Answered step by step

Verified Expert Solution

Question

1 Approved Answer

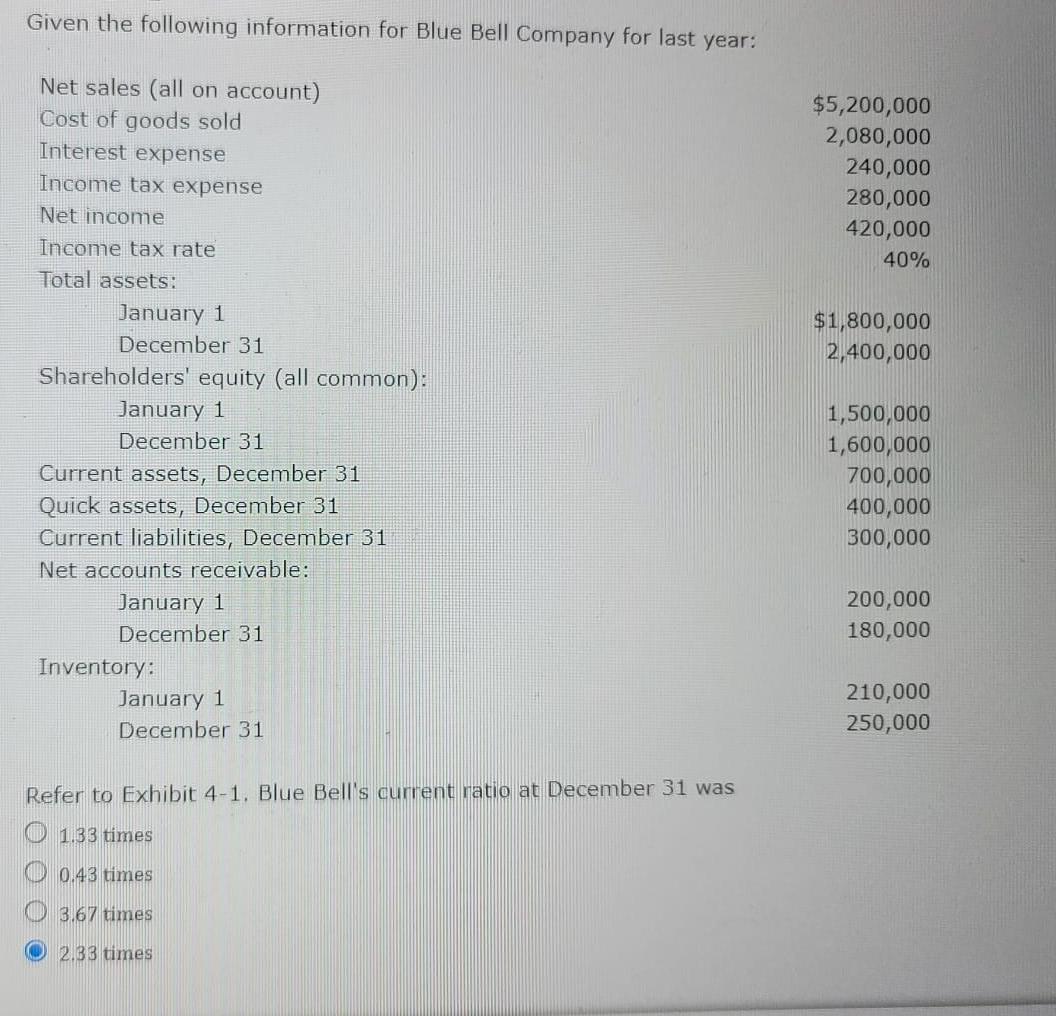

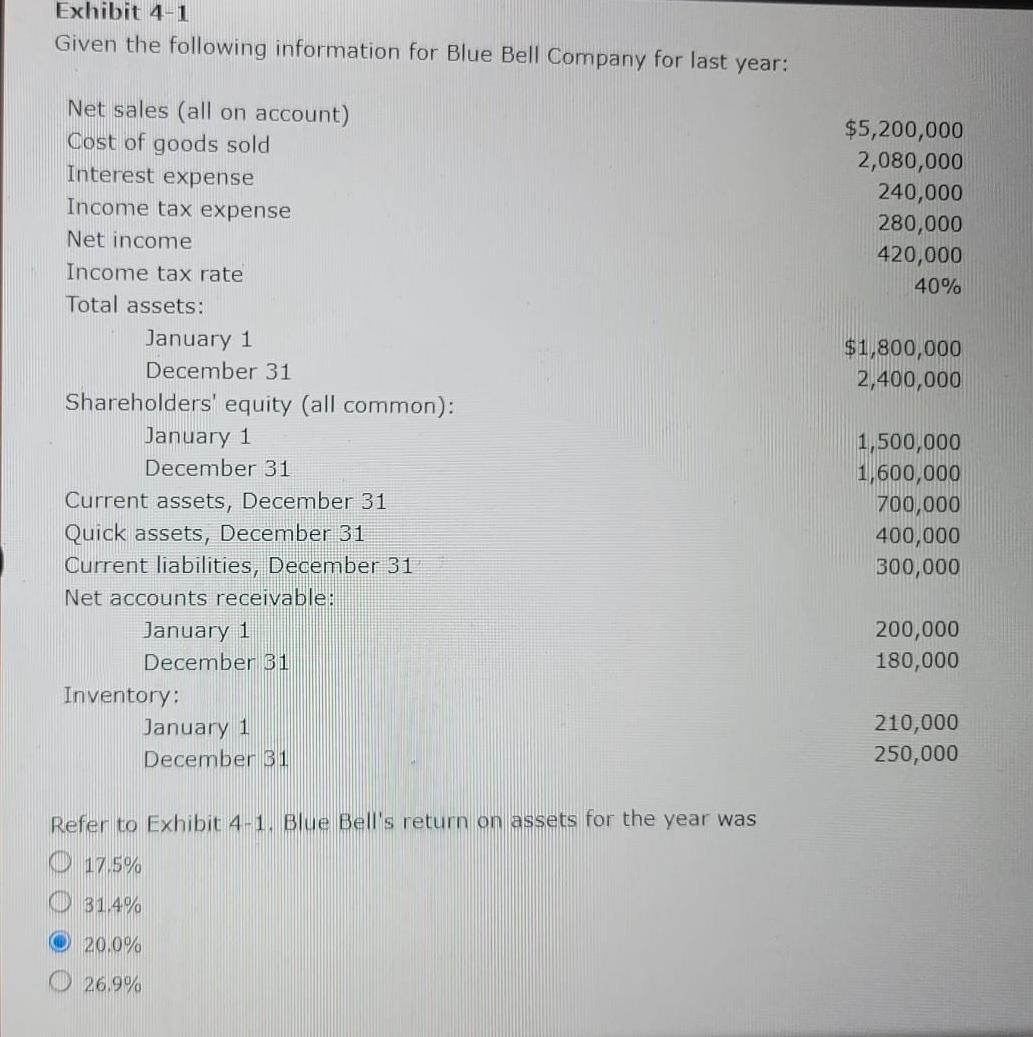

Given the following information for Blue Bell Company for last year: $5,200,000 2,080,000 240,000 280,000 420,000 40% $1,800,000 2,400,000 Net sales (all on account) Cost

Given the following information for Blue Bell Company for last year: $5,200,000 2,080,000 240,000 280,000 420,000 40% $1,800,000 2,400,000 Net sales (all on account) Cost of goods sold Interest expense Income tax expense Net income Income tax rate Total assets: January 1 December 31 Shareholders' equity (all common): January 1 December 31 Current assets, December 31 Quick assets, December 31 Current liabilities, December 31 Net accounts receivable: January 1 December 31 Inventory: January 1 December 31 1,500,000 1,600,000 700,000 400,000 300,000 200,000 180,000 210,000 250,000 Refer to Exhibit 4-1. Blue Bell's current ratio at December 31 was 0 1.33 times O 0.43 times 3.67 times 2.83 times Exhibit 4-1 Given the following information for Blue Bell Company for last year: $5,200,000 2,080,000 240,000 280,000 420,000 40% $1,800,000 2,400,000 Net sales (all on account) Cost of goods sold Interest expense Income tax expense Net income Income tax rate Total assets: January 1 December 31 Shareholders' equity (all common): January 1 December 31 Current assets, December 31 Quick assets, December 31 Current liabilities, December 31 Net accounts receivable: January 1 December 31 Inventory: January 1 December 31 1,500,000 1,600,000 700,000 400,000 300,000 200,000 180,000 210,000 250,000 Refer to Exhibit 4-1. Blue Bell's return on assets for the year was 17.5% 31.4% 20.0% 26.9% A balance sheet account that is usually reported at present value is O Accounts Payable. Note Payable. Inventory. O Land

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started