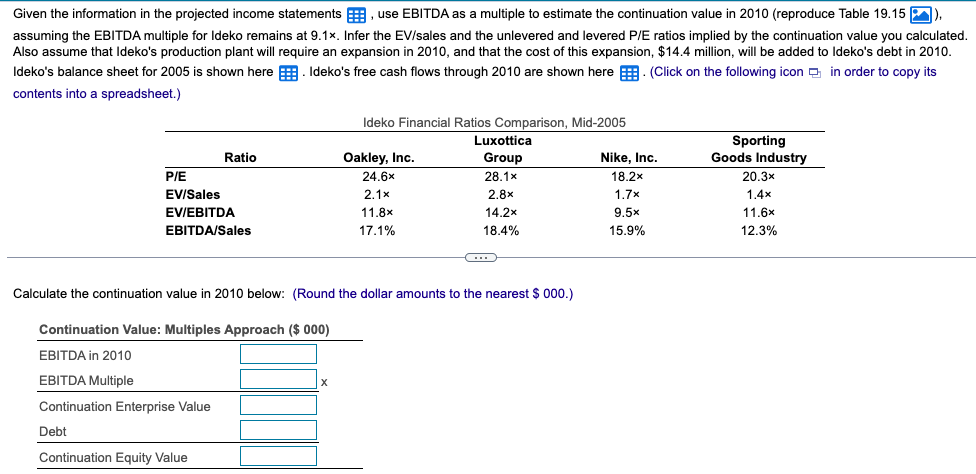

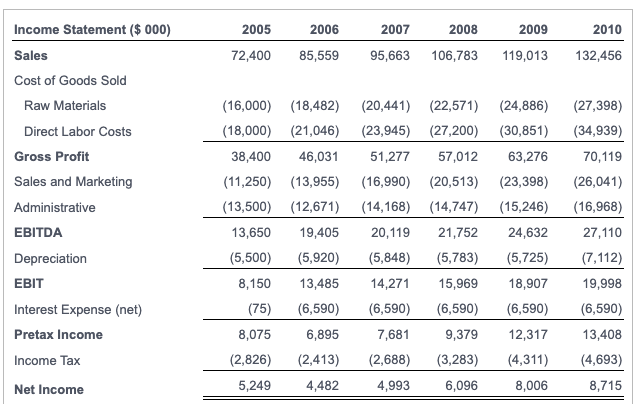

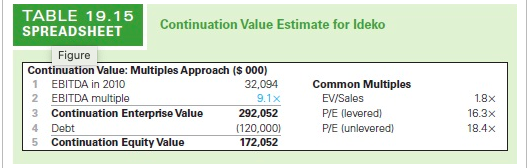

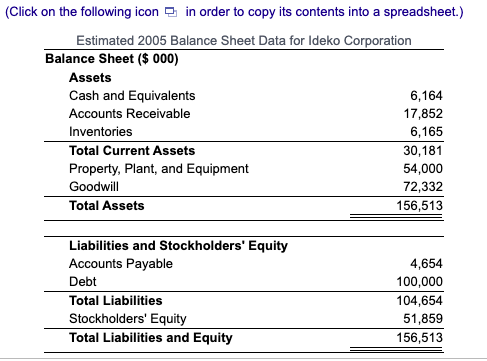

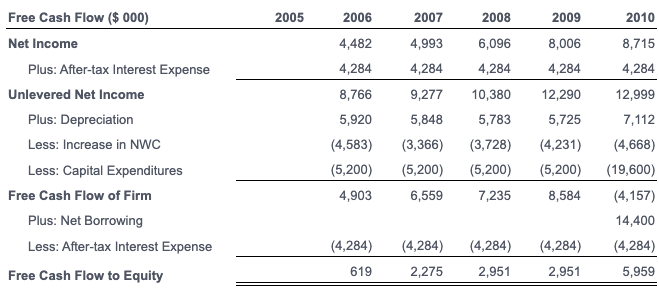

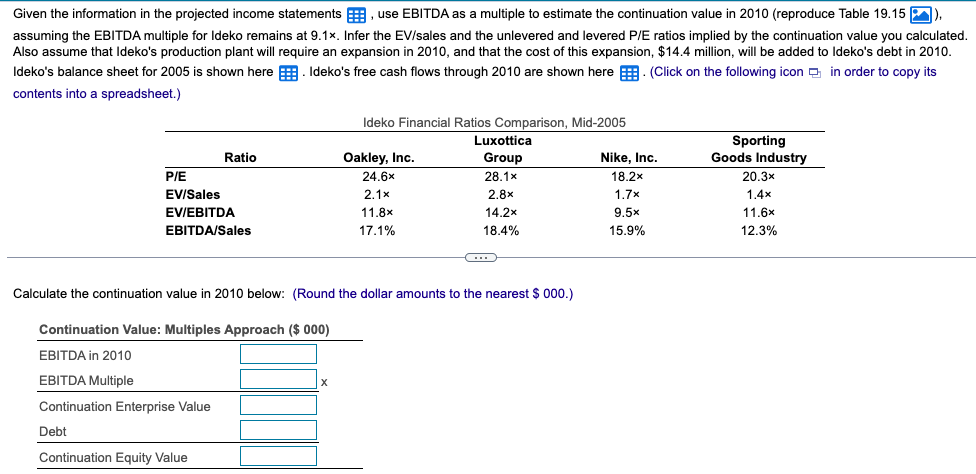

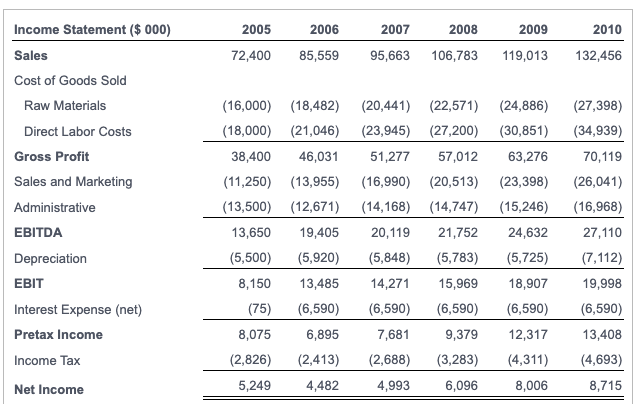

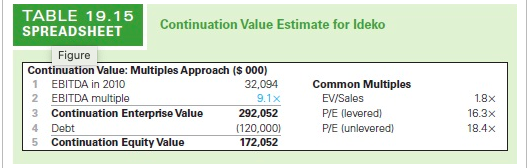

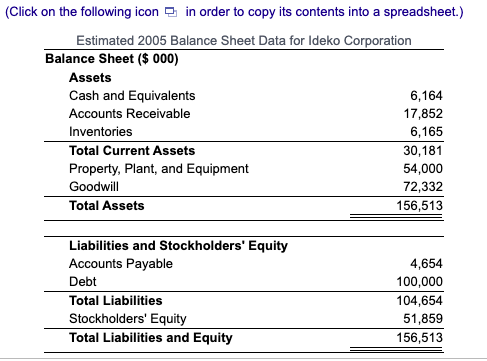

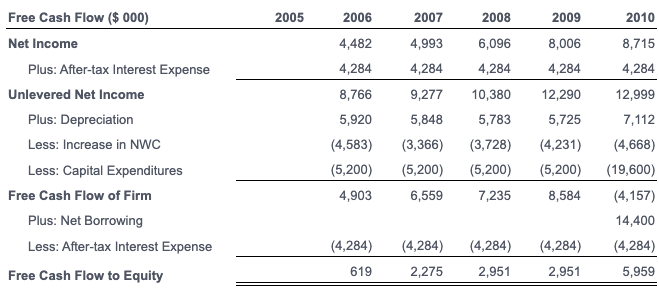

Given the information in the projected income statements, use EBITDA as a multiple to estimate the continuation value in 2010 (reproduce Table 19.15), assuming the EBITDA multiple for Ideko remains at 9.1x. Infer the EV/sales and the unlevered and levered P/E ratios implied by the continuation value you calculated. Also assume that Ideko's production plant will require an expansion in 2010, and that the cost of this expansion, $14.4 million, will be added to Ideko's debt in 2010. Ideko's balance sheet for 2005 is shown here . Ideko's free cash flows through 2010 are shown here (Click on the following icon in order to copy its contents into a spreadsheet.) Ratio PIE EV/Sales EV/EBITDA EBITDA/Sales Ideko Financial Ratios Comparison, Mid-2005 Luxottica Oakley, Inc. Group Nike, Inc. 24.6% 28.1% 18.2x 2.1 x 2.8x 1.7x 11.8x 14.2x 9.5x 17.1% 18.4% 15.9% Sporting Goods Industry 20.3 1.4x 11.6% 12.3% .. Calculate the continuation value in 2010 below: (Round the dollar amounts to the nearest $ 000.) Continuation Value: Multiples Approach ($ 000) EBITDA in 2010 EBITDA Multiple X Continuation Enterprise Value Debt Continuation Equity Value 2005 2006 2007 2008 2009 2010 72,400 85,559 95,663 106,783 119,013 132,456 (27,398) (34,939) Income Statement ($ 000) Sales Cost of Goods