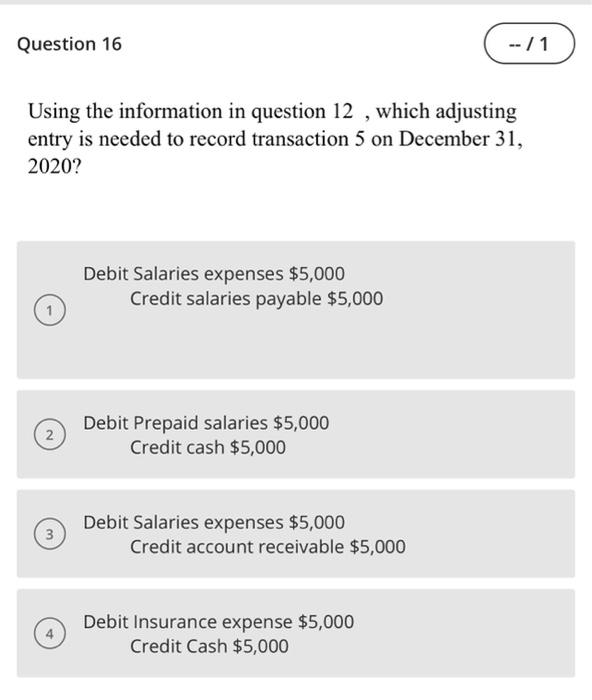

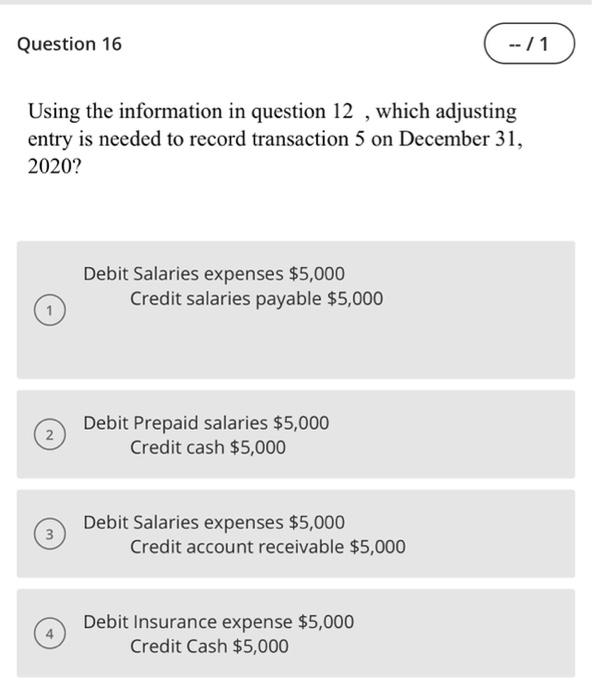

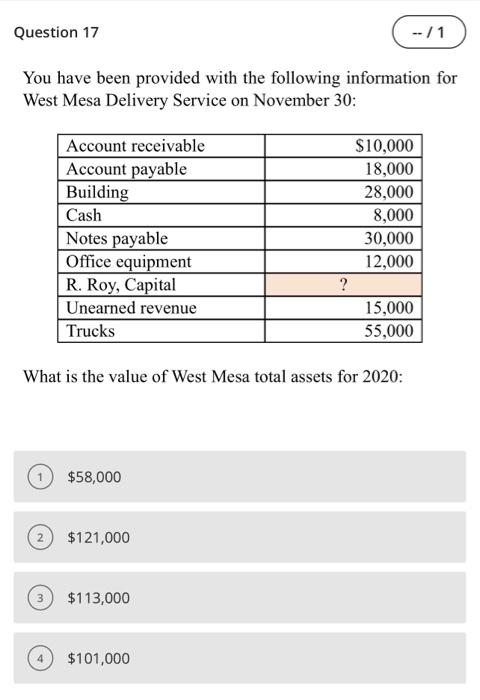

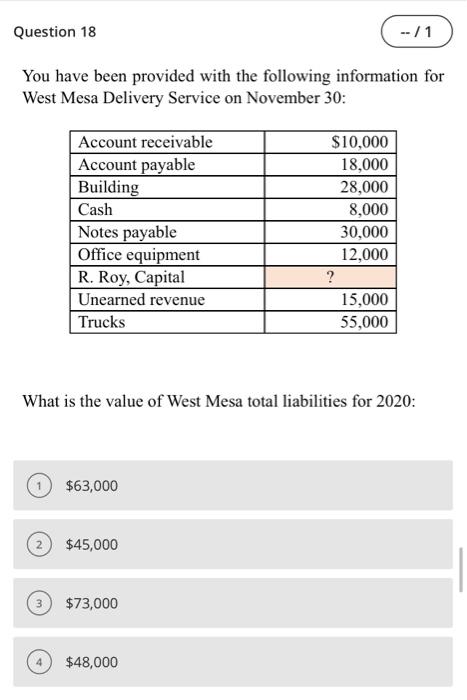

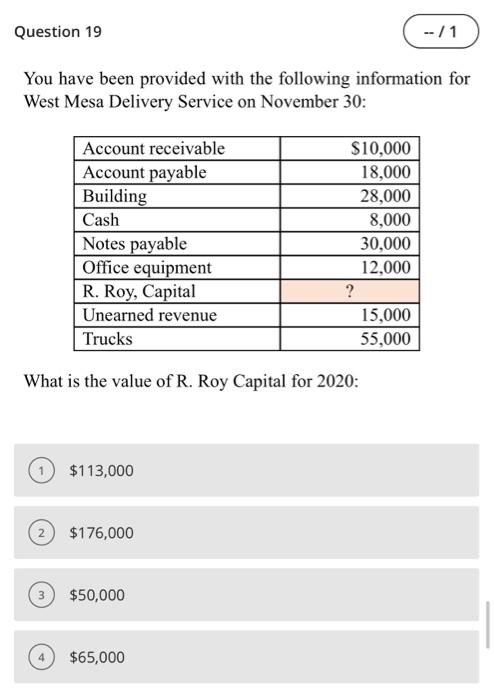

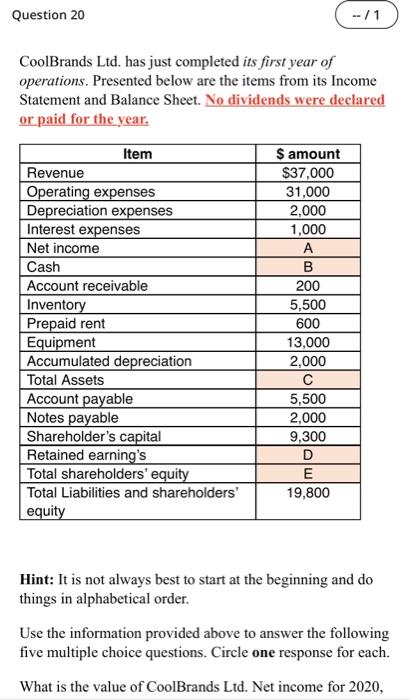

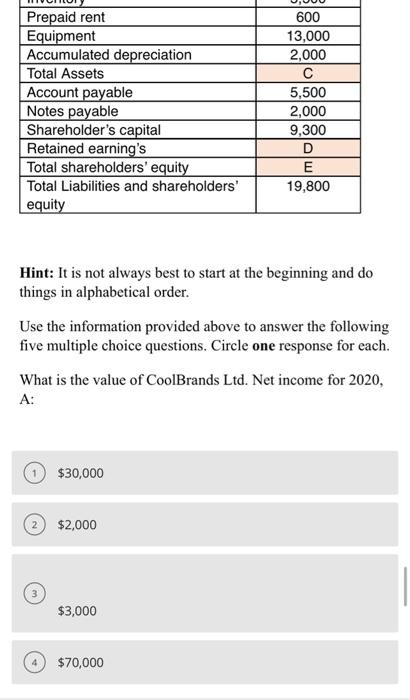

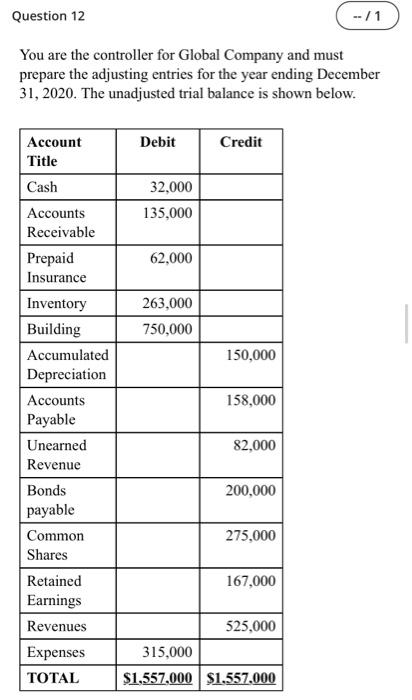

Question 16 / 1 Using the information in question 12 , which adjusting entry is needed to record transaction 5 on December 31, 2020? Debit Salaries expenses $5,000 Credit salaries payable $5,000 2 Debit Prepaid salaries $5,000 Credit cash $5,000 3 Debit Salaries expenses $5,000 Credit account receivable $5,000 Debit Insurance expense $5,000 Credit Cash $5,000 Question 16 / 1 Using the information in question 12 , which adjusting entry is needed to record transaction 5 on December 31, 2020? Debit Salaries expenses $5,000 Credit salaries payable $5,000 2 Debit Prepaid salaries $5,000 Credit cash $5,000 3 Debit Salaries expenses $5,000 Credit account receivable $5,000 Debit Insurance expense $5,000 Credit Cash $5,000 Question 17 -- / 1 You have been provided with the following information for West Mesa Delivery Service on November 30: Account receivable Account payable Building Cash Notes payable Office equipment R. Roy, Capital Unearned revenue Trucks $10,000 18,000 28,000 8,000 30,000 12,000 ? 15,000 55,000 What is the value of West Mesa total assets for 2020: $58,000 2) $121,000 $113,000 $101,000 Question 18 --/1 You have been provided with the following information for West Mesa Delivery Service on November 30: Account receivable Account payable Building Cash Notes payable Office equipment R. Roy, Capital Unearned revenue Trucks $10,000 18,000 28,000 8,000 30,000 12,000 ? 15,000 55,000 What is the value of West Mesa total liabilities for 2020: $63,000 $45,000 $73,000 $48,000 Question 19 --/1 You have been provided with the following information for West Mesa Delivery Service on November 30: Account receivable Account payable Building Cash Notes payable Office equipment R. Roy, Capital Unearned revenue Trucks $10,000 18,000 28,000 8,000 30,000 12,000 ? 