Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Glamly uses a normal costing system and applies manufacturing overhead to jobs at a rate of 110% of direct labor costs. The company had

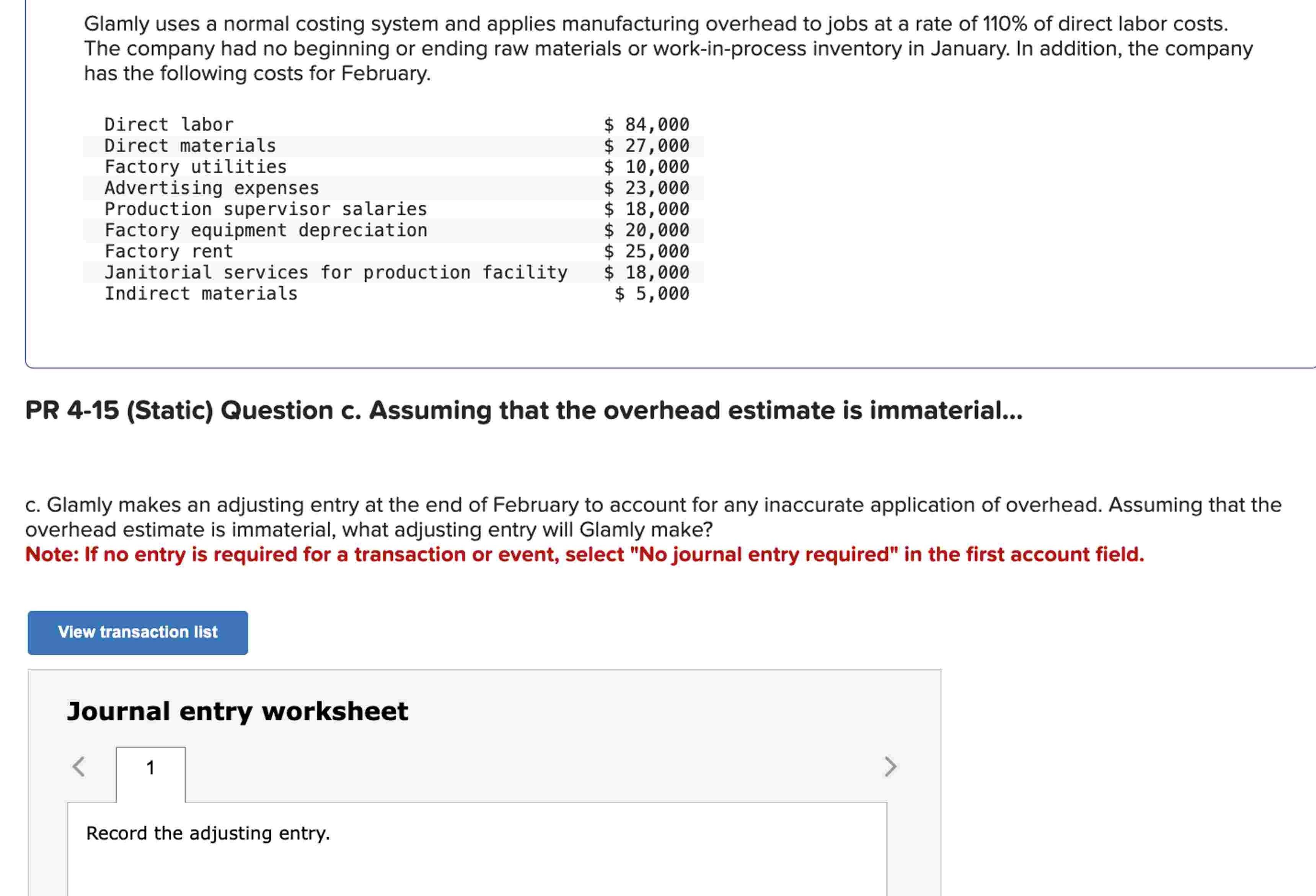

Glamly uses a normal costing system and applies manufacturing overhead to jobs at a rate of 110% of direct labor costs. The company had no beginning or ending raw materials or work-in-process inventory in January. In addition, the company has the following costs for February. Direct labor Direct materials $ 84,000 $ 27,000 Factory utilities $ 10,000 Advertising expenses $ 23,000 Production supervisor salaries $ 18,000 Factory equipment depreciation $ 20,000 Factory rent $ 25,000 Janitorial services for production facility $ 18,000 Indirect materials $ 5,000 PR 4-15 (Static) Question c. Assuming that the overhead estimate is immaterial... c. Glamly makes an adjusting entry at the end of February to account for any inaccurate application of overhead. Assuming that the overhead estimate is immaterial, what adjusting entry will Glamly make? Note: If no entry is required for a transaction or event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 Record the adjusting entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer If the overhead estimate is considered immateri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started