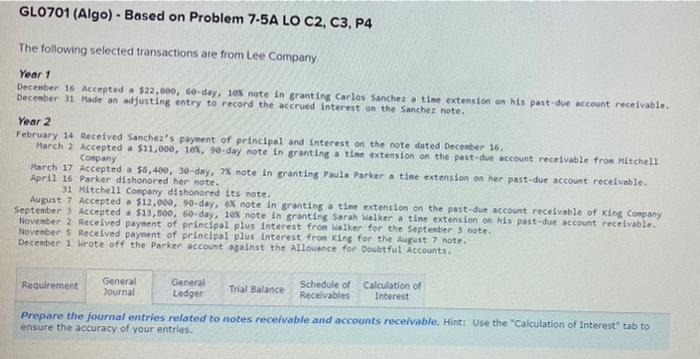

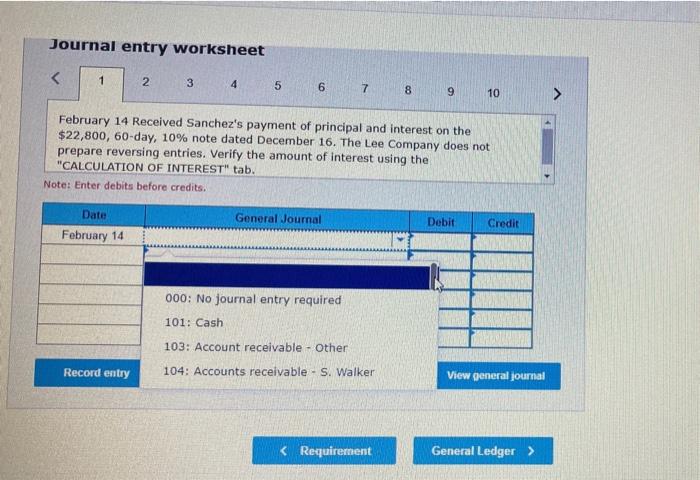

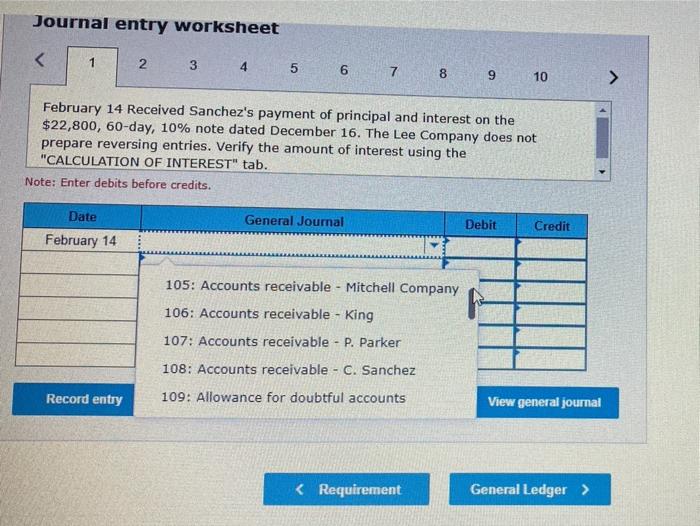

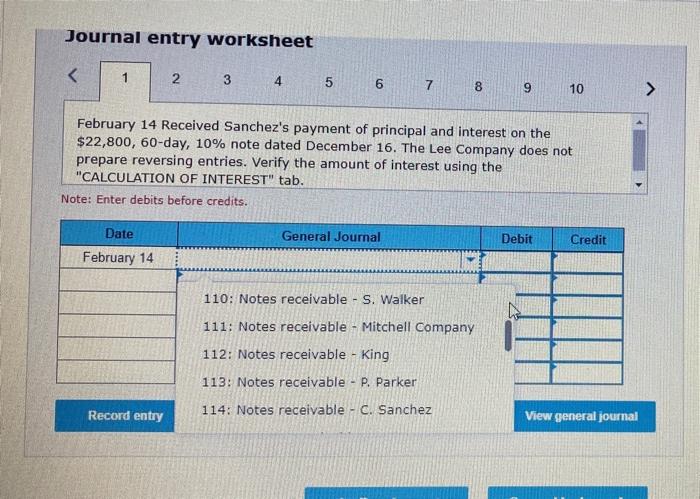

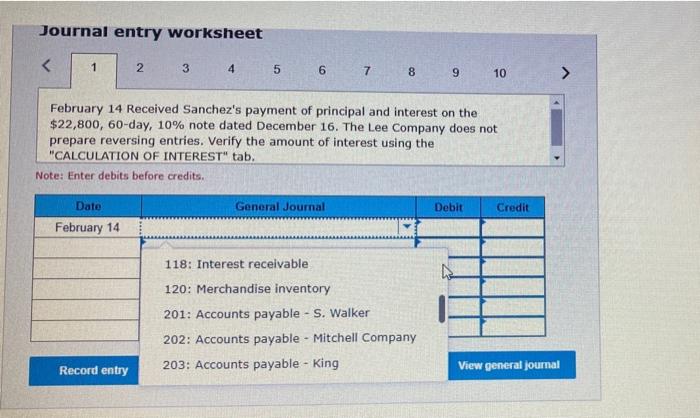

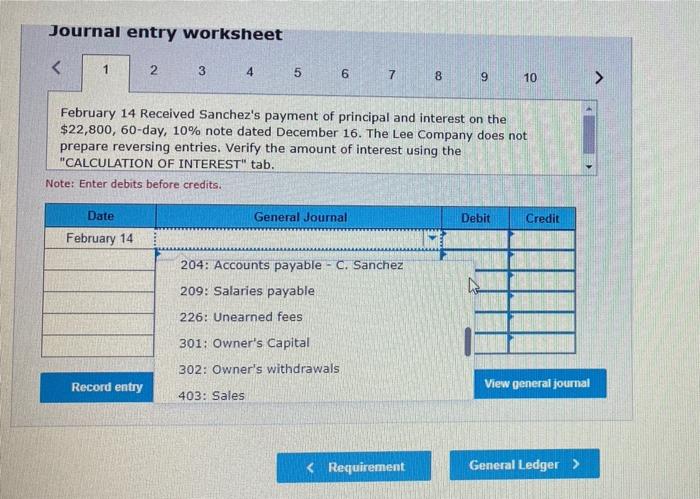

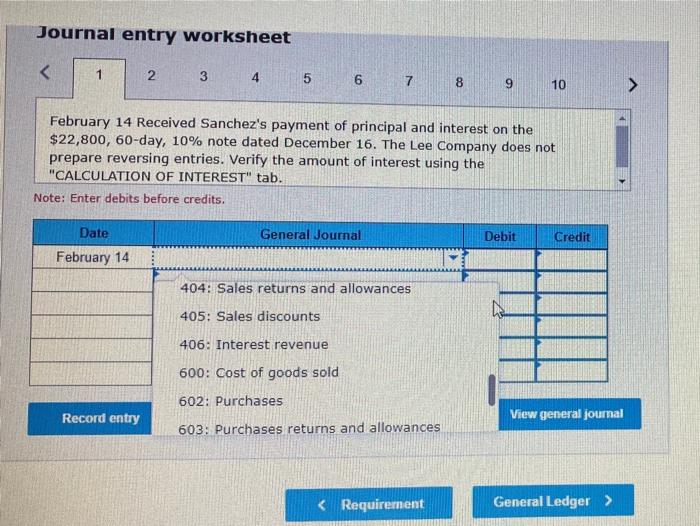

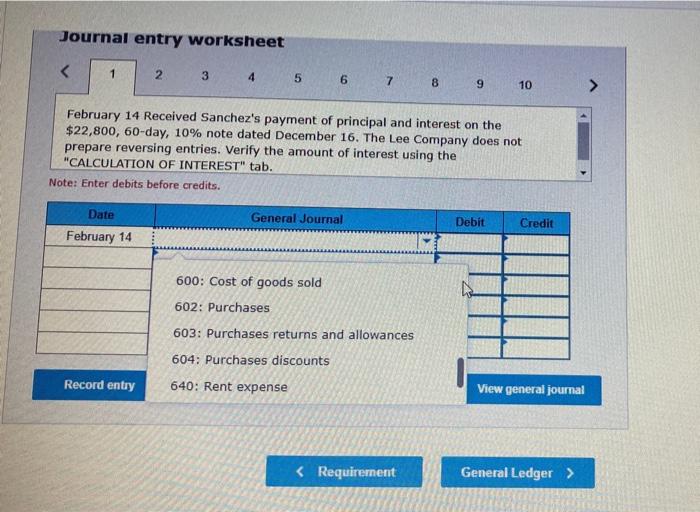

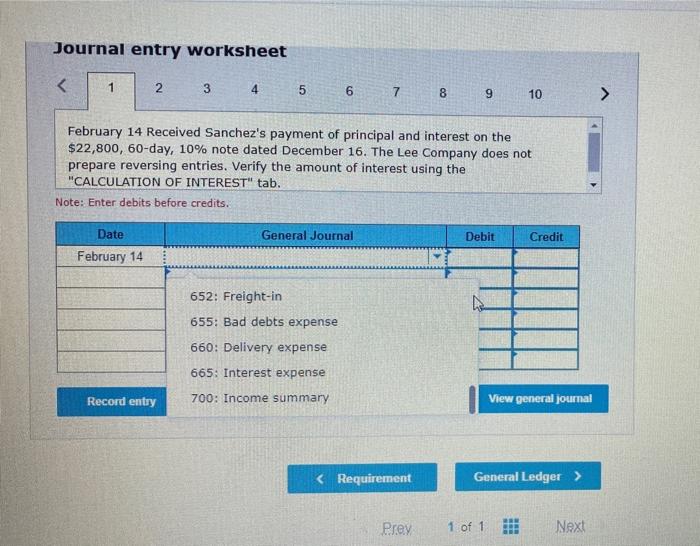

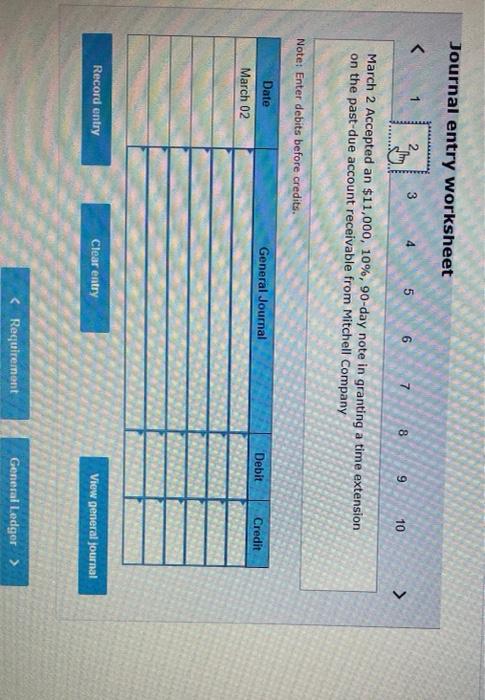

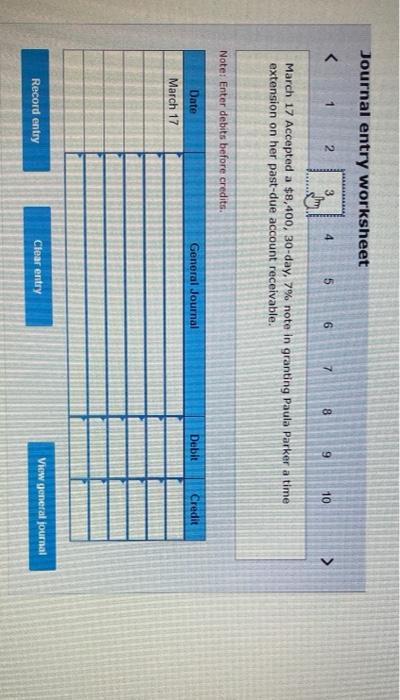

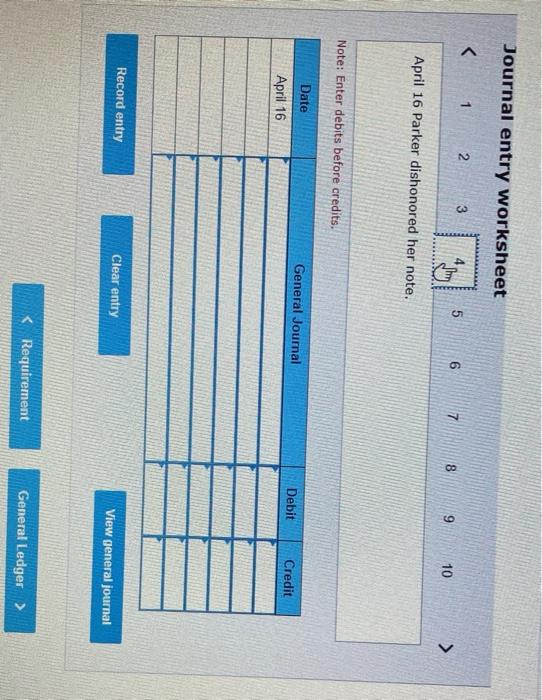

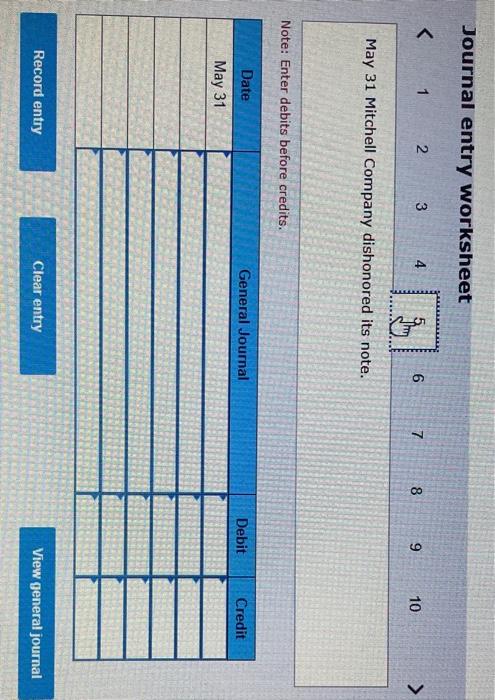

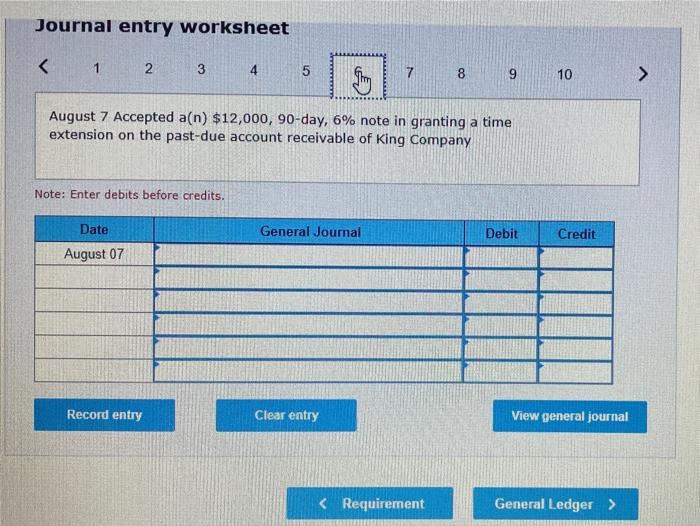

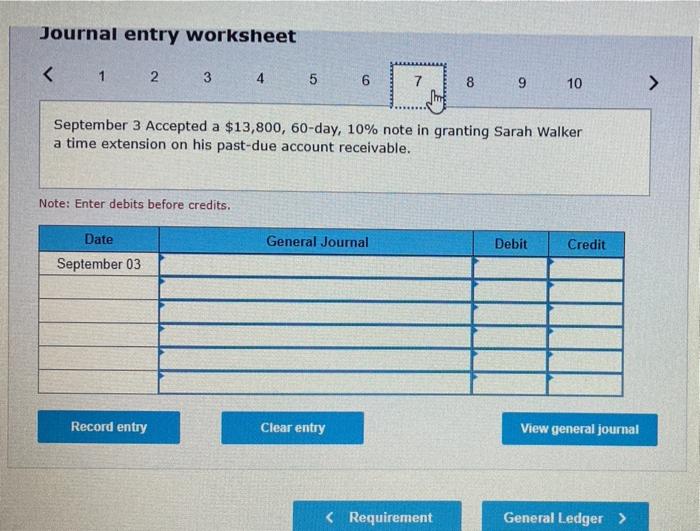

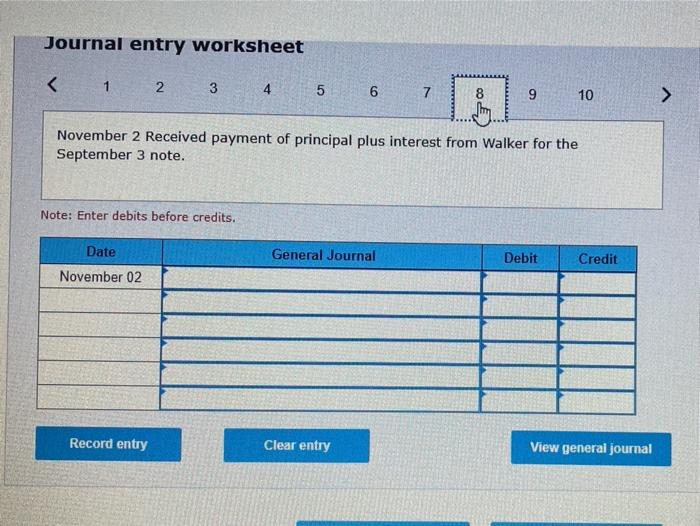

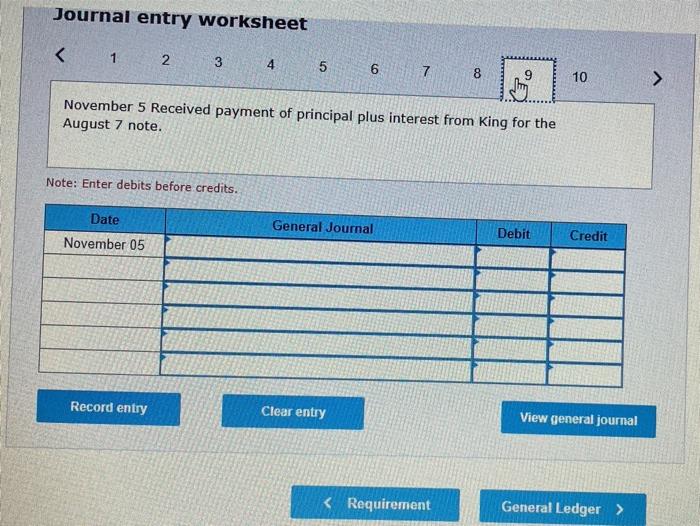

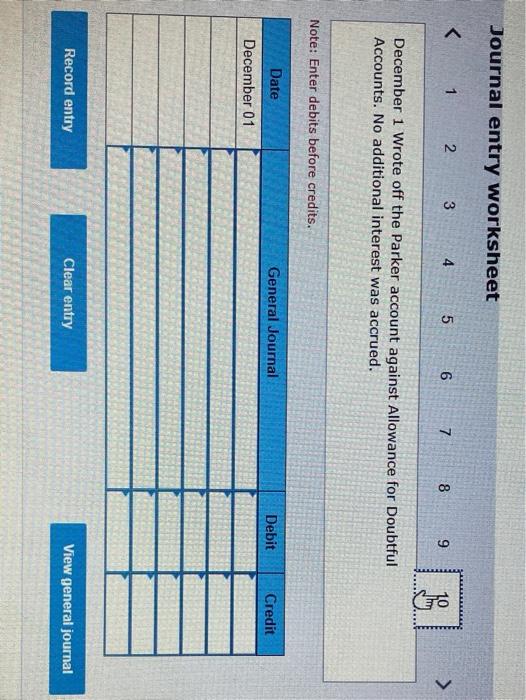

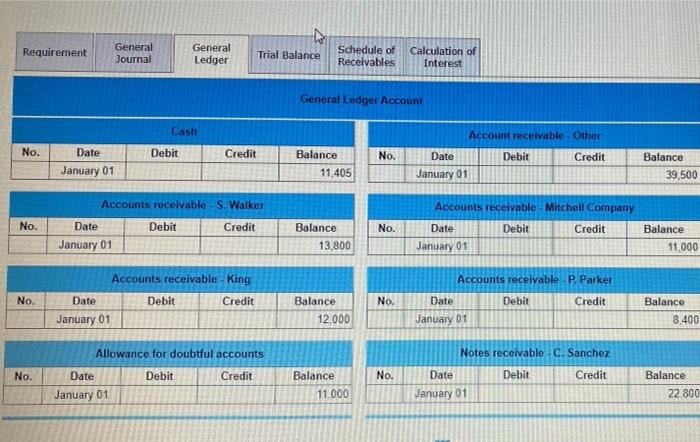

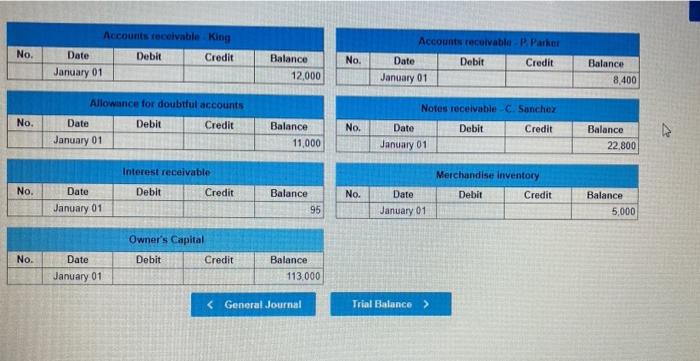

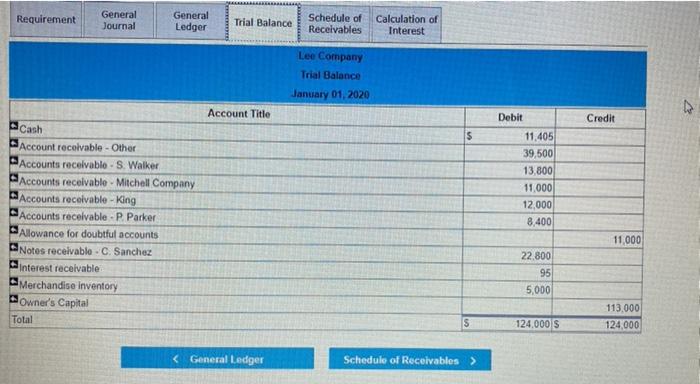

GL0701 (Algo) - Based on Problem 7-5A LO C2, C3, P4 The following selected transactions are from Lee Company Year 1 December 16 Accepted a $22,000, 60 day, 105 note in granting Carlos Sanchez a tine extension on his past due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Sanchez note. Year 2 