15,000 55,000 What is the value of R. Roy Capital for 2020: $113,000 $176,000 $50,000 $65,000 Question 20 --/1 CoolBrands Ltd. has just completed its first year of operations. Presented below are the items from its Income Statement and Balance Sheet. No dividends were declared or paid for the year. Item Revenue Operating expenses Depreciation expenses Interest expenses Net income Cash Account receivable Inventory Prepaid rent Equipment Accumulated depreciation Total Assets Account payable Notes payable Shareholder's capital Retained earning's Total shareholders' equity Total Liabilities and shareholders' equity $ amount $37,000 31,000 2,000 1,000 A B 200 5,500 600 13,000 2,000 5,500 2,000 9,300 D E 19,800 Hint: It is not always best to start at the beginning and do things in alphabetical order. Use the information provided above to answer the following five multiple choice questions. Circle one response for each. What is the value of CoolBrands Ltd. Net income for 2020, Prepaid rent Equipment Accumulated depreciation Total Assets Account payable Notes payable Shareholder's capital Retained earning's Total shareholders' equity Total Liabilities and shareholders' equity 600 13,000 2,000 5,500 2,000 9,300 D E 19,800 Hint: It is not always best to start at the beginning and do things in alphabetical order. Use the information provided above to answer the following five multiple choice questions. Circle one response for each. What is the value of CoolBrands Ltd. Net income for 2020, A: $30,000 $2,000 $3,000 $70,000 Question 12 --/1 You are the controller for Global Company and must prepare the adjusting entries for the year ending December 31, 2020. The unadjusted trial balance is shown below. Debit Credit 32,000 135,000 62,000 263,000 750,000 150,000 158,000 Account Title Cash Accounts Receivable Prepaid Insurance Inventory Building Accumulated Depreciation