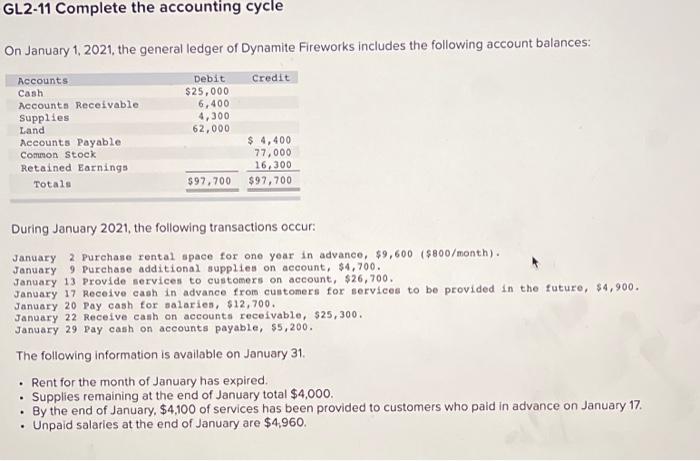

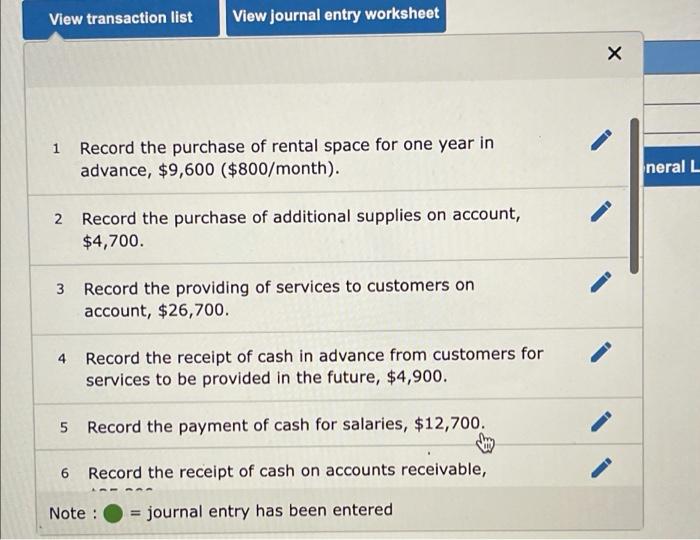

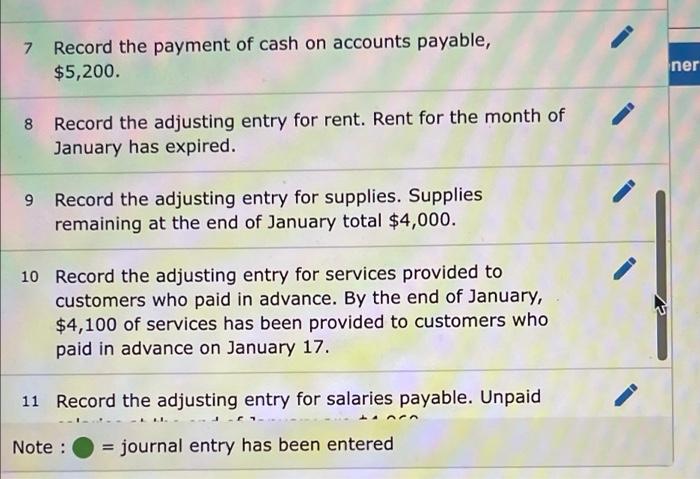

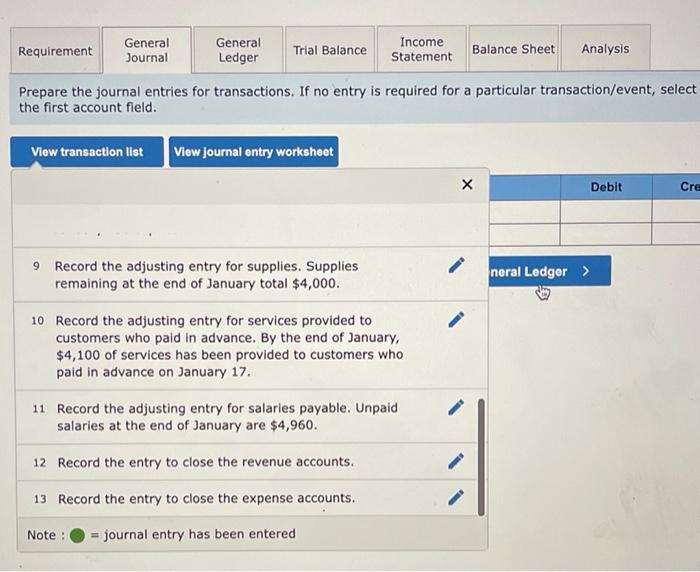

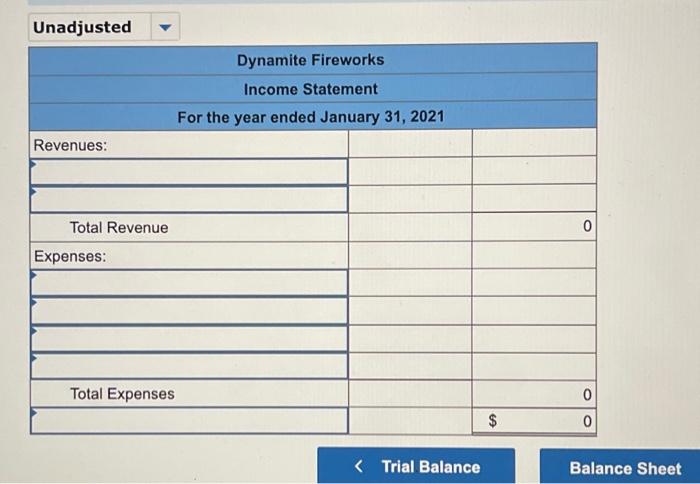

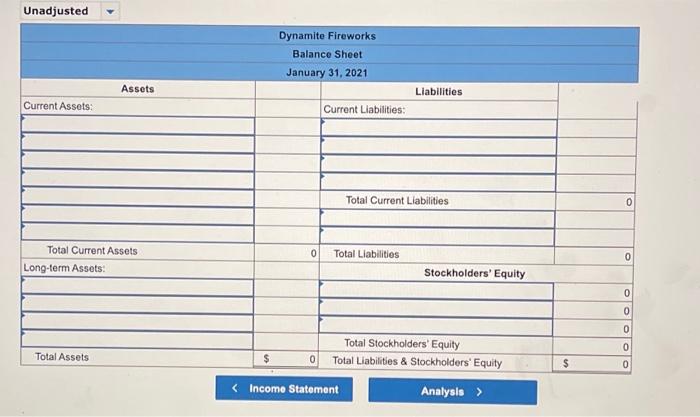

GL2-11 Complete the accounting cycle On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: Accounts Debit Credit Cash $25,000 Accounts Receivable 6,400 Supplies 4,300 Land 62,000 Accounts Payable $ 4,400 77,000 Retained Earnings 16,300 Totals $97,700 $97,700 Common Stock During January 2021, the following transactions occur January 2 Purchase rental space for one year in advance, $9,600 ($800/month). January 9 Purchase additional supplies on account, $4,700. January 13 Provide services to customers on account, $26,700. January 17 Receive cash in advance from customers for services to be provided in the futuro, $4,900. January 20 Pay cash for salarien, $12,700. January 22 Receive cash on accounts receivable, $25,300. January 29 Pay cash on accounts payable, $5,200. The following information is available on January 31, Rent for the month of January has expired. Supplies remaining at the end of January total $4,000. By the end of January, $4,100 of services has been provided to customers who paid in advance on January 17. Unpaid salaries at the end of January are $4.960, . View transaction list View journal entry worksheet x 1 Record the purchase of rental space for one year in advance, $9,600 ($800/month). neral L 2 Record the purchase of additional supplies on account, $4,700. 3 Record the providing of services to customers on account, $26,700. 4 Record the receipt of cash in advance from customers for services to be provided in the future, $4,900. 