Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following information: Belarusian Ruble (BYN), Euro (EUR), British Pound (GBP), U.S. Dollar (USD), Russian Ruble (RUB), Turkish Lira (TRY) Belarus Interest Rate: 7.75%

Given the following information:

Belarusian Ruble (BYN), Euro (EUR), British Pound (GBP), U.S. Dollar (USD), Russian Ruble (RUB), Turkish Lira (TRY)

Belarus Interest Rate: 7.75% p.a.

Euro Interest Rate: 0.1% p.a.

EUR/BYN 2.9459

1. What is the two-year EUR/BYN forward rate implied by interest rate parity?

2. Is this forward contract fairly valued, over-valued or undervalued?

3. Assuming no transaction costs, what is one transaction you might undertake to try to exploit an opportunity present in this data?

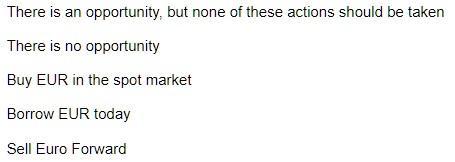

There is an There is no opportunity Buy EUR in the spot market Borrow EUR today Sell Euro Forward opportunity, but none of these actions should be taken

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution Based on the information provided we can calculate the twoyear EURBYN forward rate implied ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started