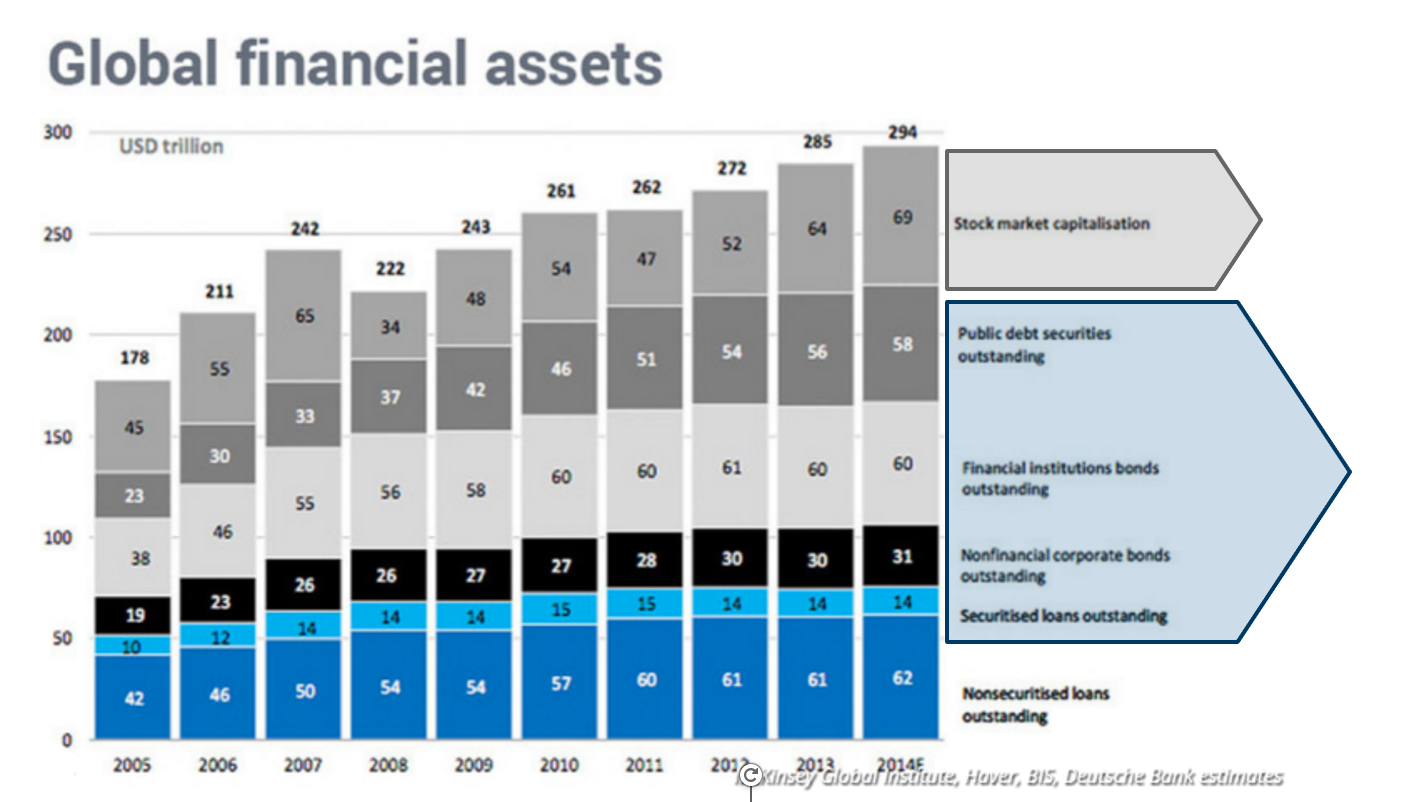

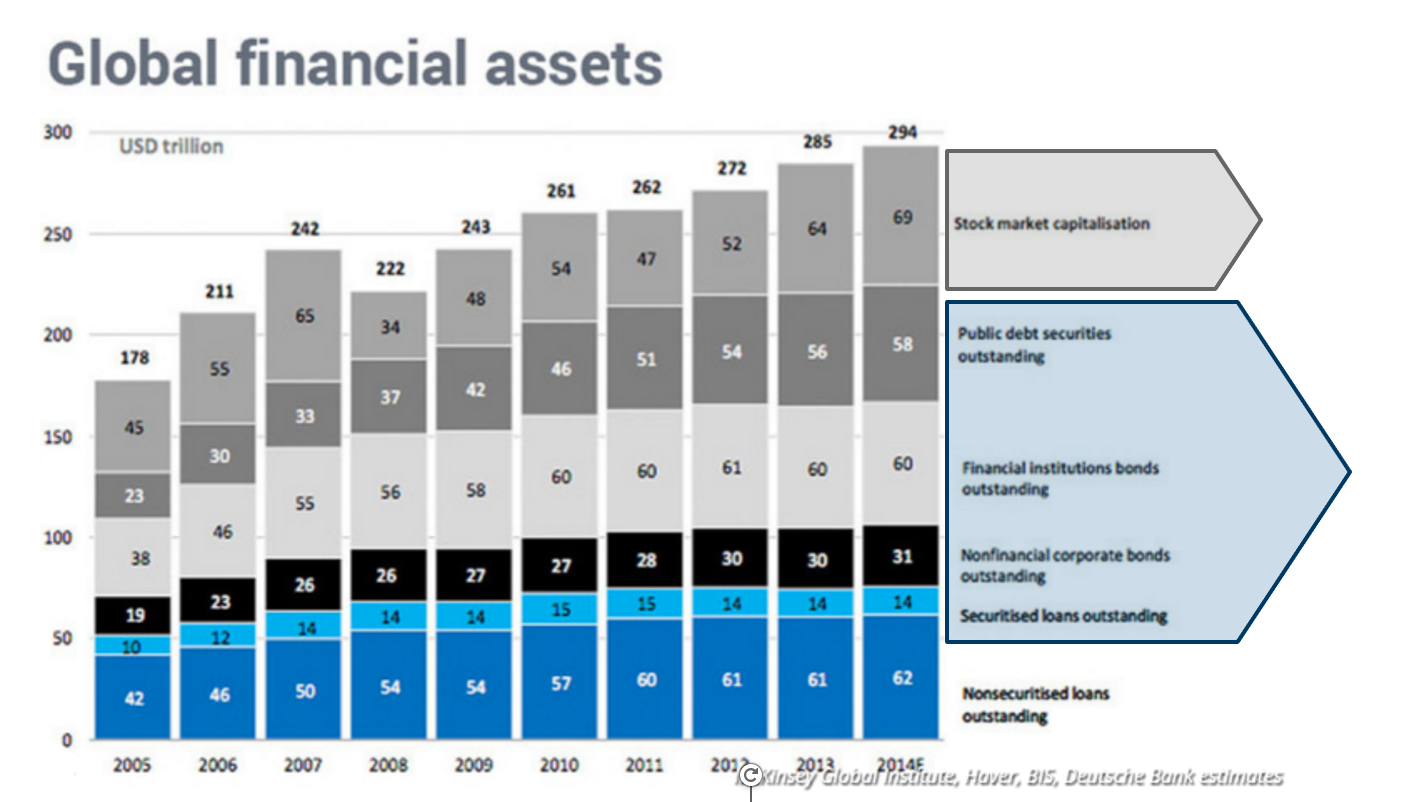

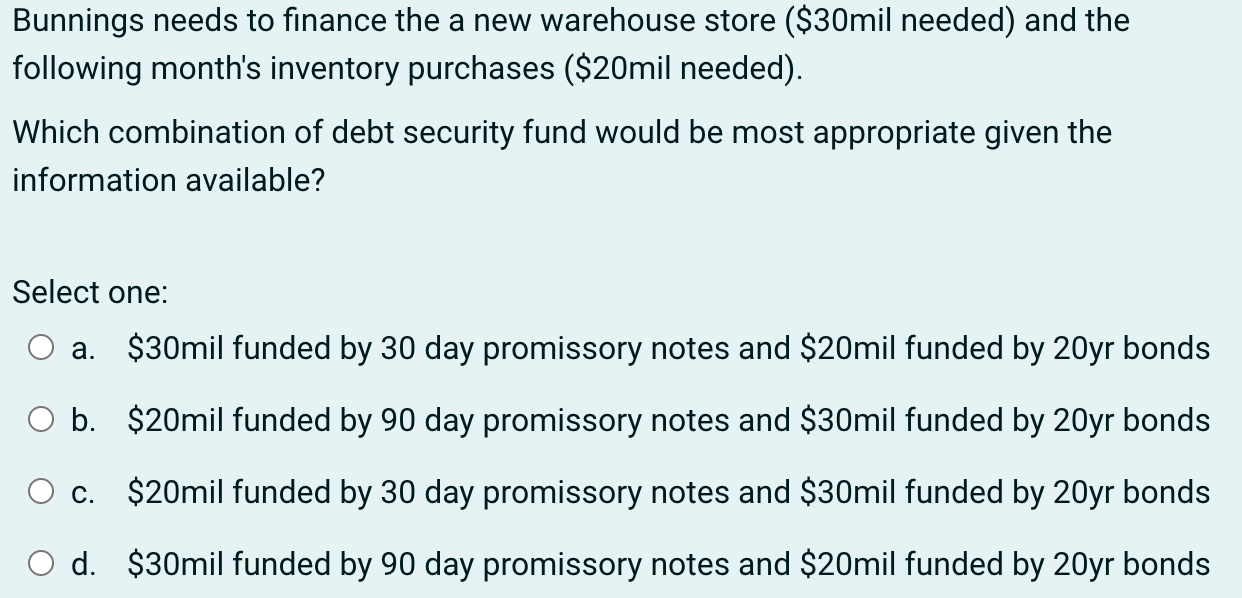

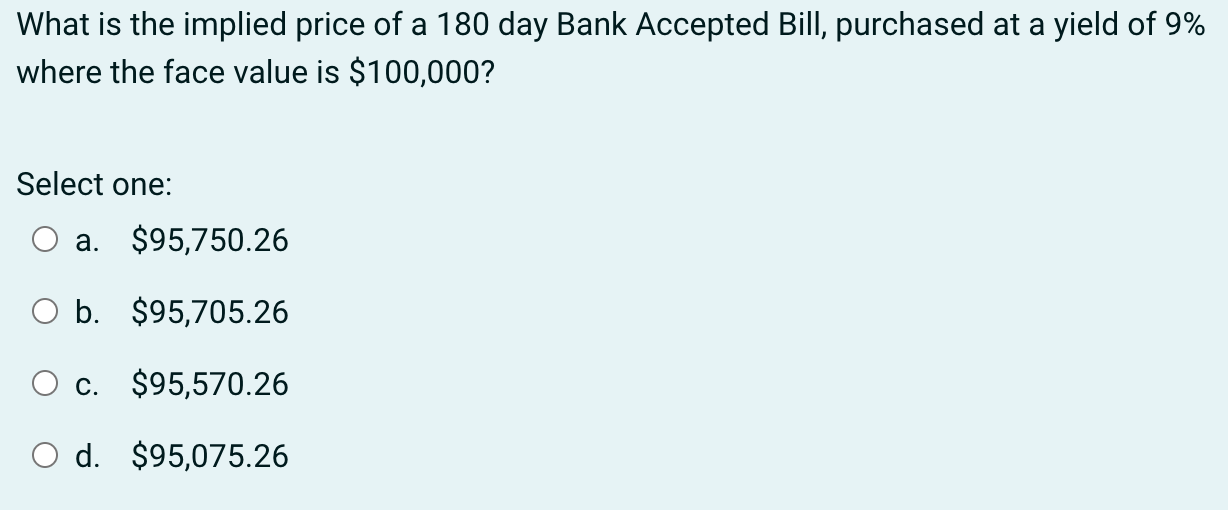

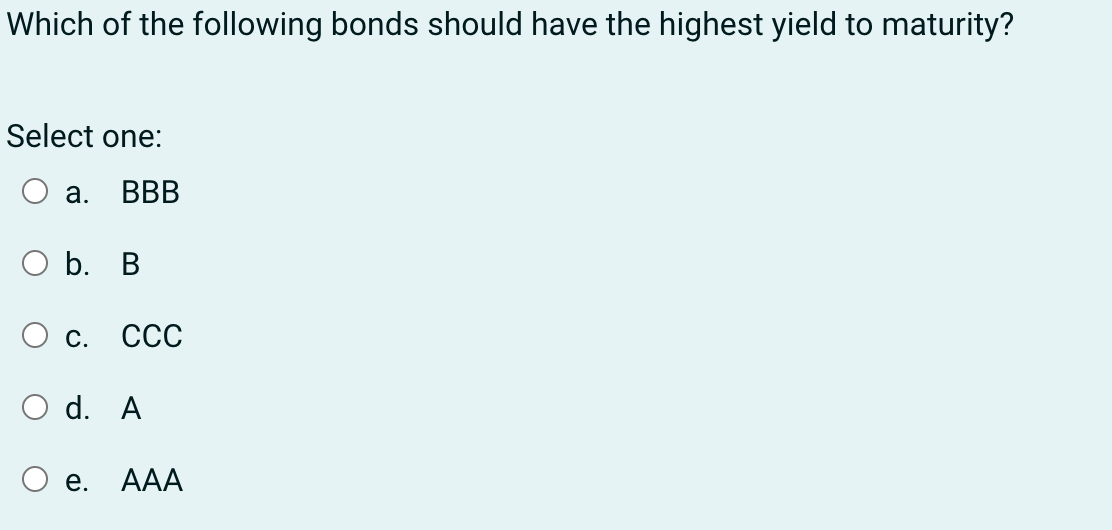

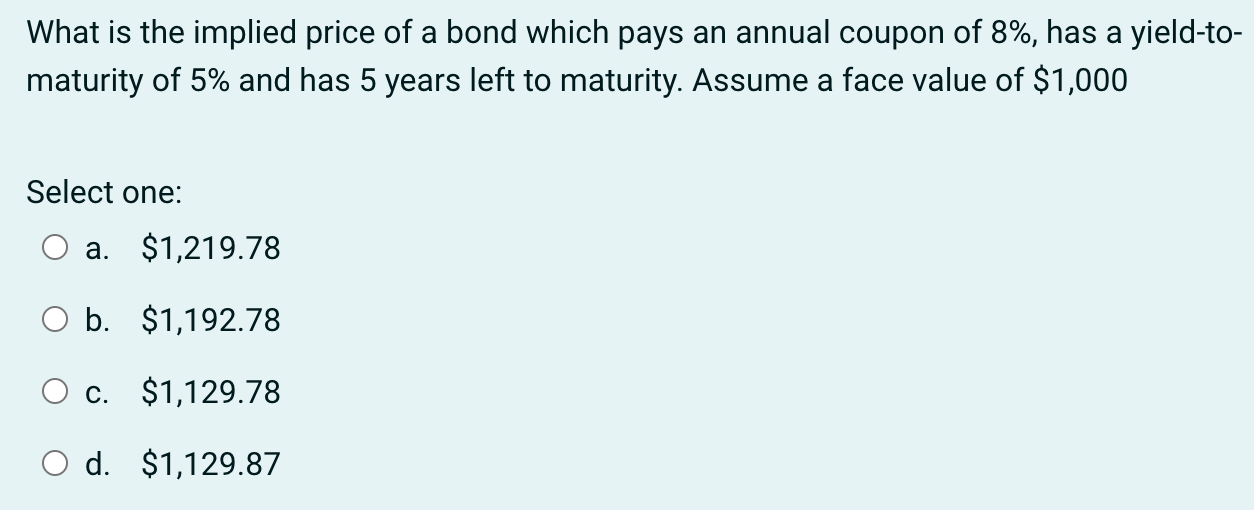

Global financial assets In 2014 , what proportion of global financial assets was government debt securities? (hint: see Preload Slide 8) Select one: a. 10% b. 40% c. 20% d. 30% Bunnings needs to finance the a new warehouse store ( $30mil needed) and the following month's inventory purchases (\$20mil needed). Which combination of debt security fund would be most appropriate given the information available? Select one: a. $30 mil funded by 30 day promissory notes and $20 mil funded by 20yr bonds b. $20 mil funded by 90 day promissory notes and $30 mil funded by 20yr bonds c. $20 mil funded by 30 day promissory notes and $30 mil funded by 20y bond d. $30 mil funded by 90 day promissory notes and $20 mil funded by 20yr bond What is the implied price of a 180 day Bank Accepted Bill, purchased at a yield of 9% where the face value is $100,000 ? Select one: a. $95,750.26 b. $95,705.26 c. $95,570.26 d. $95,075.26 Which of the following bonds should have the highest yield to maturity? Select one: a. BBB b. B c. CCC d. A e. AAA What is the implied price of a bond which pays an annual coupon of 8%, has a yield-tomaturity of 5% and has 5 years left to maturity. Assume a face value of $1,000 Select one: a. $1,219.78 b. $1,192.78 c. $1,129.78 d. $1,129.87 Global financial assets In 2014 , what proportion of global financial assets was government debt securities? (hint: see Preload Slide 8) Select one: a. 10% b. 40% c. 20% d. 30% Bunnings needs to finance the a new warehouse store ( $30mil needed) and the following month's inventory purchases (\$20mil needed). Which combination of debt security fund would be most appropriate given the information available? Select one: a. $30 mil funded by 30 day promissory notes and $20 mil funded by 20yr bonds b. $20 mil funded by 90 day promissory notes and $30 mil funded by 20yr bonds c. $20 mil funded by 30 day promissory notes and $30 mil funded by 20y bond d. $30 mil funded by 90 day promissory notes and $20 mil funded by 20yr bond What is the implied price of a 180 day Bank Accepted Bill, purchased at a yield of 9% where the face value is $100,000 ? Select one: a. $95,750.26 b. $95,705.26 c. $95,570.26 d. $95,075.26 Which of the following bonds should have the highest yield to maturity? Select one: a. BBB b. B c. CCC d. A e. AAA What is the implied price of a bond which pays an annual coupon of 8%, has a yield-tomaturity of 5% and has 5 years left to maturity. Assume a face value of $1,000 Select one: a. $1,219.78 b. $1,192.78 c. $1,129.78 d. $1,129.87