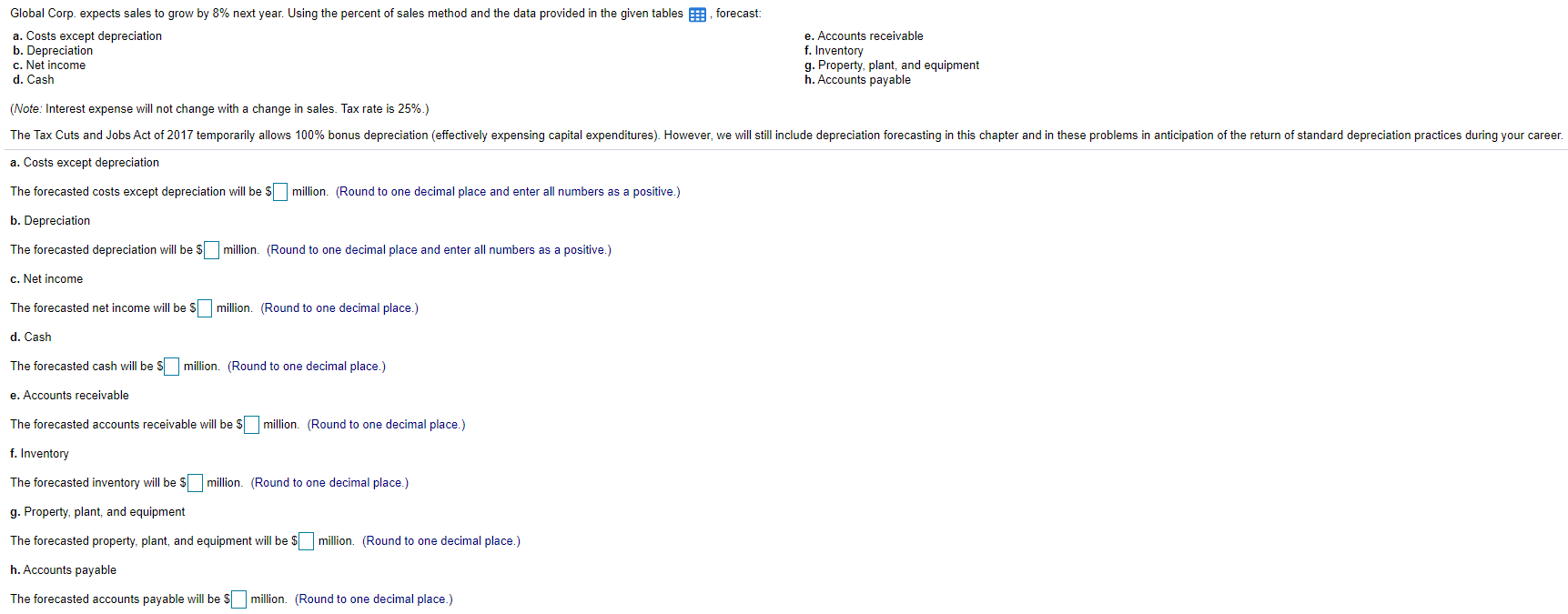

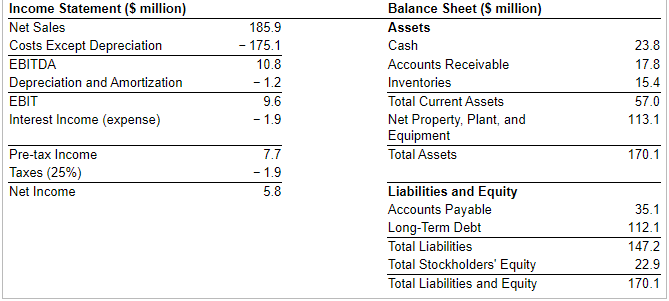

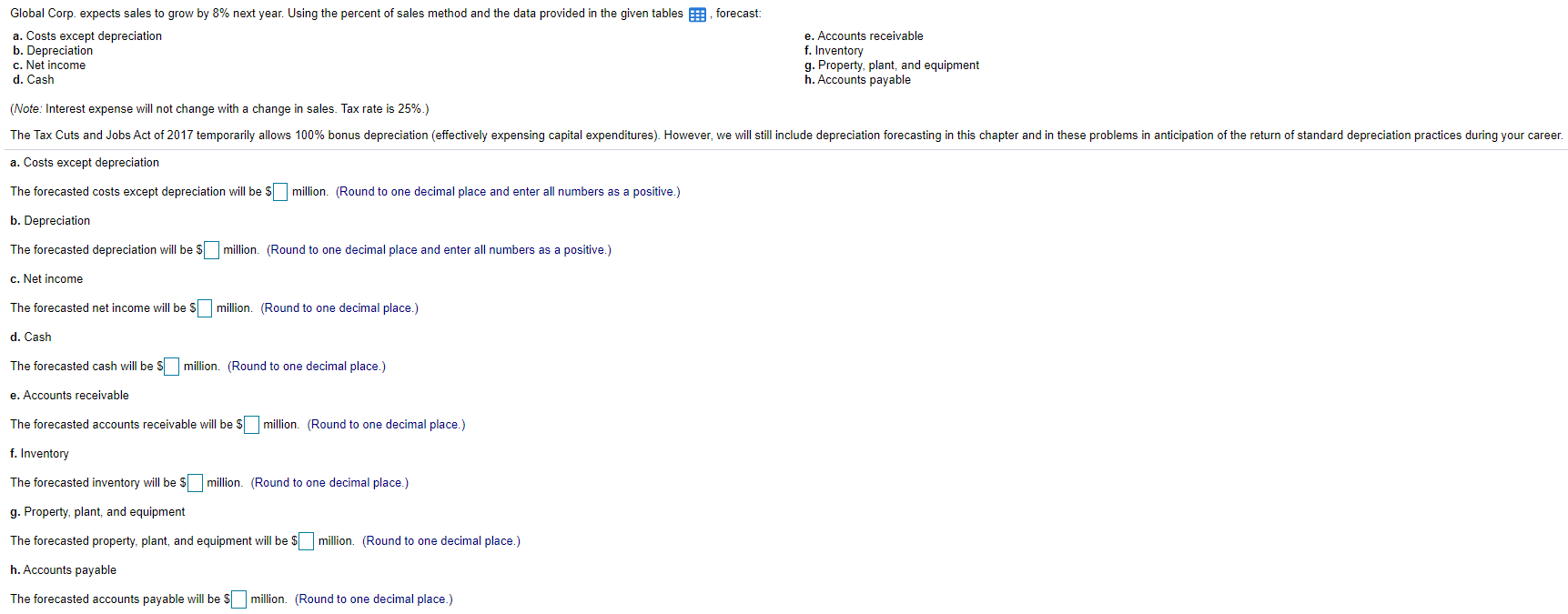

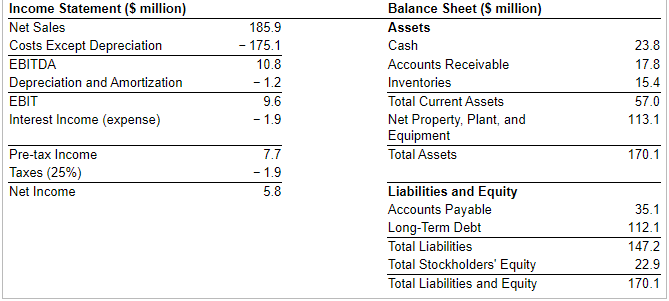

Global Corp. expects sales to grow by 8% next year. Using the percent of sales method and the data provided in the given tables forecast: a. Costs except depreciation b. Depreciation c. Net income d. Cash e. Accounts receivable f. Inventory g. Property, plant, and equipment h. Accounts payable (Note: Interest expense will not change with a change in sales. Tax rate is 25%.) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. a. Costs except depreciation The forecasted costs except depreciation will be million. (Round to one decimal place and enter all numbers as a positive.) b. Depreciation The forecasted depreciation will be 5 million. (Round to one decimal place and enter all numbers as a positive.) c. Net income The forecasted net income will be s million. (Round to one decimal place.) d. Cash The forecasted cash will be million. (Round to one decimal place.) e. Accounts receivable The forecasted accounts receivable will be million. (Round to one decimal place.) f. Inventory The forecasted inventory will be 5 million. (Round to one decimal place.) g. Property, plant, and equipment The forecasted property, plant, and equipment will be $ million. (Round to one decimal place.) h. Accounts payable The forecasted accounts payable will be $ million. (Round to one decimal place.) Income Statement ($ million) Net Sales Costs Except Depreciation EBITDA Depreciation and Amortization EBIT Interest Income (expense) 185.9 - 175.1 10.8 - 1.2 9.6 - 1.9 Balance Sheet (5 million) Assets Cash Accounts Receivable Inventories Total Current Assets Net Property, Plant, and Equipment Total Assets 23.8 17.8 15.4 57.0 113.1 170.1 Pre-tax Income Taxes (25%) Net Income 7.7 - 1.9 5.8 Liabilities and Equity Accounts Payable Long-Term Debt Total Liabilities Total Stockholders' Equity Total Liabilities and Equity 35.1 112.1 1472 22.9 170.1