Sold Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income (16,000) (18,482) (20,441) (22,571) (24,886) (18,000) (21,046) (23,945) (27,200) (30,851) 38,400 46,031 51,277 57,012 63,276 (11,250) (13,955) (16,990) (20,513) (23,398) (13,500) (12,671) (14,168) (14,747) (15,246) 13,650 19,405 20,119 21,752 24,632 (5,500) (5,920) (5,848) (5,783) (5,725) 8,150 13,485 14,271 15,969 18,907 (75) (6,590) (6,590) (6,590) (6,590) 8,075 6,895 7,681 9,379 12,317 (2,826) (2,413) (2,688) (3,283) (4,311) 5,249 4,482 4,993 6,096 8,006 70,119 (26,041) (16,968) 27,110 (7,112) 19,998 (6,590) 13,408 (4,693) 8,715 TABLE 19.15 SPREADSHEET Continuation Value Estimate for ldeko Figure Continuation Value: Multiples Approach ($ 000) 1 EBITDA in 2010 32,094 Common Multiples 2 EBITDA multiple 9.1 x EV/Sales 3 Continuation Enterprise Value 292,052 P/E (levered) Debt (120,000) P/E (unlevered) Continuation Equity Value 172,052 1.8% 16.3x 18.4x 4 5 (Click on the following icon in order to copy its contents into a spreadsheet.) Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet ($ 000) Assets Cash and Equivalents 6,164 Accounts Receivable 17,852 Inventories 6,165 Total Current Assets 30,181 Property, Plant, and Equipment 54,000 Goodwill 72,332 Total Assets 156,513 Liabilities and Stockholders' Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 4,654 100,000 104,654 51,859 156,513 2005 2006 2007 2008 2009 2010 8,006 4,482 4,284 4,993 4,284 6,096 4,284 4,284 8,766 9,277 10,380 12,290 Free Cash Flow ($ 000) Net Income Plus: After-tax Interest Expense Unlevered Net Income Plus: Depreciation Less: Increase in NWC Less: Capital Expenditures Free Cash Flow of Firm Plus: Net Borrowing Less: After-tax Interest Expense Free Cash Flow to Equity 5,920 (4,583) (5,200) 4,903 