Question: Given this information, what is the answer to question 1, If comparable bonds yields shift up by 15 bps, using the bonds duration, what will

Given this information, what is the answer to question 1, "If comparable bonds yields shift up by 15 bps, using the bonds duration, what will be the market value change of this bond?

Given this information, what is the answer to question 1, "If comparable bonds yields shift up by 15 bps, using the bonds duration, what will be the market value change of this bond?

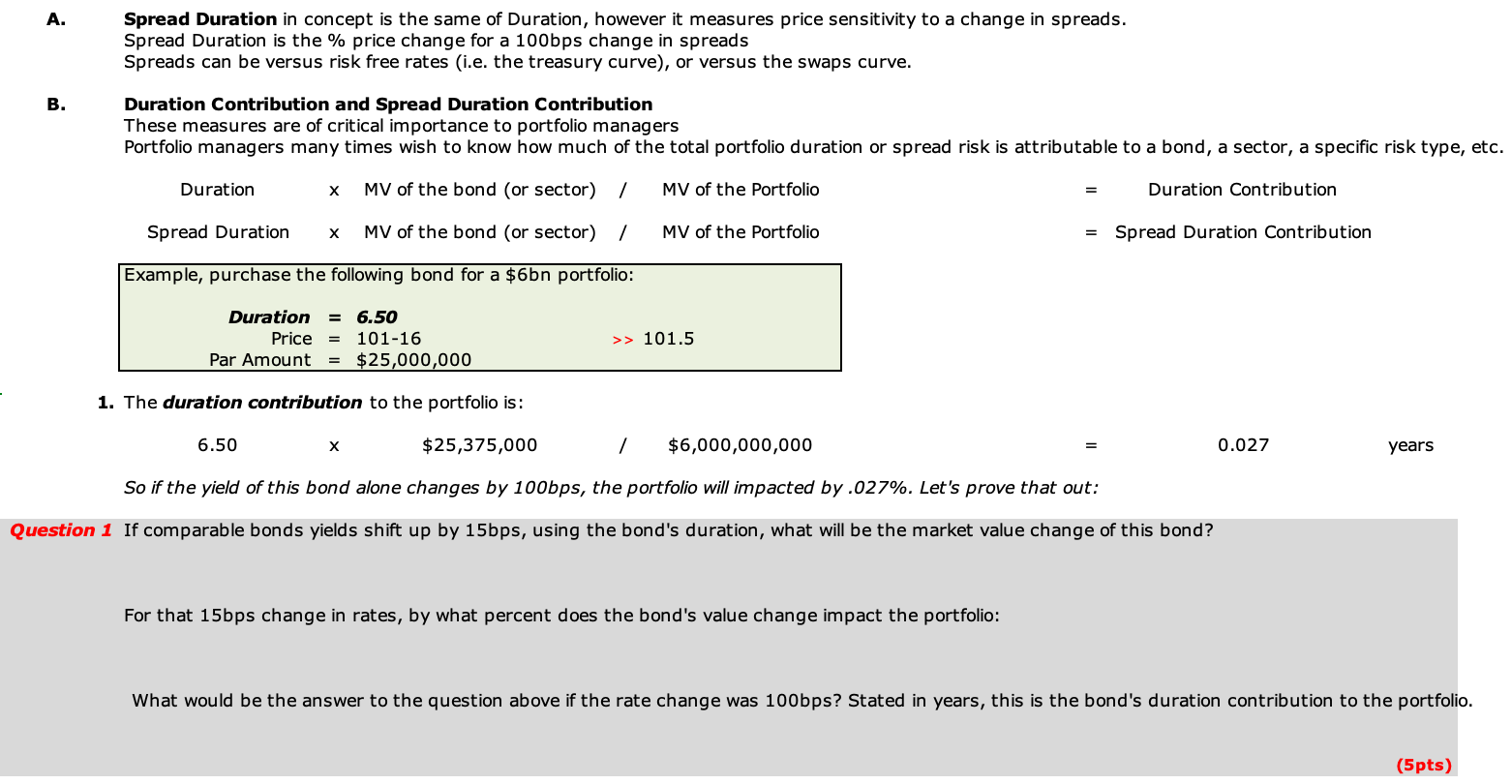

A. Spread Duration in concept is the same of Duration, however it measures price sensitivity to a change in spreads. Spread Duration is the \% price change for a 100b s change in spreads Spreads can be versus risk free rates (i.e. the treasury curve), or versus the swaps curve. B. Duration Contribution and Spread Duration Contribution These measures are of critical importance to portfolio managers Portfolio managers many times wish to know how much of the total portfolio duration or spread risk is attributable to a bond, a sector, a specific risk type, e Duration x MV of the bond (or sector) / MV of the Portfolio Duration Contribution Spread Duration x MV of the bond (or sector) / MV of the Portfolio = Spread Duration Contribution Example, purchase the following bond for a $6b portfolio: DurationPriceParAmount=6.50=10116>>101.5=$25,000,000 1. The duration contribution to the portfolio is: 6.50x$25,375,000/6.027years So if the yield of this bond alone changes by 100b ps, the portfolio will impacted by .027\%. Let's prove that out: astion 1 If comparable bonds yields shift up by 15bps, using the bond's duration, what will be the market value change of this bond? For that 15bps change in rates, by what percent does the bond's value change impact the portfolio: What would be the answer to the question above if the rate change was 100bps ? Stated in years, this is the bond's duration contribution to the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts