Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given that Mitchell number must pay suppliers the dollar amount of the cost of goods sold before it receives payment from customers, what was the

Given that Mitchell number must pay suppliers the dollar amount of the cost of goods sold before it receives payment from customers, what was the dollar cost of funding its cash conversion period during 1995? How much could the company have saved by using a line of credit? what concerns other than cost must the company consider?

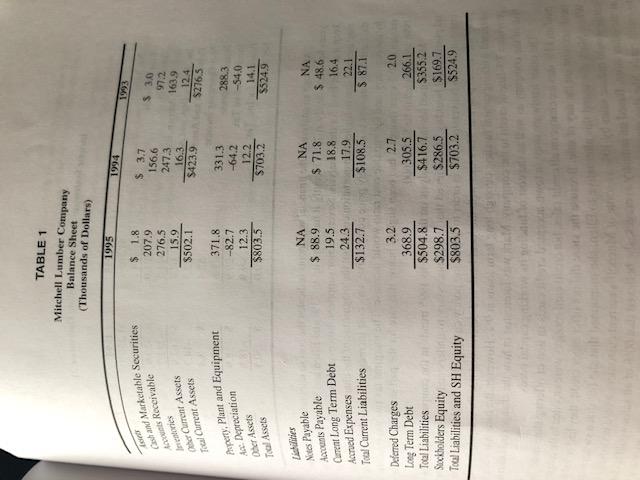

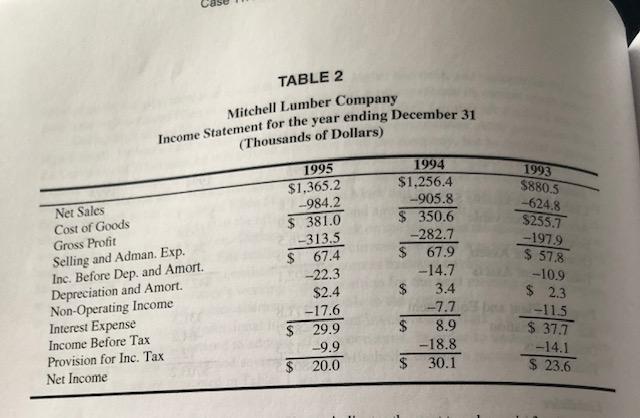

TABLE 1 Mitchell Lumber Company Balance Sheet (Thousands of Dollars) 1995 Grand Marketable Securities as Receivate $ 1.8 207.9 276.5 15.9 $502.1 $ 3.7 156,6 247.3 16.3 $423.9 her Current Assets ral Current Assets $ 3.0 97.2 1639 12.4 $276.5 Property, Plant and Equipment A. Depreciation her Assets Tal Assets 371.8 -82.7 12.3 $803.5 331.3 -64.2 12.2 $703.2 288.3 -54.0 14.1 $524.9 Listes Notes Payable Arants Payable Current Long Term Debt NA $ 88.9 19.5 24.3 $132.7 NA $ 71.8 18.8 17.9 $108.5 NA $48.6 16.4 22.1 $ 87.1 Accrued Expenses Toal Current Liabilities Deferred Charges Long Term Debt Total Liabilities Suckholders Equity Total Liabilities and SH Equity 3.2 368.9 $504.8 $298.7 $803,5 2.7 305.5 $416.7 $286.5 $703.2 2.0 266.1 $355,2 $169.7 $5249 TABLE 2 Mitchell Lumber Company Income Statement for the year ending December 31 (Thousands of Dollars) Net Sales Cost of Goods Gross Profit Selling and Adman. Exp. Inc. Before Dep. and Amort. Depreciation and Amort. Non-Operating Income Interest Expense Income Before Tax Provision for Inc. Tax Net Income 1995 $1,365.2 -984.2 $ 381.0 -313.5 $ 67.4 -22.3 $2.4 -17.6 29.9 -9.9 $ 20.0 1994 $1,256.4 -905.8 350.6 -282.7 $ 67.9 -14.7 $ 3.4 -7.7 $ 8.9 -18.8 $ 30.1 1993 $880.5 -624.8 S255.7 -1979 $ 57.8 -10.9 $ 2.3 --11.5 $ 37.7 -14.1 $ 23.6 TABLE 1 Mitchell Lumber Company Balance Sheet (Thousands of Dollars) 1995 Grand Marketable Securities as Receivate $ 1.8 207.9 276.5 15.9 $502.1 $ 3.7 156,6 247.3 16.3 $423.9 her Current Assets ral Current Assets $ 3.0 97.2 1639 12.4 $276.5 Property, Plant and Equipment A. Depreciation her Assets Tal Assets 371.8 -82.7 12.3 $803.5 331.3 -64.2 12.2 $703.2 288.3 -54.0 14.1 $524.9 Listes Notes Payable Arants Payable Current Long Term Debt NA $ 88.9 19.5 24.3 $132.7 NA $ 71.8 18.8 17.9 $108.5 NA $48.6 16.4 22.1 $ 87.1 Accrued Expenses Toal Current Liabilities Deferred Charges Long Term Debt Total Liabilities Suckholders Equity Total Liabilities and SH Equity 3.2 368.9 $504.8 $298.7 $803,5 2.7 305.5 $416.7 $286.5 $703.2 2.0 266.1 $355,2 $169.7 $5249 TABLE 2 Mitchell Lumber Company Income Statement for the year ending December 31 (Thousands of Dollars) Net Sales Cost of Goods Gross Profit Selling and Adman. Exp. Inc. Before Dep. and Amort. Depreciation and Amort. Non-Operating Income Interest Expense Income Before Tax Provision for Inc. Tax Net Income 1995 $1,365.2 -984.2 $ 381.0 -313.5 $ 67.4 -22.3 $2.4 -17.6 29.9 -9.9 $ 20.0 1994 $1,256.4 -905.8 350.6 -282.7 $ 67.9 -14.7 $ 3.4 -7.7 $ 8.9 -18.8 $ 30.1 1993 $880.5 -624.8 S255.7 -1979 $ 57.8 -10.9 $ 2.3 --11.5 $ 37.7 -14.1 $ 23.6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started