Accounts Payable Unearned Revenue Bonds payable Common Shares Retained Earnings Revenues Expenses TOTAL 82,000 200,000 275,000 167,000 525,000 315,000 $1,557,000 $1.557.000 Question 16 / 1 Using the information in question 12 , which adjusting entry is needed to record transaction 5 on December 31, 2020? Debit Salaries expenses $5,000 Credit salaries payable $5,000 2 Debit Prepaid salaries $5,000 Credit cash $5,000 3 Debit Salaries expenses $5,000 Credit account receivable $5,000 Debit Insurance expense $5,000 Credit Cash $5,000 Question 16 / 1 Using the information in question 12 , which adjusting entry is needed to record transaction 5 on December 31, 2020? Debit Salaries expenses $5,000 Credit salaries payable $5,000 2 Debit Prepaid salaries $5,000 Credit cash $5,000 3 Debit Salaries expenses $5,000 Credit account receivable $5,000 Debit Insurance expense $5,000 Credit Cash $5,000 Question 17 -- / 1 You have been provided with the following information for West Mesa Delivery Service on November 30: Account receivable Account payable Building Cash Notes payable Office equipment R. Roy, Capital Unearned revenue Trucks $10,000 18,000 28,000 8,000 30,000 12,000 ? 15,000 55,000 What is the value of West Mesa total assets for 2020: $58,000 2) $121,000 $113,000 $101,000 Question 18 --/1 You have been provided with the following information for West Mesa Delivery Service on November 30: Account receivable Account payable Building Cash Notes payable Office equipment R. Roy, Capital Unearned revenue Trucks $10,000 18,000 28,000 8,000 30,000 12,000 ? 15,000 55,000 What is the value of West Mesa total liabilities for 2020: $63,000 $45,000 $73,000 $48,000 Question 19 --/1 You have been provided with the following information for West Mesa Delivery Service on November 30: Account receivable Account payable Building Cash Notes payable Office equipment R. Roy, Capital Unearned revenue Trucks $10,000 18,000 28,000 8,000 30,000 12,000 ? 