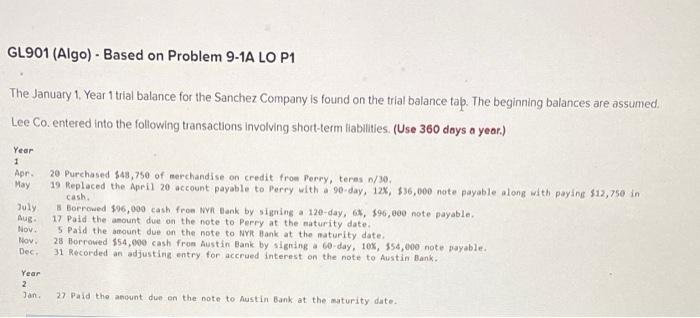

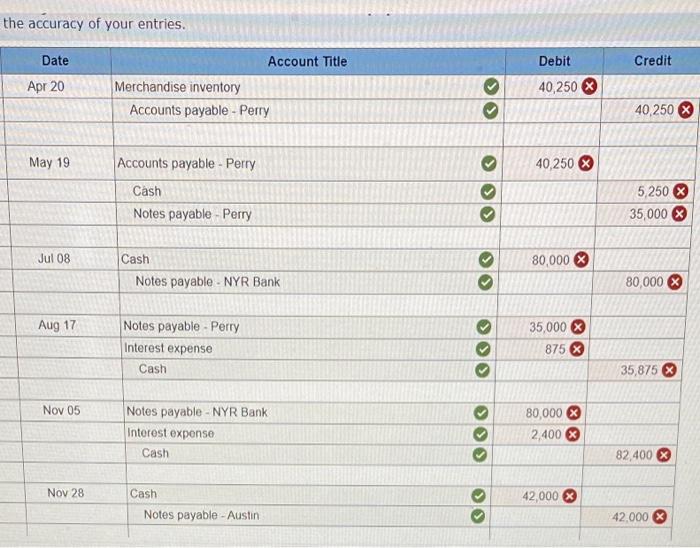

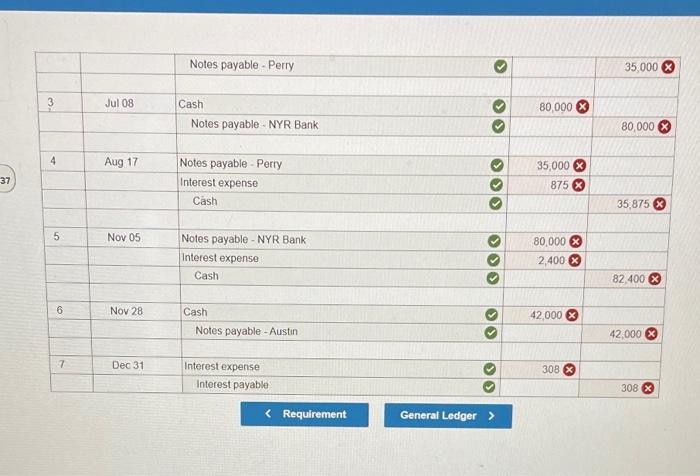

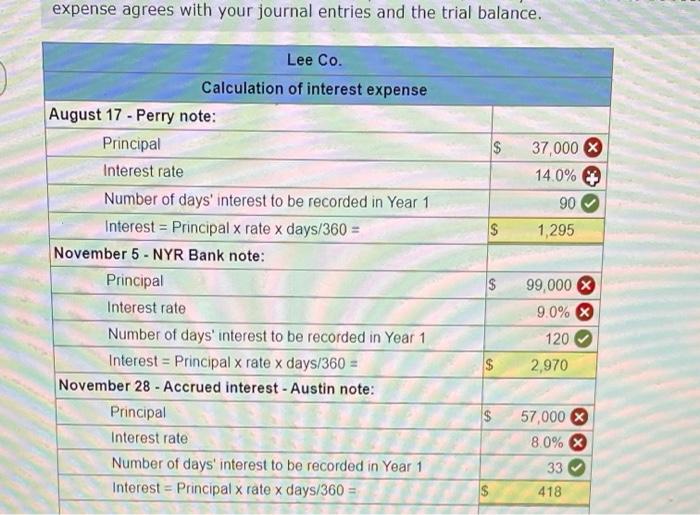

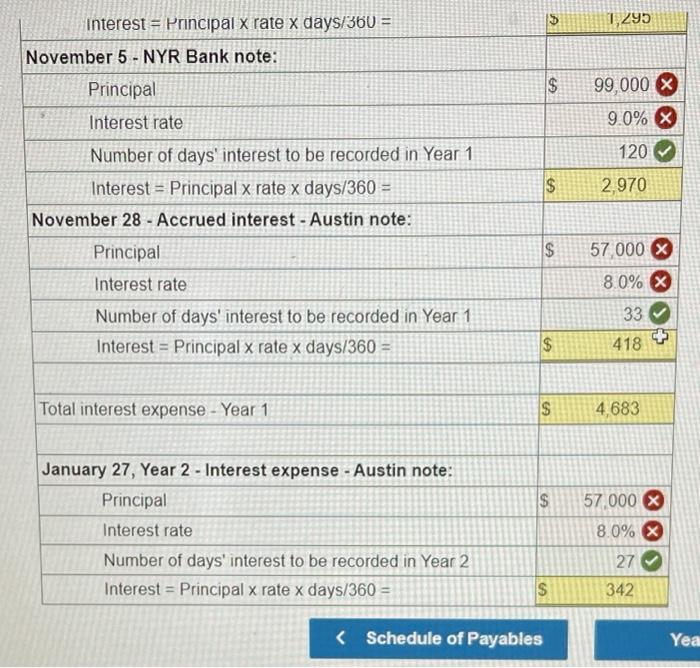

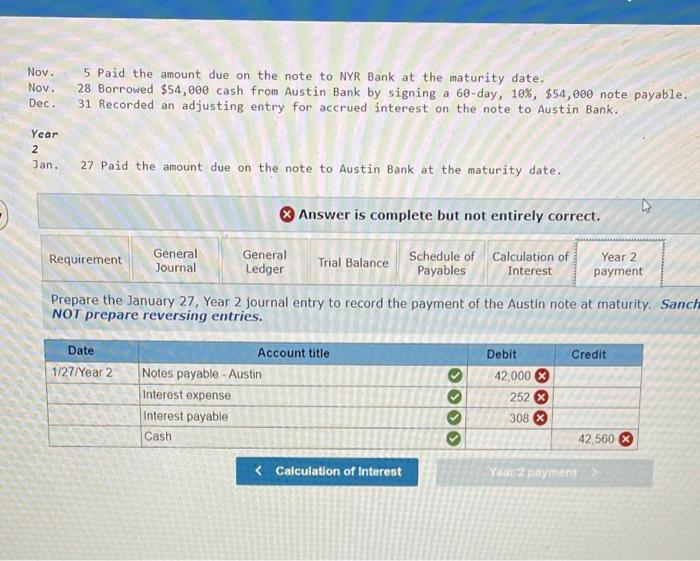

GL901 (Algo) - Based on Problem 9-1A LO P1 The January 1 Year 1 trial balance for the Sanchez Company is found on the trial balance tap. The beginning balances are assumed. Lee Co. entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year 1 Apr. May July Aug Nov Nov Dec 20 Purchased $48,750 of merchandise on credit frow Perry, teras / 19 Replaced the April 20 account payable to Perry with 90 day, 12%, $36,000 note payable along with paying $12,750 in cash. # Borrowed $96,000 cash from NVR Bank by signing a 120-day, 6%, $90,000 note payable 17 Paid the amount due on the note to Perry at the maturity date. 5 Paid the amount due on the note to NYR Bank at the maturity date. 28 Borrowed 554,000 cash from Austin Bank by signing 60-day, 10%, 554,000 note payable. 31 Recorded an adjusting entry for accrued Interest on the note to Austin Bank Year 2 Jan 27 Paid the amount due on the note to Austin Bank at the saturity date. the accuracy of your entries. Debit Credit Date Apr 20 Account Title Merchandise inventory Accounts payable - Perry 40,250 X 40 250 % May 19 40,250% Accounts payable - Perry Cash Notes payable - Perry 5,250 35,000 X Jul 08 80,000 X Cash Notes payable - NYR Bank 80,000 Aug 17 Notes payable - Perry Interest expense Cash 35,000 875 % 35,875 Nov 05 Notes payable - NYR Bank Interest expense Cash 80,000 2,400 BO 82,400 Nov 28 42,000 Cash Notes payable - Austin 