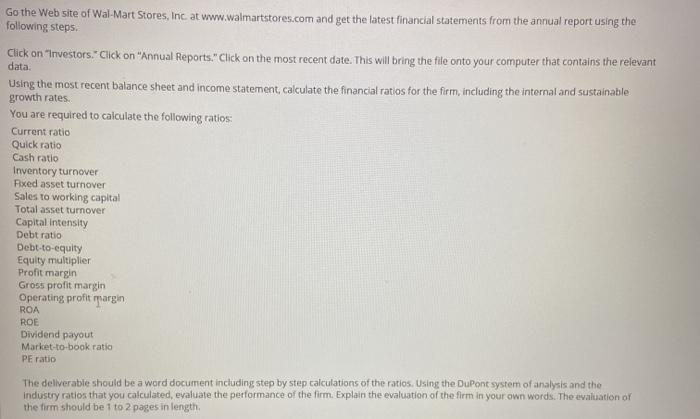

Go the Web site of Wal-Mart Stores, Inc at www.walmartstores.com and get the latest financial statements from the annual report using the following steps. Click on "Investors." Click on "Annual Reports." Click on the most recent date. This will bring the file onto your computer that contains the relevant data Using the most recent balance sheet and income statement, calculate the financial ratlos for the firm, including the internal and sustainable growth rates You are required to calculate the following ratios Current ratio Quick ratio Cash ratio Inventory turnover Fixed asset turnover Sales to working capital Total asset turnover Capital Intensity Debt ratio Debt-to-equity Equity multiplier Profit margin Gross profit margin Operating profit margin ROA ROE Dividend payout Market-to-book ratio PE ratio The deliverable should be a word document including step by step calculations of the ratios. Using the DuPont system of analysis and the Industry ratios that you calculated, evaluate the performance of the firm. Explain the evaluation of the firm in your own words. The evaluation or the firm should be 1 to 2 pages in length, Go the Web site of Wal-Mart Stores, Inc at www.walmartstores.com and get the latest financial statements from the annual report using the following steps. Click on "Investors." Click on "Annual Reports." Click on the most recent date. This will bring the file onto your computer that contains the relevant data Using the most recent balance sheet and income statement, calculate the financial ratlos for the firm, including the internal and sustainable growth rates You are required to calculate the following ratios Current ratio Quick ratio Cash ratio Inventory turnover Fixed asset turnover Sales to working capital Total asset turnover Capital Intensity Debt ratio Debt-to-equity Equity multiplier Profit margin Gross profit margin Operating profit margin ROA ROE Dividend payout Market-to-book ratio PE ratio The deliverable should be a word document including step by step calculations of the ratios. Using the DuPont system of analysis and the Industry ratios that you calculated, evaluate the performance of the firm. Explain the evaluation of the firm in your own words. The evaluation or the firm should be 1 to 2 pages in length