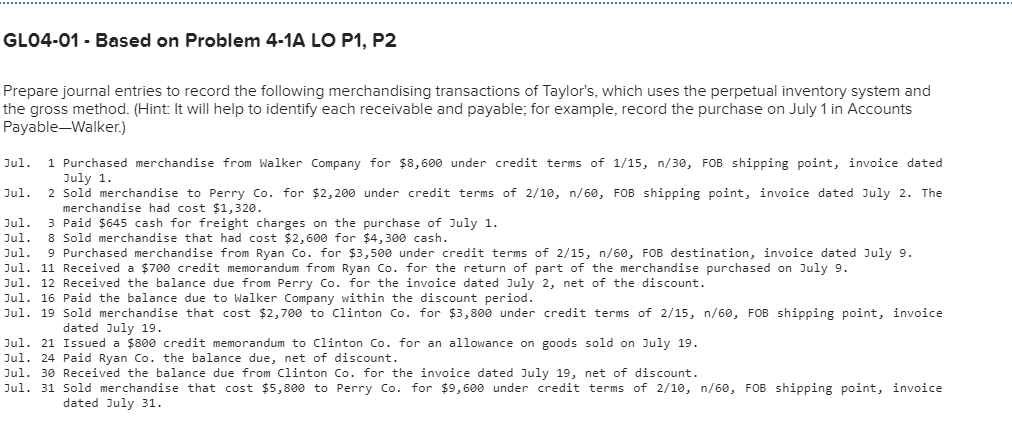

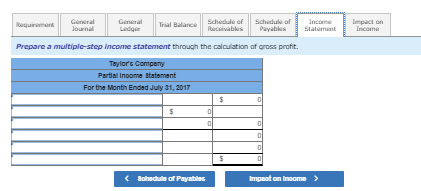

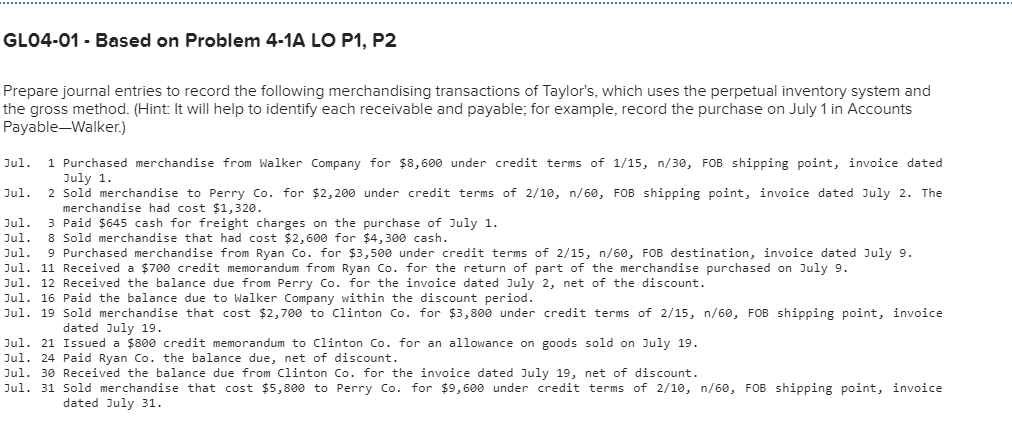

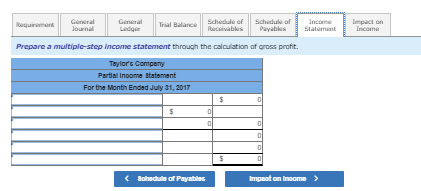

GL04-01 - Based on Problem 4-1A LO P1, P2 Prepare journal entries to record the following merchandising transactions of Taylor's, which uses the perpetual inventory system and the gross method. (Hint: It will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts Payable-Walker.) Jul. 1 Purchased merchandise from Walker Company for $8,600 under credit terms of 1/15, n/30, FOB shipping point, invoice dated uly 1 Jul. 2 Sold merchandise to Perry Co. for $2,200 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $1,320. Jul. 3 Paid $645 cash for freight charges on the purchase of July 1. Jul. 8 Sold merchandise that had cost $2,600 for $4, 300 cash Jul. 9 Purchased merchandise from Ryan Co. for $3,500 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9 Jul. 11 Received a $700 credit memorandum from Ryan Co. for the return of part of the merchandise purchased on July9 Jul. 12 Received the balance due from Perry Co. for the invoice dated July 2, net of the discount. Jul. 16 Paid the balance due to Walker Company within the discount period Jul, 19 Sold merchandise that cost $2,700 to Clinton Co. for $3,800 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. Jul. 21 Issued a $800 credit memorandum to Clinton Co. for an allowance on goods sold on July 19. Jul. 24 Paid Ryan Co. the balance due, net of discount Jul. 30 Received the balance due from Clinton Co. for the invoice dated July 19, net of discount Jul. 31 Sold merchandise that cost $5,800 to Perry Co. for $9,600 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. Inoresce (ceoreace) to mpaot on Income Invoice datnd July 1 July 2) Sold merchandiso to Pary Co. for 52,200 under crodit tarms of 2/10, VEO, FOB shipping point, invoicn dad July 2) The cost of tha merchandse soid to Parry Co was $1,320 Juya) Paid 645 cash tor fraignt charges on the purchan JAly B)Sold marchandisa for $4300 cash. ly B) The cot of tho marchandse soid was $2,600 July 9 Jy 12) Recaived the balance due from Parry Co. for the involce daind July 2, nat of the discount Jy 16) Paid the balance due to Walkar Company within the dsoount parod Juy 19) Sald manchandise to ainton Co.for $3,BOO under odit sonms of 2/15,VEO, FOR shipping point, invoicn ad Juy 19) The cost of the marchandise sold to Cinton Co was $2.700 Juy 21) lsaued a $800 aredit momorandum to Cinton Co tor an allowance on gpods soid on Juy 19 July 24) Pad Ryan Co. the balance dua nat at dcount Jly 30) Rocaived the balance due from Cinton Co for the cdms af 20,nve, FOB shipping point, invoica atod Juy 31 3)The cost af the manchandise sold to Pay Co. was $5.800 Total gross proft Impact on dThal BalanceSchedule of Rocaivabs Payabs Statement Prepare a multiple-step Income statement through the calculation of cross profit. Partial Inoome 8tatement For the Month Ended July 31, 2017 Bolhedule of Payablac Impaot on Inoome