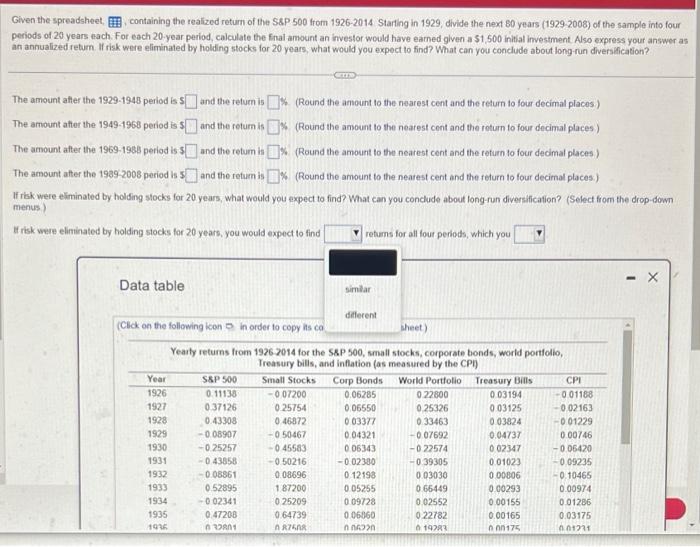

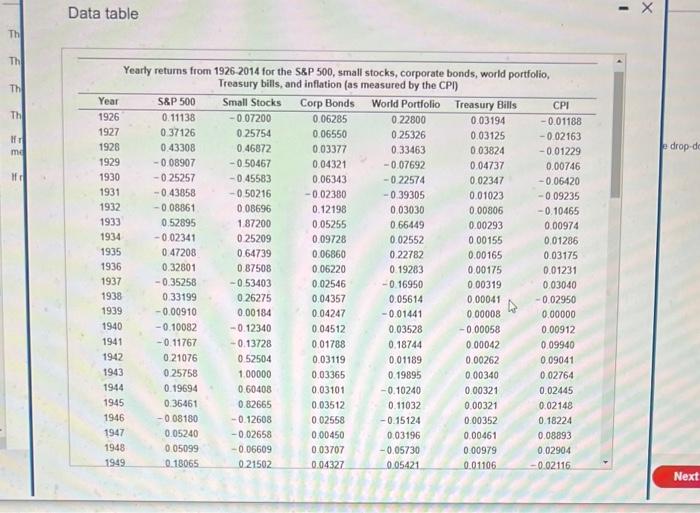

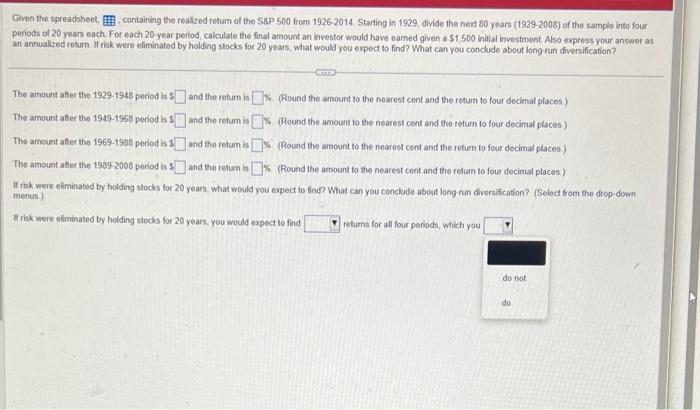

Given the spreadsheet,_ containing the tealized return of the S8P 500 from 19262014 Starting in 1929 , divide the next 80 years (1929-2008) of the sample into four periods of 20 years teach. For each 20-year period, calculate the final amount an investor would have eamed given a $1,500 initial investment. Also express your answer as an annualized return. If risk were eliminated by holding stocks for 20 years, what would you expect to find? What can you conclude about long-run diversification? The amount after the 1929-1948 period is 5 and the return is \&. (Round the amount to the nearest cent and the return to four decimal places?) The amount after the 19491968 period is 9 and the return is W (Round the amount to she nearest cent and the roturn to four decimal places.) The arnount after the 1969-1983 period is 7 and the retum is % (Round the amount to the nearest cent and the roturn to four decimal places) The amount after the 19392008 period is 3 and the return is % (Round the anount to the nearest cent and the feturn io four decimal places.) If rikk were eliminated by holding slocks for 20 years, what would you axpect to find? What can you conclude about long-run diversification? (Select from the drop-down menus ) Hf risk ware eliminated by holding stocks for 20 years, you would expect to find returns for all fout periods, which you Data table Yearly returns from 1926-2014 for the S\&P 500, small stocks. corporate bonds. world nortfolio. Given the spreadsheet, containing the realized return of the S8P 500 from 19262014.51 arting in 1929, divide the next 80 years (1929-2008) of the tample into four periods of 20 years each. For each 20 year period, calculate the final amount an investor would have earned given a $1,500 initial investment Also express your answer as an annualized return. If risk were eliminated by holding stocks for 20 years, what would you expect to find? What can you conclude about long-run diversification? The amount after the 1929.1948 period is 5 and the return is % (Round the amount to the nearest cent and the retum to four decimal places ) The amount after the 1949-1968 period is 5 and the return is \%. (Round the amount to the nearest cent and the rofurn to four decimal places) The amount after the 1969-1986 period is $ und the return is W. (Round the arnownt to the nearest cont and the return to four decimal places.) The amount atter the 19692008 period is 1 and the return is \%. (Round the amount to the nearest cent and the retum to four decimal places) If rek were eliminated by holding stocks for 20 years, what would you expect to finc? What can you conclude about long-run diversification? (Select from the drop-down menus) It risk wore eliminated by holding stocks for 20 years, you would expect to find returns for all four periods, which you