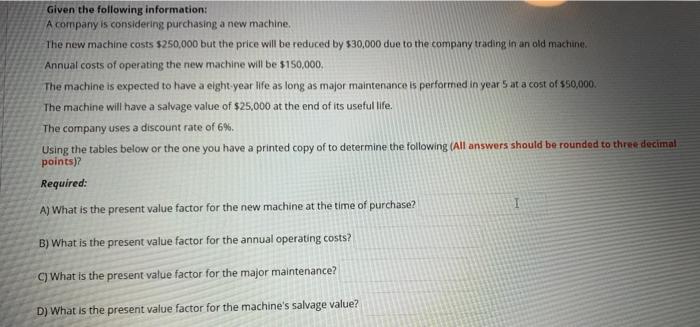

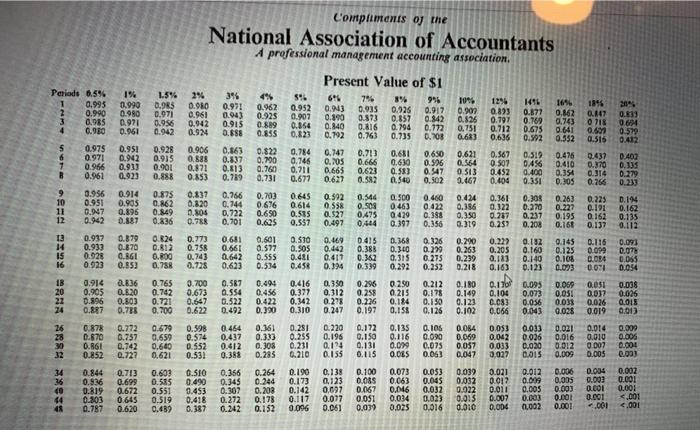

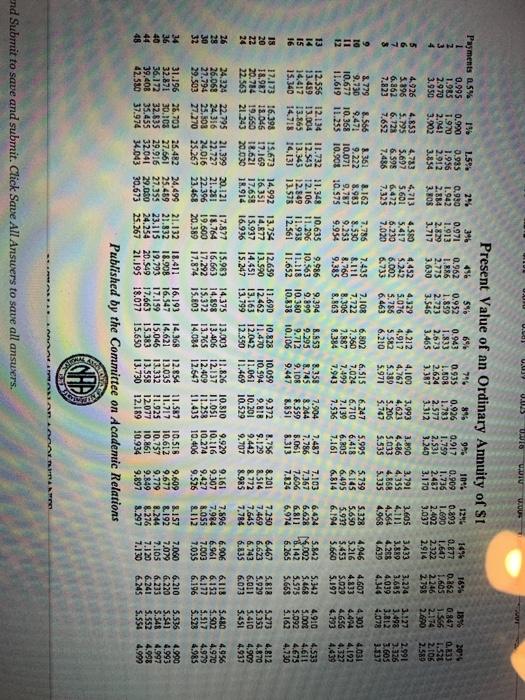

Given the following information: A company is considering purchasing a new machine The new machine costs $250,000 but the price will be reduced by $30,000 due to the company trading in an old machine Annual costs of operating the new machine will be $150,000, The machine is expected to have a eight-year life as long as major maintenance is performed in years at a cost of $50,000. The machine will have a salvage value of $25,000 at the end of its useful life. The company uses a discount rate of 6%. Using the tables below or the one you have a printed copy of to determine the following (All answers should be rounded to three decimal points)? Required: I A) What is the present value factor for the new machine at the time of purchase? B) What is the present value factor for the annual operating costs? C) What is the present value factor for the major maintenance? D) What is the present value factor for the machine's salvage value? 361 569 Perlads 6.596 0.995 0.990 0.985 4 0.960 0.990 0.980 0.971 0.961 1.5% 0.9RS 0.971 0.956 0.942 1896 0.147 0718 0. 0.515 0.772 $ 6 7 B 0.833 0.614 0.579 0.412 0.400 0.133 0.279 0.871 0.353 0.928 0.915 0.901 0.888 0.875 0.162 0.849 0.836 0.437 0.370 0.314 0.256 0.975 0.951 0.971 0.942 0.966 0.933 0.961 0.923 3.956 0.914 0.951 0.905 0.07 0.896 0.887 0.937 0.879 0.933 0.870 0.928 0.861 0.923 0.853 9 10 11 12 Compliments o the National Association of Accountants A professional management accounting association, Present Value of $1 2% 395 786 0.910 0.971 8% 9% 1046 1294 1496 1696 0.962 0.952 0.943 0.935 0.961 0.943 0.926 0.917 0.900 0.893 0.925 0.907 0.890 0.873 0.877 0.862 0.942 0.915 0.857 0.842 0.826 0.797 0.889 0.354 0.840 0.769 0.816 0.743 0.924 0.888 0.794 0.712 0.855 0.751 0.123 0.675 0.792 0.763 0.641 0.735 0.708 0.683 0.636 0.592 0.552 0.906 0.863 0.822 0.784 0.747 0.888 0.713 0.631 0.650 0.337 0.700 0,621 0.567 0.519 0.476 0.746 0.205 0.666 0.630 0.526 0.760 0.564 0 507 0456 0.410 0.665 0.711 0.58) 0.623 0.731 0.547 0.789 0.400 0513 0.452 0.627 0.354 0.677 0.582 0.540 0.502 0.404 0.351 0.305 0.837 0.756 0.703 0.645 0.544 0.500 