Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the importance of working capital management, consider the case of Pudgy Panda Production Company and both the amount of working capital that it is

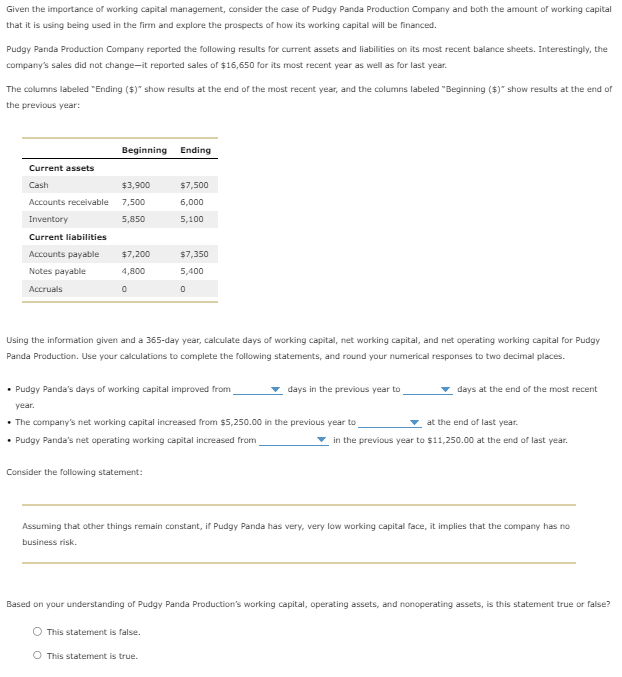

Given the importance of working capital management, consider the case of Pudgy Panda Production Company and both the amount of working capital that it is using being used in the firm and explore the prospects of how its working capital will be financed. Pudgy Panda Production Company reported the following results for current assets and liabilities on its most recent balance sheets. Interestingly, the company's sales did not change-it reported sales of \\( \\$ 16,650 \\) for its most recent year as well as for last year. The columns labeled \"Ending (\\$)* show results at the end of the most recent year, and the columns labeled \"Beginning (\\$)* show results at the end of the previous year: Using the information given and a 365-day year, calculate days of working capital, net working capital, and net operating working capital for Pudgy Panda Production. Use your calculations to complete the following statements, and round your numerical responses to two decimal places. - Pudgy Panda's days of working capital improved from year. days in the previous year to - The company's net working capital increased from \\( \\$ 5,250.00 \\) in the previous year to days at the end of the most recent at the end of last year. - Pudgy Panda's net operating working capital increased from in the previous year to \\( \\$ 11,250.00 \\) at the end of last year. Consider the following statement: Assuming that other things remain constant, if Pudgy Panda has very, very low working capital face, it implies that the company has no business risk. Based on your understanding of Pudgy Panda Production's working capital, operating assets, and nonoperating assets, is this statement true or false? This statement is false. This statement is true

Given the importance of working capital management, consider the case of Pudgy Panda Production Company and both the amount of working capital that it is using being used in the firm and explore the prospects of how its working capital will be financed. Pudgy Panda Production Company reported the following results for current assets and liabilities on its most recent balance sheets. Interestingly, the company's sales did not change-it reported sales of \\( \\$ 16,650 \\) for its most recent year as well as for last year. The columns labeled \"Ending (\\$)* show results at the end of the most recent year, and the columns labeled \"Beginning (\\$)* show results at the end of the previous year: Using the information given and a 365-day year, calculate days of working capital, net working capital, and net operating working capital for Pudgy Panda Production. Use your calculations to complete the following statements, and round your numerical responses to two decimal places. - Pudgy Panda's days of working capital improved from year. days in the previous year to - The company's net working capital increased from \\( \\$ 5,250.00 \\) in the previous year to days at the end of the most recent at the end of last year. - Pudgy Panda's net operating working capital increased from in the previous year to \\( \\$ 11,250.00 \\) at the end of last year. Consider the following statement: Assuming that other things remain constant, if Pudgy Panda has very, very low working capital face, it implies that the company has no business risk. Based on your understanding of Pudgy Panda Production's working capital, operating assets, and nonoperating assets, is this statement true or false? This statement is false. This statement is true Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started