Answered step by step

Verified Expert Solution

Question

1 Approved Answer

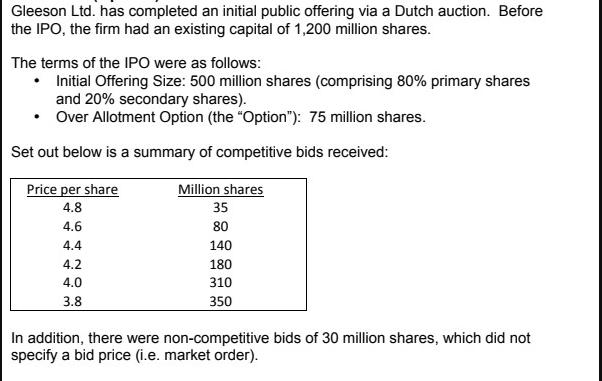

Gleeson Ltd. has completed an initial public offering via a Dutch auction. Before the IPO, the firm had an existing capital of 1,200 million

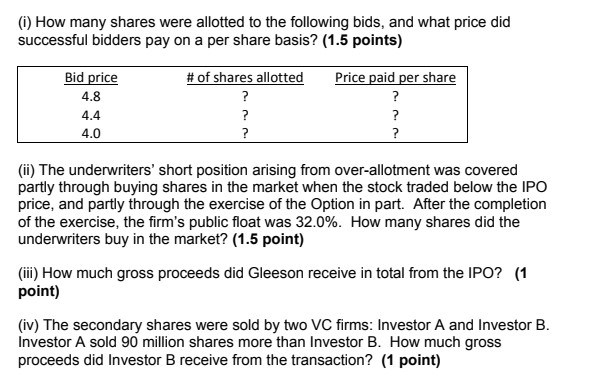

Gleeson Ltd. has completed an initial public offering via a Dutch auction. Before the IPO, the firm had an existing capital of 1,200 million shares. The terms of the IPO were as follows: Initial Offering Size: 500 million shares (comprising 80% primary shares and 20% secondary shares). Over Allotment Option (the "Option"): 75 million shares. Set out below is a summary of competitive bids received: Price per share 4.8 4.6 4.4 4.2 4.0 3.8 Million shares 35 80 140 180 310 350 In addition, there were non-competitive bids of 30 million shares, which did not specify a bid price (i.e. market order). (i) How many shares were allotted to the following bids, and what price did successful bidders pay on a per share basis? (1.5 points) Bid price 4.8 4.4 4.0 # of shares allotted ? ? ? Price paid per share ? ? ? (ii) The underwriters' short position arising from over-allotment was covered partly through buying shares in the market when the stock traded below the IPO price, and partly through the exercise of the Option in part. After the completion of the exercise, the firm's public float was 32.0%. How many shares did the underwriters buy in the market? (1.5 point) (iii) How much gross proceeds did Gleeson receive in total from the IPO? (1 point) (iv) The secondary shares were sold by two VC firms: Investor A and Investor B. Investor A sold 90 million shares more than Investor B. How much gross proceeds did Investor B receive from the transaction? (1 point)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer i To determine the shares allotted and the price paid per share for each bid we need to start by arranging the bids in descending order of thei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started