Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the analysis we went through in class regarding the specific-factors model, now assume the relative price rise in manufacturers from Home's viewpoint, as

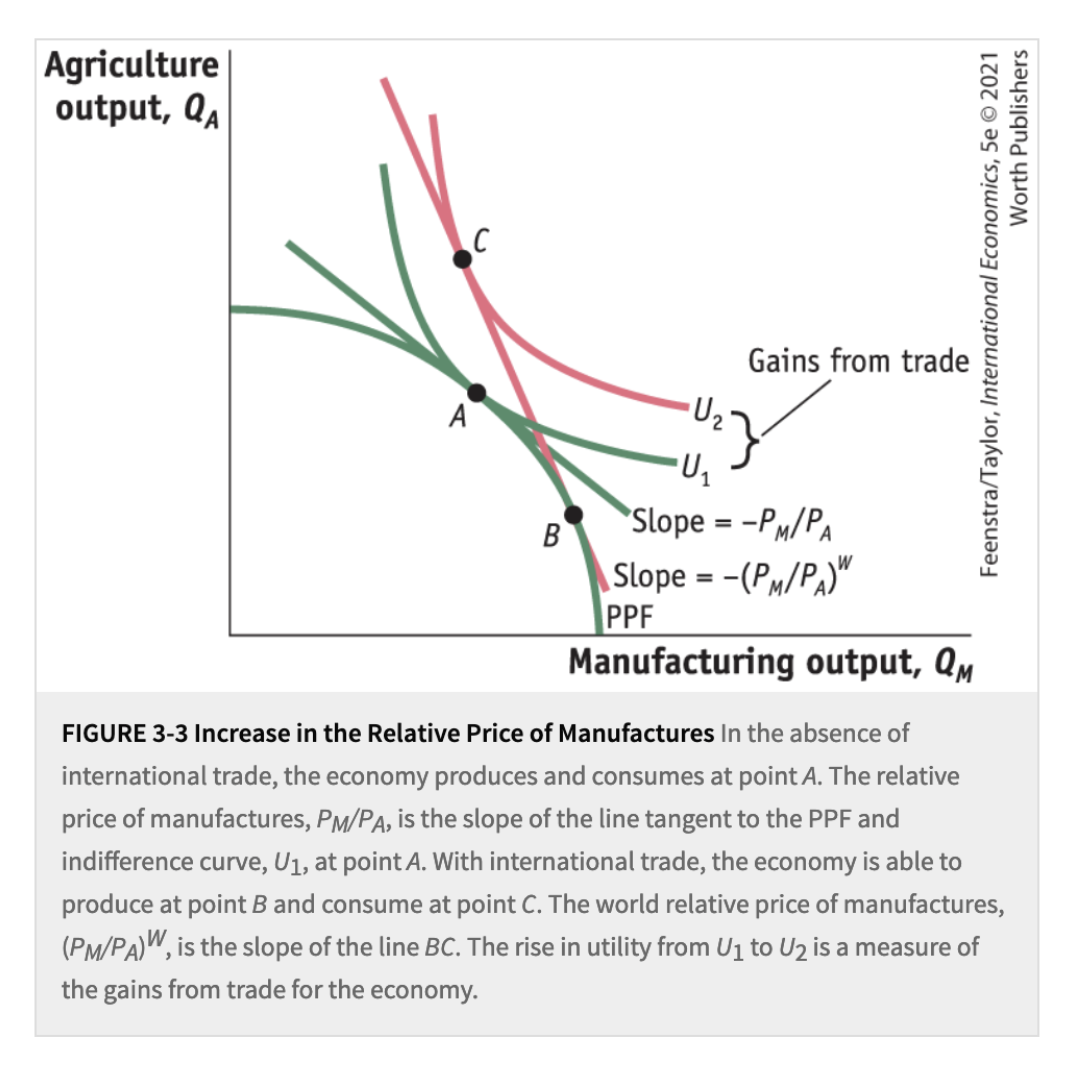

Given the analysis we went through in class regarding the specific-factors model, now assume the relative price rise in manufacturers from Home's viewpoint, as shown in Figure 3-3 below. Assume Home engages in international trade with Foreign and that the PM no-trade of manufactured goods for Foreign is greater than that for Home. That is: a. Draw a figure showing the same information as figure 3.3, but from Foreign's perspective. PA b. Where will Foreign produce and consume after it engages in international trade? Label you chart to show these points. C. PM PA Does the relative price for manufactured goods versus agricultural goods fall or rise for Foreign? Why? d. Foreign will be a net exporter of which good? Foreign will be a net importer of which good? e. Discuss how Foreign benefits from international trade with Home. Agriculture output, QA A C B -U U Gains from trade Slope = -PM/PA Slope -(PM/PA)" PPF = Manufacturing output, QM Feenstra/Taylor, International Economics, 5e 2021 Worth Publishers FIGURE 3-3 Increase in the Relative Price of Manufactures In the absence of international trade, the economy produces and consumes at point A. The relative price of manufactures, PM/PA, is the slope of the line tangent to the PPF and indifference curve, U, at point A. With international trade, the economy is able to produce at point B and consume at point C. The world relative price of manufactures, (PM/PA), is the slope of the line BC. The rise in utility from U to U2 is a measure of the gains from trade for the economy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started