42,000 Notes payable - Perry 35,000 3 Jul 08 80,000 Cash Notes payable - NYR Bank O 80,000 4 Aug 17 37 Notes payable - Perry Interest expense Cash 35,000 X 875 % OO 35,875 5 Nov 05 80,000 X Notes payable - NYR Bank Interest expense Cash 2.400 X BO 82 400 6 Nov 28 Cash Notes payable - Austin 42,000 % O 42,000 X 7 Dec 31 Interest expense Interest payable 308 308 expense agrees with your journal entries and the trial balance. $ 37,000 14.0% 4 90 1,295 $ G Lee Co. Calculation of interest expense August 17 - Perry note: Principal Interest rate Number of days' interest to be recorded in Year 1 Interest - Principal x rate x days/360 = November 5 - NYR Bank note: Principal Interest rate Number of days interest to be recorded in Year 1 Interest = Principal x rate x days/360 = November 28 - Accrued interest - Austin note: Principal Interest rate Number of days interest to be recorded in Year 1 Interest - Principal x rate x days/360 = $ 99,000 X 9.0% X 120 2,970 $ $ 57,000 $ 8.0% 33 $ 418 5 A 1.295 $ CA 99.000 X 9.0% X 120 Interest = Principal x rate x days/360 = November 5 - NYR Bank note: Principal Interest rate Number of days' interest to be recorded in Year 1 Interest - Principal x rate x days/360 = November 28 - Accrued interest - Austin note: Principal Interest rate Number of days' interest to be recorded in Year 1 Interest = Principal x rate x days/360 = $ 2,970 - $ 57 000 X 8.0% X 33 418 $ $ Total interest expense - Year 1 $ 4,683 $ 57,000 January 27, Year 2 - Interest expense - Austin note: Principal Interest rate Number of days' interest to be recorded in Year 2 Interest - Principal x rate x days/360 = x x 8.0% x 27 S 342