Answered step by step

Verified Expert Solution

Question

1 Approved Answer

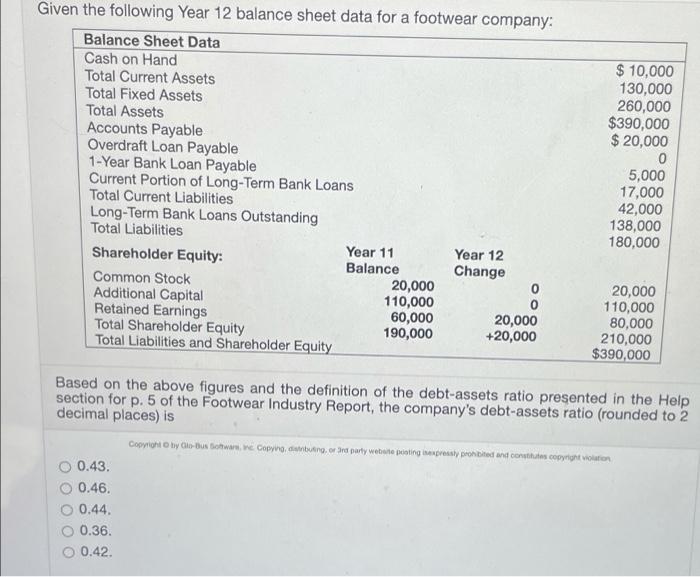

Given the following Year 12 balance sheet data for a footwear company: Balance Sheet Data Cash on Hand Total Current Assets Total Fixed Assets

Given the following Year 12 balance sheet data for a footwear company: Balance Sheet Data Cash on Hand Total Current Assets Total Fixed Assets Total Assets Accounts Payable Overdraft Loan Payable 1-Year Bank Loan Payable Current Portion of Long-Term Bank Loans Total Current Liabilities Long-Term Bank Loans Outstanding Total Liabilities $ 10,000 130,000 260,000 $390,000 $ 20,000 5,000 17,000 42,000 138,000 180,000 Shareholder Equity: Year 11 Year 12 Balance 20,000 110,000 60,000 190,000 Change Common Stock Additional Capital Retained Earnings Total Shareholder Equity Total Liabilities and Shareholder Equity 20,000 110,000 80,000 210,000 $390,000 20,000 +20,000 Based on the above figures and the definition of the debt-assets ratio presented in the Help section for p. 5 of the Footwear Industry Report, the company's debt-assets ratio (rounded to 2 decimal places) is Copyright O by Glo-Bus Sotwar, e Copying, datnbutng, or ard party website posting inepressly prohibited and constitutes copyright violation 0.43. O 0.46. O 0.44. 0.36. O 0.42.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Correct Answer 046 DebtAsset ratio is a leverage ratio which shows the portion ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started