February 14 Received Sanchez's payment of principal and interest on the note dated December 16. March 2 Accepted a $11,000, 10, 90-day note in granting a tine extension on the past due account receivable from Mitchell Company March 17 Accepted $8,400, 30-day, 28 note in granting Paula Parker a tine extension on her past-due account receivable. April 16 Parker dishonored her note. 31 Mitchell Company dishonored its note. August 7 Accepted a $12,000, 90-day, 6 note in granting a tine extension on the post-due account receivable of King Company September > Accepted $13,800, 60-day, 10x note in granting Sarah Walker a tine extension on his post-due account receivable. November 2 Received payment of principal plus interest from Walker for the September 3 note November 5 Received payment of principal plus interest from King for the August 7 note. December 1 wrote off the Parker account against the Allowance for Doubtful Accounts. Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Recelvables Interest Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest' tab to ensure the accuracy of your entries. Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 > February 14 Received Sanchez's payment of principal and interest on the $22,800, 60-day, 10% note dated December 16. The Lee Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. Date General Journal Debit Credit February 14 000: No journal entry required 101: Cash 103: Account receivable - Other Record entry 104: Accounts receivable - S. Walker View general journal Journal entry worksheet February 14 Received Sanchez's payment of principal and interest on the $22,800, 60-day, 10% note dated December 16. The Lee Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. General Journal Date February 14 Debit Credit 105: Accounts receivable - Mitchell Company 106: Accounts receivable - King 107: Accounts receivable - P. Parker 108: Accounts receivable - C. Sanchez 109: Allowance for doubtful accounts Record entry View general journal Journal entry worksheet A February 14 Received Sanchez's payment of principal and interest on the $22,800, 60-day, 10% note dated December 16. The Lee Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits Date General Journal Debit Credit February 14 204: Accounts payable - C. Sanchez 209: Salaries payable 226: Unearned fees 301: Owner's Capital 302: Owner's withdrawals Record entry View general journal 403: Sales Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 February 14 Received Sanchez's payment of principal and interest on the $22,800, 60-day, 10% note dated December 16. The Lee Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. Date General Journal Debit Credit February 14 404: Sales returns and allowances 405: Sales discounts 406: Interest revenue 600: Cost of goods sold 602: Purchases Record entry View general journal 603: Purchases returns and allowances Journal entry worksheet February 14 Received Sanchez's payment of principal and interest on the $22,800, 60-day, 10% note dated December 16. The Lee Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. Date General Journal Debit Credit February 14 652: Freight-in 655: Bad debts expense 660: Delivery expense 665: Interest expense Record entry 700: Income summary View general journal Prey 1 of 1 Next Journal entry worksheet March 2 Accepted an $11,000, 10%, 90-day note in granting a time extension on the past-due account receivable from Mitchell Company Note: Enter debits before credits. Date General Journal Debit Credit March 02 Record entry Clear entry View general journal Journal entry worksheet March 17 Accepted a $8,400, 30-day, 7% note in granting Paula Parker a time extension on her past-due account receivable. Note: Enter debits before credits. General Journal Debit Credit Date March 17 Record entry Clear entry View general journal Journal entry worksheet 1 2 3 5 6 7 8 9 10 April 16 Parker dishonored her note. Note: Enter debits before credits, Date General Journal Debit Credit April 16 Record entry Clear entry View general journal Journal entry worksheet 10 May 31 Mitchell Company dishonored its note. Note: Enter debits before credits. Date General Journal Debit Credit May 31 Record entry Clear entry View general journal Journal entry worksheet August 7 Accepted a(n) $12,000, 90-day, 6% note in granting a time extension on the past-due account receivable of King Company Note: Enter debits before credits. Date General Journal Debit Credit August 07 Record entry Clear entry View general journal Journal entry worksheet September 3 Accepted a $13,800, 60-day, 10% note in granting Sarah Walker a time extension on his past-due account receivable. Note: Enter debits before credits. Date General Journal