15,000 55,000 What is the value of R. Roy Capital for 2020: $113,000 $176,000 $50,000 $65,000 Question 20 --/1 CoolBrands Ltd. has just completed its first year of operations. Presented below are the items from its Income Statement and Balance Sheet. No dividends were declared or paid for the year. Item Revenue Operating expenses Depreciation expenses Interest expenses Net income Cash Account receivable Inventory Prepaid rent Equipment Accumulated depreciation Total Assets Account payable Notes payable Shareholder's capital Retained earning's Total shareholders' equity Total Liabilities and shareholders' equity $ amount $37,000 31,000 2,000 1,000 A B 200 5,500 600 13,000 2,000 5,500 2,000 9,300 D E 19,800 Hint: It is not always best to start at the beginning and do things in alphabetical order. Use the information provided above to answer the following five multiple choice questions. Circle one response for each. What is the value of CoolBrands Ltd. Net income for 2020, Prepaid rent Equipment Accumulated depreciation Total Assets Account payable Notes payable Shareholder's capital Retained earning's Total shareholders' equity Total Liabilities and shareholders' equity 600 13,000 2,000 5,500 2,000 9,300 D E 19,800 Hint: It is not always best to start at the beginning and do things in alphabetical order. Use the information provided above to answer the following five multiple choice questions. Circle one response for each. What is the value of CoolBrands Ltd. Net income for 2020, A: $30,000 $2,000 $3,000 $70,000 Question 12 --/1 You are the controller for Global Company and must prepare the adjusting entries for the year ending December 31, 2020. The unadjusted trial balance is shown below. Debit Credit 32,000 135,000 62,000 263,000 750,000 150,000 158,000 Account Title Cash Accounts Receivable Prepaid Insurance Inventory Building Accumulated Depreciation Accounts Payable Unearned Revenue Bonds payable Common Shares Retained Earnings Revenues Expenses TOTAL 82,000 200,000 275,000 167,000 525,000 315,000 $1,557,000 $1.557.000