5 Record the payment of cash for salaries, $12,700. 6 Record the receipt of cash on accounts receivable, A- Note : = journal entry has been entered 7 Record the payment of cash on accounts payable, $5,200. ner 8 Record the adjusting entry for rent. Rent for the month of January has expired. Record the adjusting entry for supplies. Supplies remaining at the end of January total $4,000. 10 Record the adjusting entry for services provided to customers who paid in advance. By the end of January, $4,100 of services has been provided to customers who paid in advance on January 17. 11 Record the adjusting entry for salaries payable. Unpaid Note : = - journal entry has been entered Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis Prepare the journal entries for transactions. If no entry is required for a particular transaction/event, select the first account field. View transaction list View journal entry worksheet Debit Cre 9 Record the adjusting entry for supplies. Supplies remaining at the end of January total $4,000. neral Ledger > 10 Record the adjusting entry for services provided to customers who paid in advance. By the end of January, $4,100 of services has been provided to customers who paid in advance on January 17. 11 Record the adjusting entry for salaries payable. Unpaid salaries at the end of January are $4,960. 12 Record the entry to close the revenue accounts. 13 Record the entry to close the expense accounts. Note : journal entry has been entered Unadjusted Dynamite Fireworks Income Statement For the year ended January 31, 2021 Revenues: 0 Total Revenue Expenses: Total Expenses 0 $ 0