Answered step by step

Verified Expert Solution

Question

1 Approved Answer

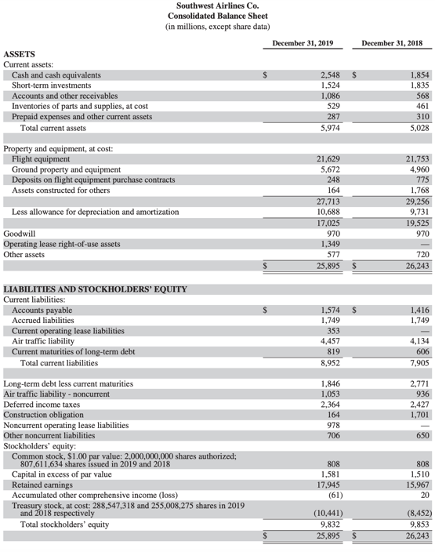

Given the information find: What is the par value of each share of common stock issued? How much money in excess of the par value

Given the information find:

- What is the par value of each share of common stock issued?

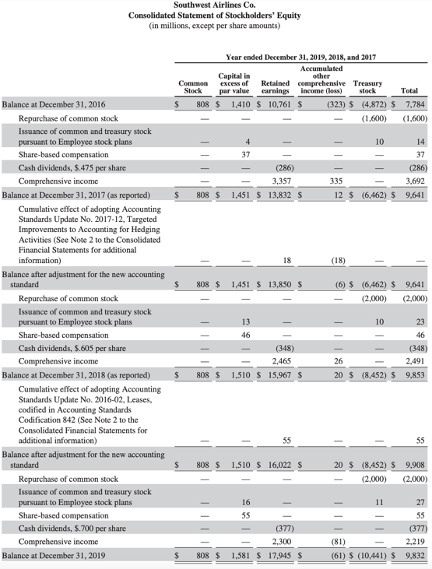

- How much money in excess of the par value of the stock (i.e. Additional Paid in Capital, or APIC) had been contributed by shareholders as of the end of 2019 (hint: this is listed as Capital in Excess of Par Value on the balance sheet)

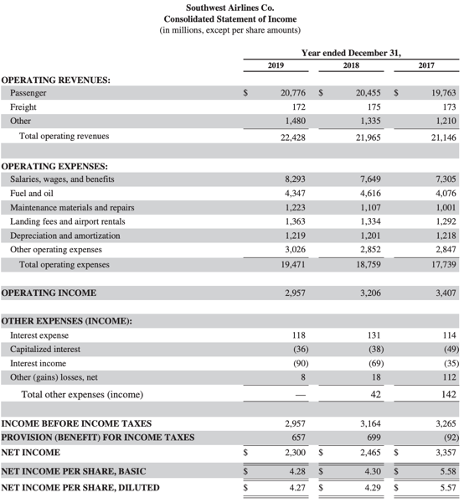

- What is Southwests Earnings Per Share (Basic) for the fiscal year ended 12/31/2019?

- What is the Return on Equity (ROE) for Southwest for the fiscal year ended 12/31/2019?

- ****when calculating average equity for the denominator of ROE, for the 12/31/2018 ending equity balance, use the reported balance number, $9,853 million. Average that amount with the 12/31/2019 ending equity balance to calculate average equity for the period)

*Please show as much work as needed, I want to make sure I actually know how to calculate these things

Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2019 December 31, 2018 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, al cost Prepaid expenses and other current assets Total current assets 2,548 5 1.524 1,086 529 287 5.974 1,854 1,835 568 461 310 5.028 Property and equipment, al cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others 21,629 5,672 248 164 27,713 10,688 17,025 970 1,349 577 25,895 21,753 4.980 775 1,768 29,256 9.731 19.525 970 Less allowance for depreciation and amortization Goodwill Operating lease right-of-use assets Other assets 720 26,243 $ 1,416 1,749 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities 1,574 1,749 353 4,457 819 8,952 606 7,905 1.846 1,053 2.3644 164 978 206 2,771 936 2,427 1,701 650 Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes Construction obligation Noncurrent operating lease liabilities Other moncurrent liabilities Stockholders' equity: Common stock. $1.00 par value: 2.000,000,000 shares authorized; 807,611,634 shares issued in 2019 and 2018 Capital in excess of par value Retained earnings Accumulated other comprehensive income (loss) Treasury stock, at cost: 288,547,318 and 255.008.275 shares in 2019 and 2018 respectively Total stockholders' equity 808 1.581 17.945 (61) 808 1.510 15,967 20 (10,441) 9,832 25,895 (8,452) 9,853 26,243 Southwest Airlines Co. Consolidated Statement of Income (in millions, except per share amounts) Year ended December 31, 2018 2019 2017 $ $ OPERATING REVENUES: Passenger Freight Other Total operating revenues 20.776 $ 172 1.480 22.428 20,455 175 1,335 19,763 173 1.210 21,965 21.146 7,305 4,076 1,001 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Landing fees and airport rentals Depreciation and amortization Other operating expenses Total operating expenses 8.293 4.347 1.223 1.363 1.219 3,026 19,471 7,649 4,616 1,107 1,334 1,201 2,852 1.292 1.218 2,847 17,739 18,759 OPERATING INCOME 2.957 3,206 3,407 114 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) 118 (36) (90) 8 131 (38) (69) 18 (49) (35) 112 42 142 2.957 3,164 699 3.265 (92) 2.300 $ INCOME BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXE NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED 2,465 $ 3,357 S 4.28 S 4.30 $ 5.58 4.29 S 5.57 Southwest Airlines Co. Consolidated Statement of Stockholders' Equity in millions, except per share amounts) ther Year ended December 31, 2019, 2018, and 2017 Accumulated Common excess of Retained comprehensive Treasury Stock per value earnings income) stock Total $ 808 $ 1,410 $ 10,761 S (323) $ (4.872) $ 7,784 (1.600) (1.600) 37 10 14 37 (286) 335 3,692 12 $ (6.462) $ 9,641 3,357 1,451 $ 13,832 S 808$ - IS (18) - 808$ 1,451 $ 13,850 $ (6) $ (6,462) $ 9,641 (2.000) (2.000) Balance at December 31, 2016 Repurchase of common stock Issuance of common and treasury stock pursuant to Employee stock plans Share-based compensation Cash dividends, $.475 per share Comprehensive income Balance at December 31, 2017 (as reported) Cumulative effect of adopting Accounting Standards Update No. 2017-12, Targeted Improvements to Accounting for Hedging Activities (See Note 2 to the Consolidated Financial Statements for additional information) Balance after adjustment for the new accounting standard Repurchase of common stock Issuance of common and treasury stock pursuant to Employee stock plans Share-based compensation Cash dividends, $.605 per share Comprehensive income Balance at December 31, 2018 (as reported) Cumulative effect of adopting Accounting Standards Update No. 2016-02. Leases. codified in Accounting Standards Codification 842 (See Note 2 to the Consolidated Financial Statements for additional information) Balance after adjustment for the new accounting standard Repurchase of common stock Issuance of common and treasury stock pursuant to Employee stock plans Share-based compensation Cash dividends, $.700 per share Comprehensive income Balance at December 31, 2019 13 46 (348) 2,465 808 $ 1,510 $ 15,967 S III 10 23 46 (348) 26 2,491 20 $ 8,452) $ 9,853 $ 55 S 808 $ 1.510 $ 16,022 S 12 20 $ (8.452) $ 9,908 (2.000) (2.000) 27 11 " 16 55 (377) 2,300 1,581 $ 17,945 $ 55 (377) (81) 2.219 (61) $ (10,441) $ 9,832 $ 808 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started