Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following data for demand at the XYZ Company, calculate the monthly forecast using a 3-month moving average and simple exponential smoothing (SES)

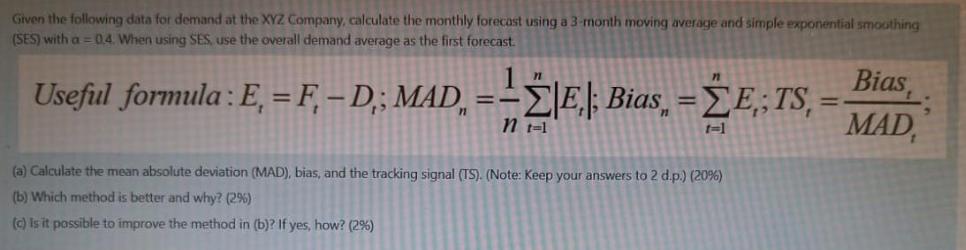

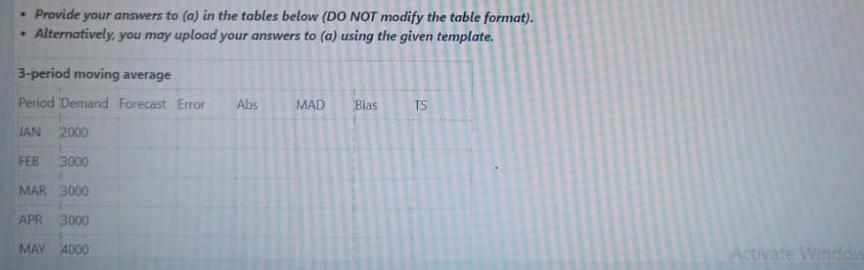

Given the following data for demand at the XYZ Company, calculate the monthly forecast using a 3-month moving average and simple exponential smoothing (SES) with a = 0.4. When using SES, use the overall demand average as the first forecast. n n Useful formula : E, = F, D,; MAD, = -|E,|; Bias = E, TS, Bias, = nt-1 MAD t=1 (a) Calculate the mean absolute deviation (MAD), bias, and the tracking signal (TS). (Note: Keep your answers to 2 d.p.) (20%) (b) Which method is better and why? (2%) (c) Is it possible to improve the method in (b)? If yes, how? (2%) Provide your answers to (a) in the tables below (DO NOT modify the table format). Alternatively, you may upload your answers to (a) using the given template. . 3-period moving average Period Demand Forecast Error Abs JAN 2000 FEB 3000 MAR 3000 APR 3000 MAY 4000 MAD Bias TS Activate Window

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the mean absolute deviation MAD bias and tracking signal TS lets use the given data and formulas a Calculation of MAD Bias and TS 3period ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started