Question

Given the ff information, solve for: Earnings per share Price-earnings ratio Market-Book value ratio Inventory turnover Days sales outstanding Accounts receivable turnover Fixed assets turnover

Given the ff information, solve for:

Earnings per share

Price-earnings ratio

Market-Book value ratio

Inventory turnover

Days sales outstanding

Accounts receivable turnover

Fixed assets turnover

Operating margin

Profit margin

Return on total assets

Basic earnings power

Return on equity

Current ratio

Quick ratio

Total assets turnover

Inventory conversion period

Total debt to total assets

Times interest earned

Payable deferral period

Cash flow adequacy

Reinvestment ratio

Long term debt repayment ratio

Free cash flow

Depreciation impact ratio

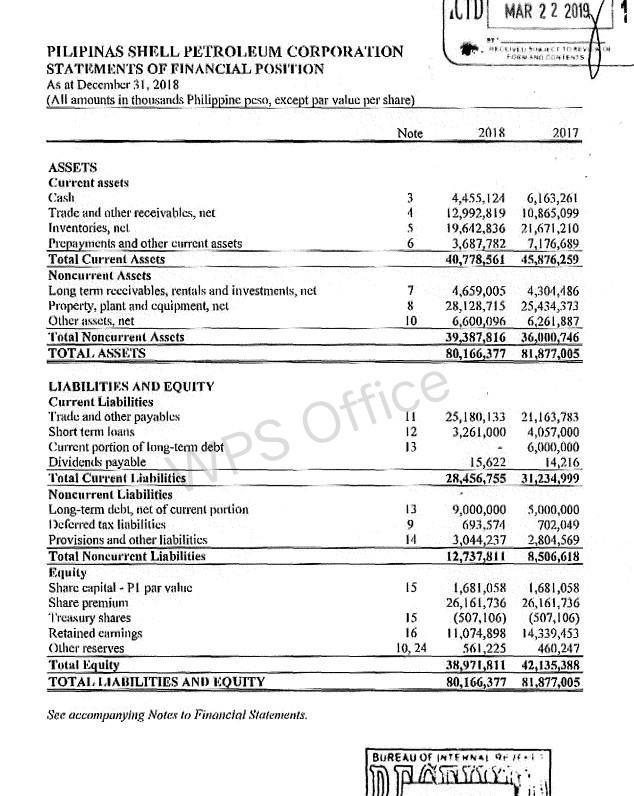

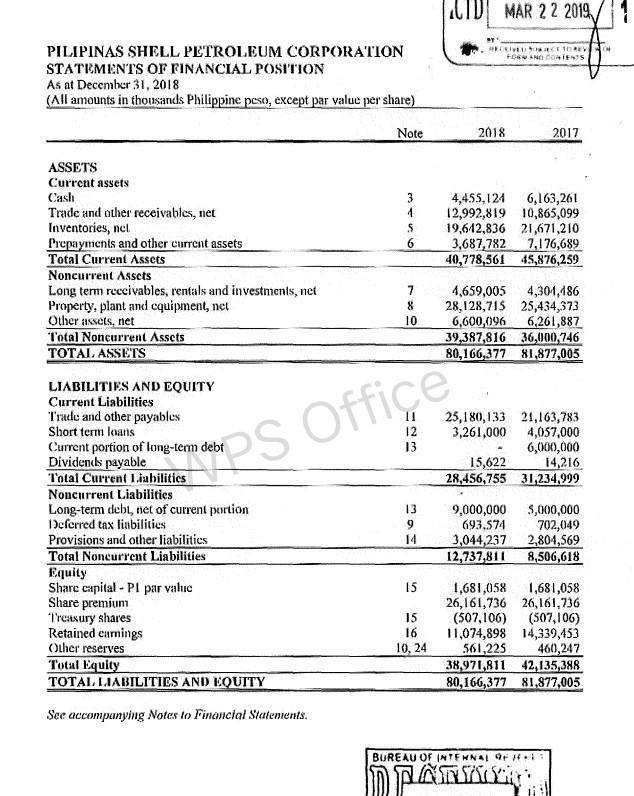

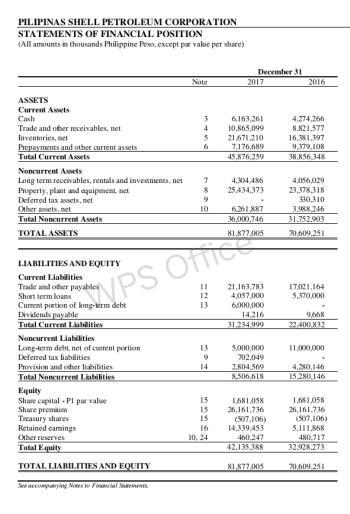

Solve for the year 2016, 2017, and 2018.