5,848 (3,366) (5,200) 6,559 5,783 (3,728) (5,200) 7,235 5,725 (4,231) (5,200) 8,584 8,715 4,284 12,999 7,112 (4,668) (19,600) (4,157) 14,400 (4,284) 5,959 (4,284) (4,284) (4,284) (4,284) 2,275 619 2,951 2,951 Given the information in the projected income statements, use EBITDA as a multiple to estimate the continuation value in 2010 (reproduce Table 19.15), assuming the EBITDA multiple for Ideko remains at 9.1x. Infer the EV/sales and the unlevered and levered P/E ratios implied by the continuation value you calculated. Also assume that Ideko's production plant will require an expansion in 2010, and that the cost of this expansion, $14.4 million, will be added to Ideko's debt in 2010. Ideko's balance sheet for 2005 is shown here . Ideko's free cash flows through 2010 are shown here (Click on the following icon in order to copy its contents into a spreadsheet.) Ratio PIE EV/Sales EV/EBITDA EBITDA/Sales Ideko Financial Ratios Comparison, Mid-2005 Luxottica Oakley, Inc. Group Nike, Inc. 24.6% 28.1% 18.2x 2.1 x 2.8x 1.7x 11.8x 14.2x 9.5x 17.1% 18.4% 15.9% Sporting Goods Industry 20.3 1.4x 11.6% 12.3% .. Calculate the continuation value in 2010 below: (Round the dollar amounts to the nearest $ 000.) Continuation Value: Multiples Approach ($ 000) EBITDA in 2010 EBITDA Multiple X Continuation Enterprise Value Debt Continuation Equity Value 2005 2006 2007 2008 2009 2010 72,400 85,559 95,663 106,783 119,013 132,456 (27,398) (34,939) Income Statement ($ 000) Sales Cost of Goods Sold Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income (16,000) (18,482) (20,441) (22,571) (24,886) (18,000) (21,046) (23,945) (27,200) (30,851) 38,400 46,031 51,277 57,012 63,276 (11,250) (13,955) (16,990) (20,513) (23,398) (13,500) (12,671) (14,168) (14,747) (15,246) 