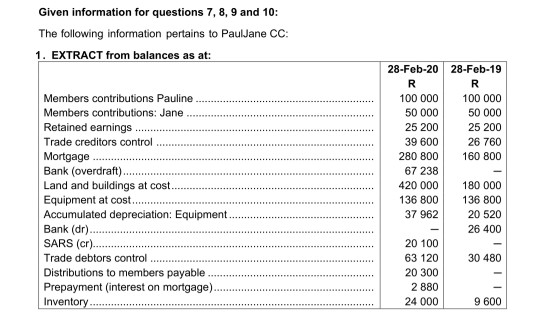

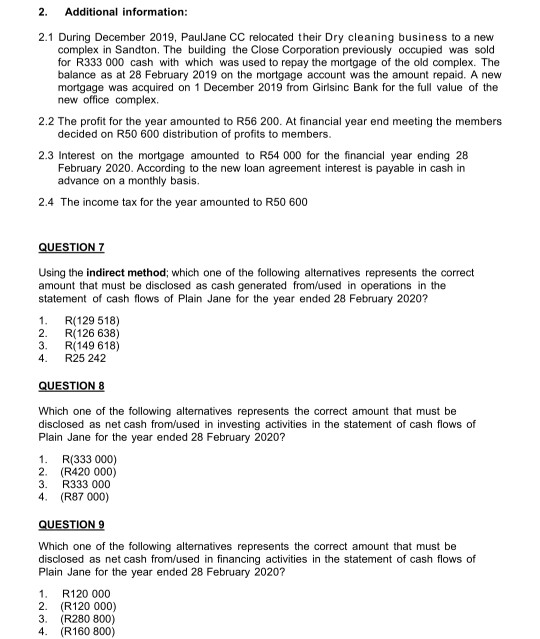

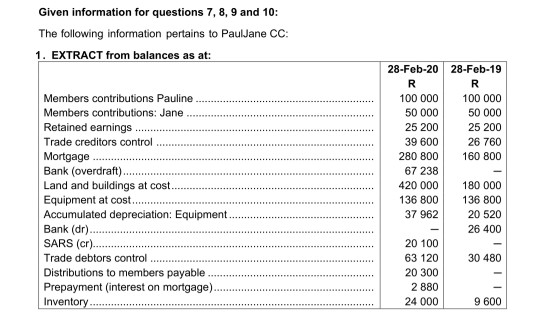

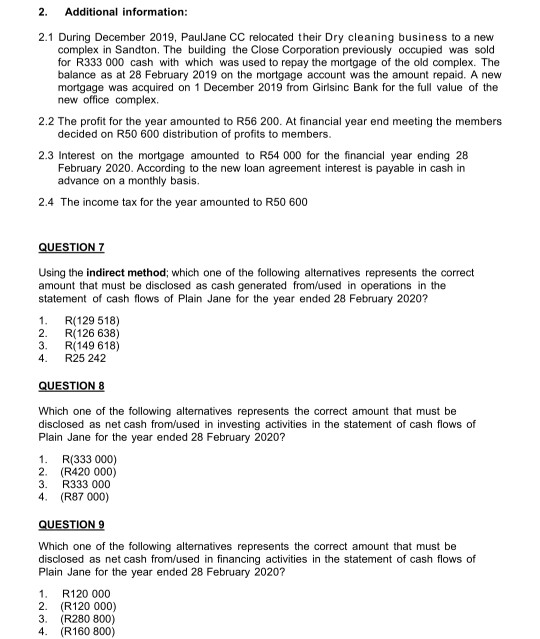

Given information for questions 7, 8, 9 and 10: The following information pertains to PaulJane CC: 1. EXTRACT from balances as at: 28-Feb-20 R 100 000 50 000 25 200 39 600 280 800 28-Feb-19 R 100 000 50 000 25 200 26 760 160 800 67 238 Members contributions Pauline Members contributions: Jane Retained earnings ........... Trade creditors control ........ Mortgage Bank (overdraft)........ Land and buildings at cost. Equipment at cost...... Accumulated depreciation: Equipment Bank (dr). SARS (cr)... .. Trade debtors control ........ Distributions to members payable Prepayment interest on mortgage)...... Inventory 420 000 136 800 37 962 180 000 136 800 20 520 26 400 30 480 20 100 63 120 20 300 2 880 24 000 9600 2. Additional information: 2.1 During December 2019, PaulJane CC relocated their Dry cleaning business to a new complex in Sandton. The building the Close Corporation previously occupied was sold for R333 000 cash with which was used to repay the mortgage of the old complex. The balance as at 28 February 2019 on the mortgage account was the amount repaid. A new mortgage was acquired on 1 December 2019 from Girlsinc Bank for the full value of the new office complex. 2.2 The profit for the year amounted to R56 200. At financial year end meeting the members decided on R50 600 distribution of profits to members. 2.3 Interest on the mortgage amounted to R54 000 for the financial year ending 28 February 2020. According to the new loan agreement interest is payable in cash in advance on a monthly basis. 2.4 The income tax for the year amounted to R50 600 QUESTION 7 Using the indirect method; which one of the following alternatives represents the correct amount that must be disclosed as cash generated from/used in operations in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. 2. 3. 4. R(129 518) R(126 638) R(149 618) R25 242 QUESTION 8 Which one of the following alternatives represents the correct amount that must be disclosed as net cash from/used in investing activities in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. R(333 000) 2. (R420 000) 3. R333 000 4. (R87 000) QUESTION 9 Which one of the following alternatives represents the correct amount that must be disclosed as net cash from/used in financing activities in the statement of cash flows of Plain Jane for the year ended 28 February 2020? 1. R120 000 2. (R120 000) 3. (R280 800) 4. (R160 800)