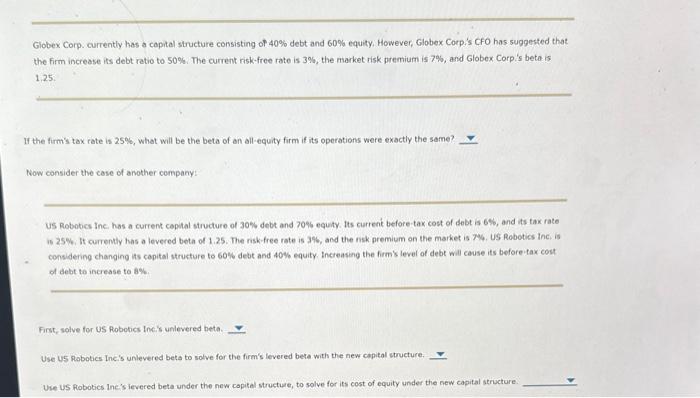

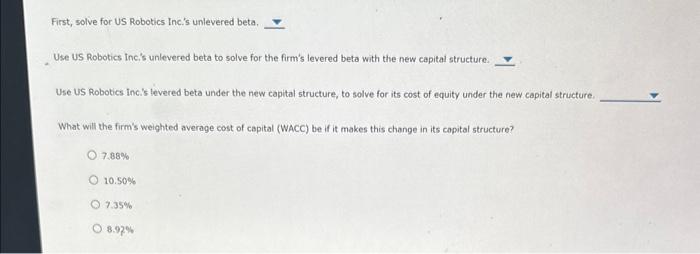

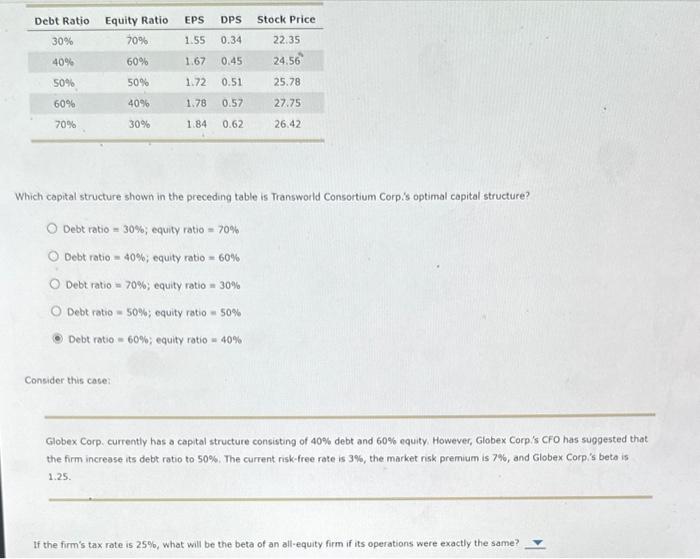

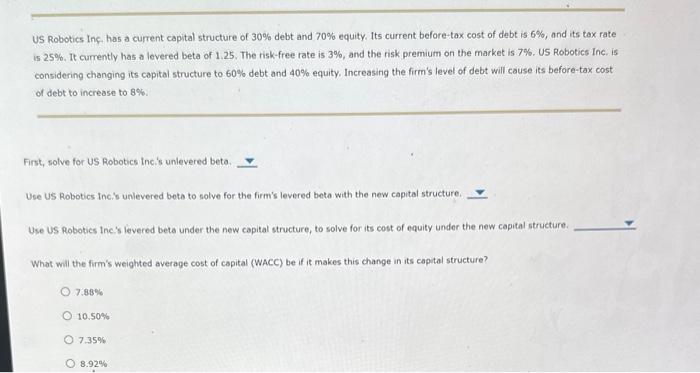

Globex Corp. currently has a copital structure consisting of 40% debt and 60% equity. However, Globex Corp.'s cfo has suggested that the firm increase its debt ratio to 50%. The current risk-free rate is 3%, the market risk premium is 7%, and Globex Corp.'s beta is 1,25 . If the firm's tax rate is 25%, what will be the beta of an all-equity firm if its operations were exactly the same? Now consider the case of another company: Us Robobes Inc has a current copotal structure of 30% debt and 70% equity. fts current before tak cost of bebt is 6%, and its tax rate i6 25\%. It currently has a levered beta of 1.25. The risk-free rate is 396, and the nsk premium on the market is 74 . US Robotics Inc. is considering changing its copital structure to 60% debt and 40% equity. Incieasing the firm's level of debt will cavse its before tax cost of debt to increase to 8%. First, solve for us Robotics Incis urlevered heta. Use us rlobotics Inci's unlevered beta to solve for the firm's levered beta with the new capital structure. Uhe us flobotics Ine's ievered beta under the new capital structure, to solve for its cost of equity under the new capital structure. First, solve for US Robotics Inc.'s unlevered beta. Use US Robotics inci's unlevered beta to solve for the firm's levered beta with the new capital structure. Use US Robotics inci's levered beta under the new capital structure, to solve for its cost of equity under the new capital structure. What will the firm's weighted average cost of capital (WACC) be if it makes this change in its copital structure? 7.88% 10.50% 7.35% 8.97% Which capital structure shown in the preceding table is Transworld Consortium Corp.'s optimal capital structure? Debt ratio =30%; equity ratio =70% Debt ratio =40%; equity ratio =60% Debt ratio =70%; equity ratio =30% Debt ratio =50%; equity ratio =50% Debt ratio =60%; equity ratio =40% Consider this case: Globex Corp. currently has a capital structure consisting of 40% debt and 60% equity. However, Globex Corp's CFO has suggested that the firm increase its debt ratio to 50%. The current risk-free rate is 3%, the market risk premium is 7%, and Globex Corp's beto is 1.25. If the firm's tax rate is 25%, what will be the beta of an all-equity firm if its operations were exactly the same? US Robotics Inc, has a current capital structure of 30% debt and 70% equity, Its current before-tax cost of debt is 6%, and its tax rate is 25%. It currently has a levered beta of 1.25. The risk-free rate is 3%, and the risk premium on the market is 7%. US Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-tax cost; of debt to increase to 8%. First, solve for US Robotics Inci's unlevered beta. Use Us Robotics incib unlevered beta to solve for the firm's levered beta with the new capital structure. Use US Robotics Inc's levered beta under the new capital structure, to solve for its cost of equity under the new capital structure. What will the firm's weighted average cost of capital (WACC) be if it makes this change in its capital structure? 7,88% 10.50% 7.35% 8.92%