13,650 19,405 20,119 21,752 24,632 (5,500) (5,920) (5,848) (5,783) (5,725) 8,150 13,485 14,271 15,969 18,907 (75) (6,590) (6,590) (6,590) (6,590) 8,075 6,895 7,681 9,379 12,317 (2,826) (2,413) (2,688) (3,283) (4,311) 5,249 4,482 4,993 6,096 8,006 70,119 (26,041) (16,968) 27,110 (7,112) 19,998 (6,590) 13,408 (4,693) 8,715 TABLE 19.15 SPREADSHEET Continuation Value Estimate for ldeko Figure Continuation Value: Multiples Approach ($ 000) 1 EBITDA in 2010 32,094 Common Multiples 2 EBITDA multiple 9.1 x EV/Sales 3 Continuation Enterprise Value 292,052 P/E (levered) Debt (120,000) P/E (unlevered) Continuation Equity Value 172,052 1.8% 16.3x 18.4x 4 5 (Click on the following icon in order to copy its contents into a spreadsheet.) Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet ($ 000) Assets Cash and Equivalents 6,164 Accounts Receivable 17,852 Inventories 6,165 Total Current Assets 30,181 Property, Plant, and Equipment 54,000 Goodwill 72,332 Total Assets 156,513 Liabilities and Stockholders' Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 4,654 100,000 104,654 51,859 156,513 2005 2006 2007 2008 2009 2010 8,006 4,482 4,284 4,993 4,284 6,096 4,284 4,284 8,766 9,277 10,380 12,290 Free Cash Flow ($ 000) Net Income Plus: After-tax Interest Expense Unlevered Net Income Plus: Depreciation Less: Increase in NWC Less: Capital Expenditures Free Cash Flow of Firm Plus: Net Borrowing Less: After-tax Interest Expense Free Cash Flow to Equity 5,920 (4,583) (5,200) 4,903 5,848 (3,366) (5,200) 6,559 5,783 (3,728) (5,200) 7,235 5,725 (4,231) (5,200) 8,584 8,715 4,284 12,999 7,112 (4,668) (19,600) (4,157) 14,400 (4,284) 5,959 (4,284) (4,284) (4,284) (4,284) 2,275 619 2,951 2,951