0.820 0.592 0.744 0.361 0.460 0.676 0.308 0.424 0.263 0.614 0.500 0.558 0.463 0.104 0.650 0.422 0.386 0.322 0.270 0.227 0.722 0.595 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.788 0.625 0.701 0.195 0.357 0.497 0.444 0.397 0.356 0.319 0.257 0.2018 0.168 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.222 0.758 0.182 0.661 0.577 0.145 0.505 0.442 0.383 0.340 0.299 0.263 0.743 0.642 0.555 0.205 0.125 0.41 0.160 0.411 0.362 0.315 0.275 0.623 0.728 0.534 0.239 0.108 0.183 0.140 0.458 0.394 0.399 0.292 0.252 0.218 0.163 0.123 0.023 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.110 0.093 0.060 2.673 0.554 0.456 0.377 0.312 0.258 0.213 0.178 0.149 0.100 0.073 0.051 0.647 0.522 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.03 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.066 0.043 0.028 0.598 0.464 0.161 0.281 0.220 0.172 0.135 0.105 0.053 0.033 0.084 0.021 0.574 0.437 0.333 0.255 0.195 0.150 0.116 0.090 0.069 0.042 0.026 0.016 0.552 0.412 0.308 0.231 0.14 0.131 0.009 0.075 0.057 0.033 0.020 0.012 0.531 0.383 0.283 0.210 0.155 0.115 0.045 0.06) 0.047 3.927 0.015 0.009 0.510 0.356 0.264 0.190 0.138 0.100 0.073 0.053 0.039 0.021 0.012 0.006 0.490 0.345 0.244 0.193 0.123 0.08 0.063 0.045 0.032 0.012 0.009 0.003 0.453 0.307 0.203 0.142 0,097 0.067 0.046 0.032 0.022 0.011 0.005 0.003 0.418 0.272 0.178 0.117 0.077 0.051 0.034 0.023 0.015 0.007 0.00 0.387 0.242 0.152 0.006 0.051 0.039 0.025 0.016 0.010 0.000 0.002 0.001 0.225 0.191 0.162 0.137 0.144 0.162 0.135 0.112 12 14 15 16 0.024 0.812 0.800 0.116 0.099 0.014 0.01 0.003 0.07 0.055 0.054 0.788 0.338 1B 20 22 24 0.914 0.905 0.996 0.887 2.836 0.8.20 0.80) O.TES 0.765 0.742 0.721 0.700 0.051 0.017 0.026 0.019 0.038 0.026 0.018 0.01) 26 28 30 32 0.878 0.870 0.861 0.852 0.772 0.757 0.742 0.722 0.679 0,659 0.640 0.621 0.014 0.010 0.007 0.005 0.009 0.006 0.001 0.00) 34 36 40 $4 48 0.844 0.713 0.836 0.699 0.819 0.672 0.303 0645 0.787 0.620 0.603 0.585 0.551 0.519 0.489 0.004 0.001 NGI 0.001 -.001 0.002 0.001 0.001 <.001 u.lu uu udio udiu vou. present value of an ordinary annuity st payments l5 io il published by the committee on academic relations polec ment anato and submit to save submit. click all answers>