December 2019 from Girlsinc Bank for the full value of the new office complex 2.2 The profit for the year amounted to R56 200. At financial year end meeting the members decided on R50 600 distribution of profits to members. 2.3 Interest on the mortgage amounted to R54 000 for the financial year ending 28 February 2020. According to the new loan agreement interest is payable in cash in advance on a monthly basis. 2.4 The income tax for the year amounted to R50 600 QUESTION 7 Using the indirect method, which one of the following alternatives represents the correct amount that must be disclosed as cash generated from/used in operations in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. R(129 518) 2. R(126 638) 3. R(149 618) R25 242 QUESTION 8 Which one of the following alternatives represents the correct amount that must be disclosed as net cash from/used in investing activities in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. R(333 000) 2. (R420 000) 3. R333 000 4. (R87 000) QUESTION 9 Which one of the following alternatives represents the correct amount that must be disclosed as net cash from/used in financing activities in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. R120 000 2. (R120 000) 3. (R280 800) 4. (R160 800) QUESTION 10 Which one of the following alternatives represents the opening balance of the cash and cash equivalents in the statement of cash flows for the year ended 28 February 2020 of Plain Jane? 1. (R67 238) 2. R26 400 3. (R42 438) 4. (R68 838)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started