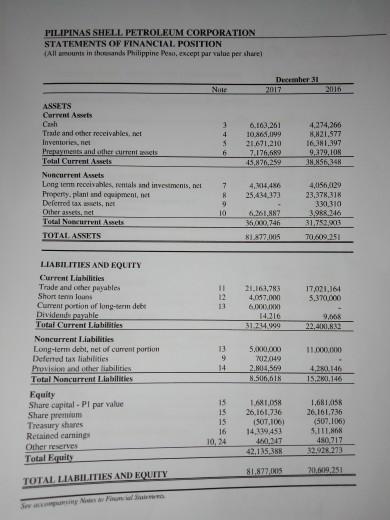

PILIPINAS SHELL PETROLEUM CORPORATION STATEMENTS OF FINANCIAL POSITION LAll amunts in theands Philippine Pesn, except par vulue per shrel December 31 Nute 2017 2016 ASSETS Carrent Assets Cah Trade and other receivahles, net Inventories, net Prepayments and uther current scts 6.163.261 10.365,9 21.671.210 4,274,266 HH21.577 16.3N1.397 9.379,108 38.N56,348 4. 7.176,689 Total Current Assets 45,876,259 Nuncurrent Assets Long tenn receivahles, rentals and investmenis, net Property, plant and oquipment, net Deferred tax sets, net Other assets, net Total Noneurrent Assets 7. 4,156,129 4.14,486 25,434.373 23.378,318 330.310 3,98R.246 10 6,261,887 36000.746 31.752903 TOTAL ASSETS 81.877.MI5 T0,609.251 LIABILITIES AND EQUITY Current Linbilities Trade and other payables Short tenn loans Cument portion of long-term debe Dividemde payahle Total Current Liabilities %3D 12 13 21,163,783 17,021.164 5,370.000 4,067.000 14.216 9,068 31.24.999 22,400,82 Noncurrent Liabilities Long-term debt, net of current portion Defened tax liabilities Provision and other liabilities Total Noncurrent Liabilities 13 5.000,000 11.000.000 NI2049 2.804,569 8.506,618 14 4,280.146 15.280.146 Equity Share cupital - PI par value Share premium Treasury shares Retained carnings 15 1,6810S8 26.161.736 (507,106) 15 26.161,736 (50T,100) 14,339453 40.247 42.135.388 15 16 5,111868 480,717 32.928.273 10, 24 Other reserves Total Equity 81.8770005 20,609,251 TOTAL LIABILITIES AND EQUITY S a ny Nite Finun l

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

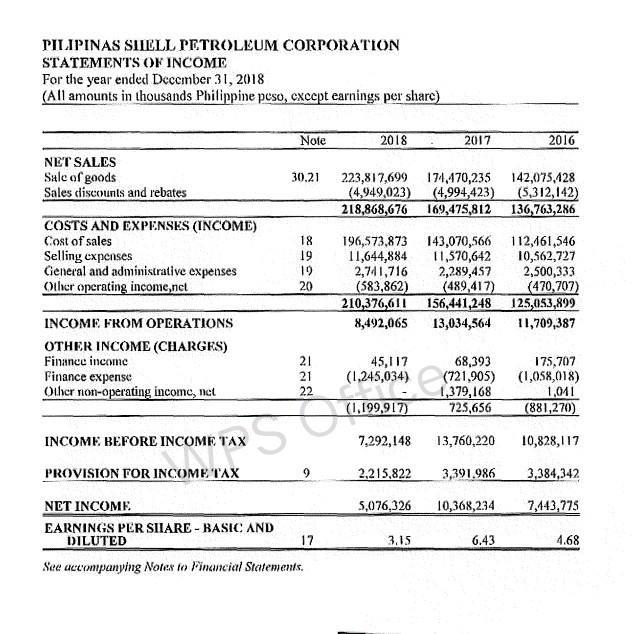

Earnings per share 2018 2017 2016 Net Income a 5076326 10368234 7443775 Outstanding number of shares b 1681058 1681058 1681058 Earnings per share ab 302 617 443 Price Earnings ratio 2018 2017 2016 Sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started