Debit Credit September 03 Record entry Clear entry View general journal Journal entry worksheet November 5 Received payment of principal plus interest from King for the August 7 note. Note: Enter debits before credits. Date General Journal Debit November 05 Credit Record entry Clear entry View general journal Journal entry worksheet Go December 1 Wrote off the Parker account against Allowance for Doubtful Accounts. No additional interest was accrued. Note: Enter debits before credits. Date General Journal Debit Credit December 01 Record entry Clear entry View general journal ho Requirement General Journal General Ledger Trial Balance Schedule of Receivables Calculation of Interest General Ledger Account Cash No. Debit Credit No. Date January 01 Balance 11.405 Account receivable. Other Date Debit Credit January 01 Balance 39,500 Accounts receivable - S. Walker No. Date Debit Credit No. Balance 13,800 Accounts receivable - Mitchell Company Date Debit Credit January 01 January 01 Balance 11.000 Accounts receivable - King No. Debit Credit No. Date January 01 Balance 12,000 Accounts receivable -P. Parker Date Debit Credit January 01 Balance 8,400 Allowance for doubtful accounts Notes receivable C. Sanchez No. Debit Credit No. Debit Credit Date January 01 Balance 11.000 Date January 01 Balance 22.800 No. Accounts receivable King Date Debit Credit January 01 No. Balance 12,000 Accounts receivable Parker Date Debit Credit January 01 Balance 8.400 Allowance for doubtful accounts Notes receivable C Sanchez No. Debit Credit No. Date January 01 Date Debit Credit Balance 11,000 Balance 22.800 January 01 Interest receivable Merchandise inventory Debit Credit No. Date Debit Credit No. Balance 95 January 01 Date January 01 Balance 5,000 Owner's Capital Debit Credit No. Date January 01 Balance 113.000 Requirement General Journal General Ledger Trial Balance Schedule of Recelvables Calculation of Interest Lee Company Trial Balance January 01, 2020 Account Title Credit s Debit 11,405 39,500 13.800 11,000 12.000 8.400 Cash Account receivable - Other Accounts receivablo - S. Walker Accounts receivable - Mitchell Company Accounts receivable - King Accounts receivable - P Parker Allowance for doubtful accounts Notes receivable - C. Sanchez Interest receivable Merchandise Inventory Owner's Capital Total 222 11,000 22.800 95 5,000 113,000 124.000 S 124.000 $ General Ledger Schedule of Receivables > Requirement General Journal General Ledger Trial Balance Schedule of Receivables Calculation of Interest Here are the balances in Accounts and Notes receivable based on your journal entries: Dates: January 01 to: January 31 Lee Company Schedule of Accounts Receivable Accounts receivable - S. Walker Accounts receivable - Mitchell Company Accounts receivable - King Accounts receivable - P.Parker Total accounts receivable 13,800 11,000 12,000 8,400 45,200 $ Lee Company Schedule of Notes Receivable Notes receivable - C. Sanchez Total accounts receivable 22,800 22,800 $ Dates: January 01 to: January 31 Lee Company Calculation of interest revenue February 14 - Sanchez note: Principal Interest rate Number of days interest to be recorded in Year 2 Number of days interest to be recorded in Year 2 Principal Interest rate Number of days interest to be recorded in Year 2 Number of days interest to be recorded in Year 2 Principal Interest rate Number of days' interest to be recorded in Year 2 Number of days' interest to be recorded in Year 2 Number of days interest to be recorded in Year 2 Total interest ravenue - Year 2