Answered step by step

Verified Expert Solution

Question

1 Approved Answer

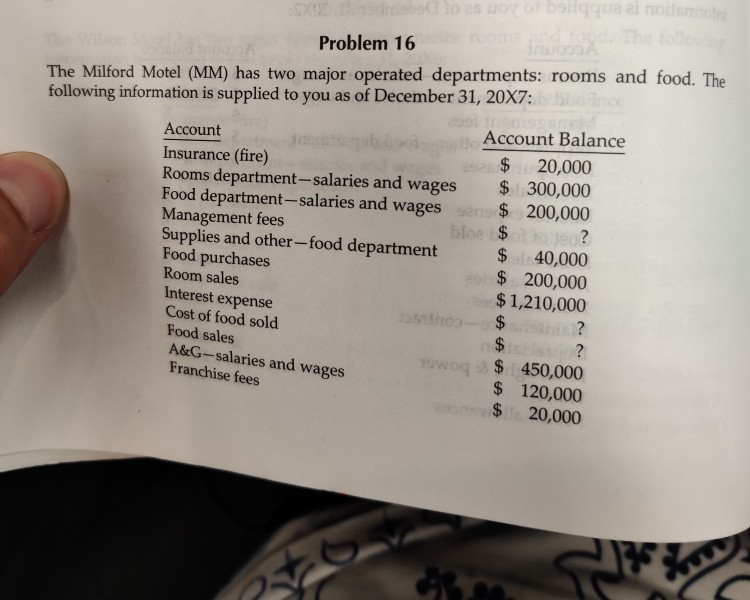

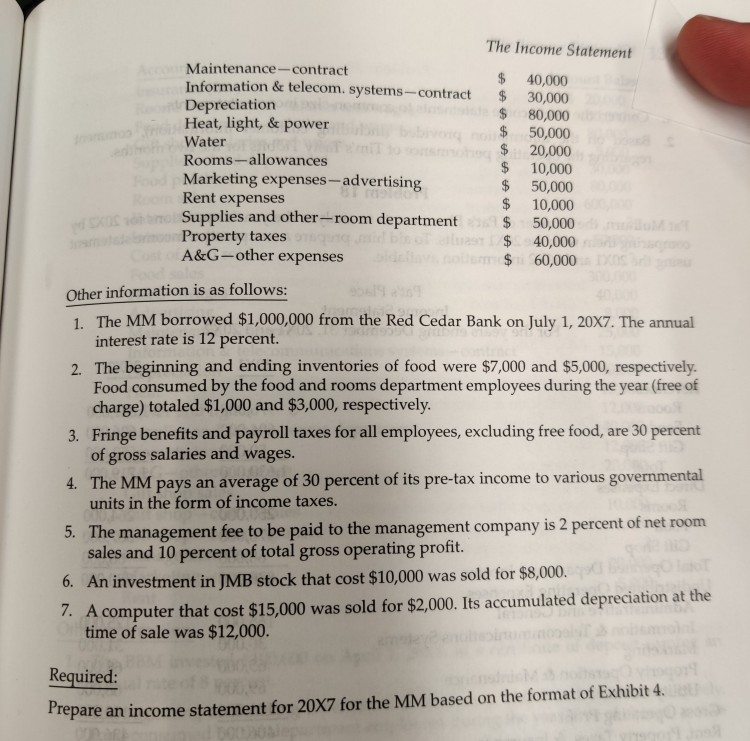

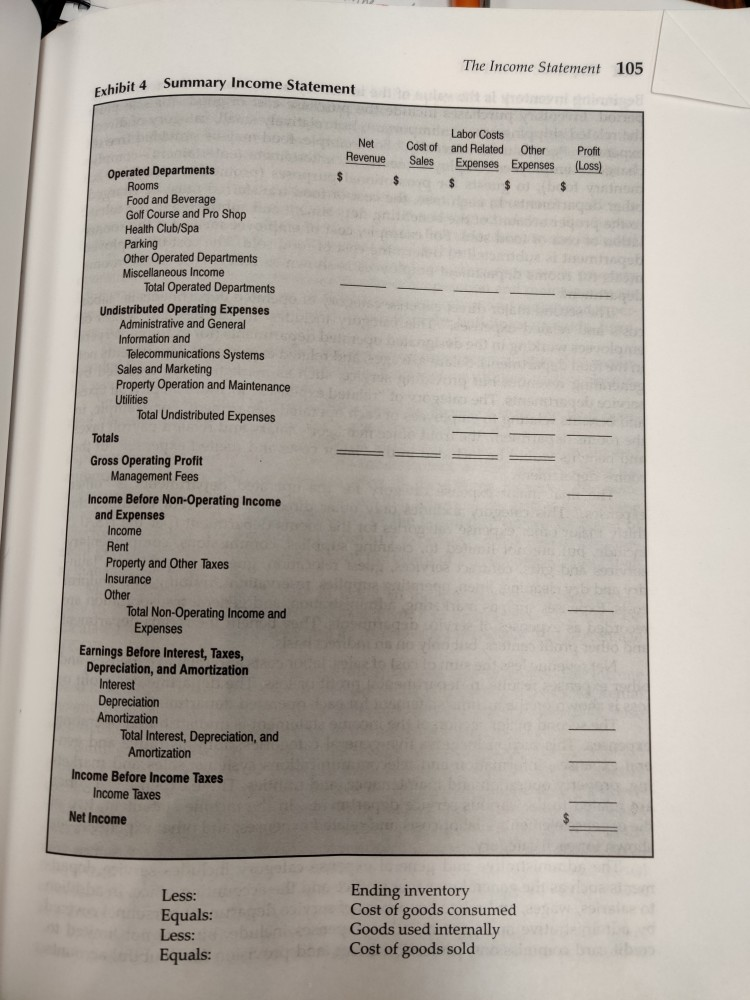

given the information in the first two pictures, I am supposed to prepare an income statement via Microsoft Excel, modeling exhibit 4 (the third attached

given the information in the first two pictures, I am supposed to prepare an income statement via Microsoft Excel, modeling exhibit 4 (the third attached picture) and based off of the 7 steps of other information provided in picture 2.

assistance through all of the problem is needed, but especially wondering which values Column 4 in the income statement (Other Expenses) ends up being derived from.

thanks in advance.

oloo following me es uov of b SX05 Problem 16 The Milford Motel (MM) has two major operated departments: rooms and food. The following information is supplied to you as of December 31, 20X7: Account Balance Account $ 20,000 Insurance (fire) Rooms department-salaries and wages Food department-salaries and wages Management fees Supplies and other-food department Food purchases Room sales Interest expense Cost of food sold Food sales A&G-salaries and wages Franchise fees $1300,000 $ 200,000 pe? $:40,000 bloe $ $ 200,000 $1,210,000 hin? Stioo--o $ ow s 450,000 $ 120,000 $ : 20,000 The Income Statement AccouMaintenance-contract $ 40,000 $ 30,000 80,000 $ Information & telecom. systems-contract Depreciation Heat, light, & power $ 50,000 $ 20,000 $ Water Rooms-allowances 10,000 50,000 $ Marketing expenses-advertising Rent expenses Supplies and other-room department Property taxes A&G-other expenses 10,000 50,000 $ 40,000 $60,000 Other information is as follows: The MM borrowed $1,000,000 from the Red Cedar Bank on July 1, 20X7. The annual interest rate is 12 percent. 1 2. The beginning and ending inventories of food were $7,000 and $5,000, respectively. Food consumed by the food and rooms department employees during the year (free of charge) totaled $1,000 and $3,000, respectively. 3. Fringe benefits and payroll taxes for all employees, excluding free food, of gross salaries and wages. are 30 percent 4. The MM pays an average of 30 percent of its pre-tax income to various governmental units in the form of income taxes. 5. The management fee to be paid to the management company is 2 percent of net room sales and 10 percent of total gross operating profit. 6. An investment in JMB stock that cost $10,000 was sold for $8,000. 7. A computer that cost $15,000 was sold for $2,000. Its accumulated depreciation at the time of sale was $12,000 Required: Prepare an income statement for 20X7 for the MM based on the format of Exhibit 4. CORRA oloo following me es uov of b SX05 Problem 16 The Milford Motel (MM) has two major operated departments: rooms and food. The following information is supplied to you as of December 31, 20X7: Account Balance Account $ 20,000 Insurance (fire) Rooms department-salaries and wages Food department-salaries and wages Management fees Supplies and other-food department Food purchases Room sales Interest expense Cost of food sold Food sales A&G-salaries and wages Franchise fees $1300,000 $ 200,000 pe? $:40,000 bloe $ $ 200,000 $1,210,000 hin? Stioo--o $ ow s 450,000 $ 120,000 $ : 20,000 The Income Statement AccouMaintenance-contract $ 40,000 $ 30,000 80,000 $ Information & telecom. systems-contract Depreciation Heat, light, & power $ 50,000 $ 20,000 $ Water Rooms-allowances 10,000 50,000 $ Marketing expenses-advertising Rent expenses Supplies and other-room department Property taxes A&G-other expenses 10,000 50,000 $ 40,000 $60,000 Other information is as follows: The MM borrowed $1,000,000 from the Red Cedar Bank on July 1, 20X7. The annual interest rate is 12 percent. 1 2. The beginning and ending inventories of food were $7,000 and $5,000, respectively. Food consumed by the food and rooms department employees during the year (free of charge) totaled $1,000 and $3,000, respectively. 3. Fringe benefits and payroll taxes for all employees, excluding free food, of gross salaries and wages. are 30 percent 4. The MM pays an average of 30 percent of its pre-tax income to various governmental units in the form of income taxes. 5. The management fee to be paid to the management company is 2 percent of net room sales and 10 percent of total gross operating profit. 6. An investment in JMB stock that cost $10,000 was sold for $8,000. 7. A computer that cost $15,000 was sold for $2,000. Its accumulated depreciation at the time of sale was $12,000 Required: Prepare an income statement for 20X7 for the MM based on the format of Exhibit 4. CORRAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started