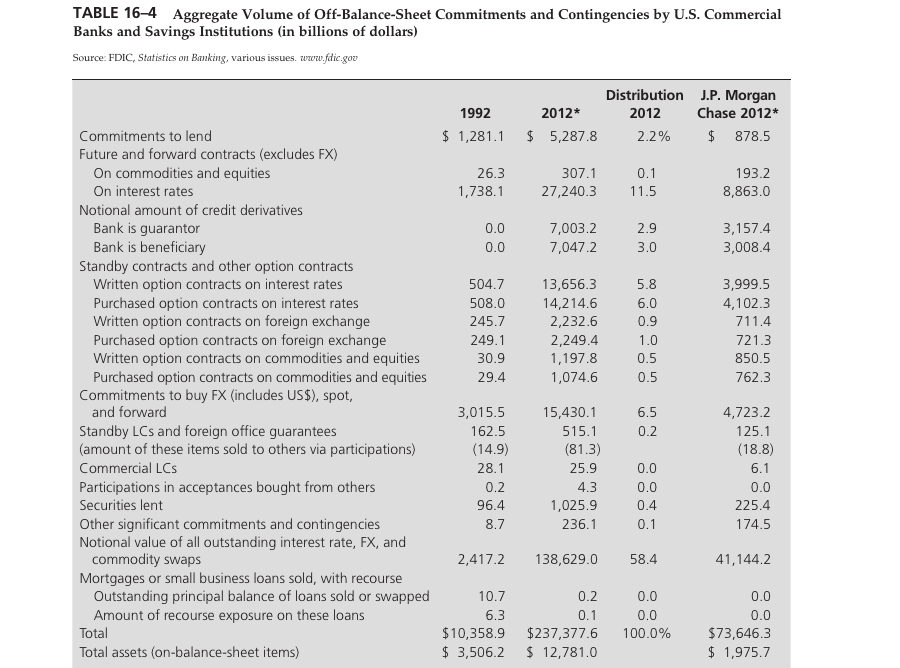

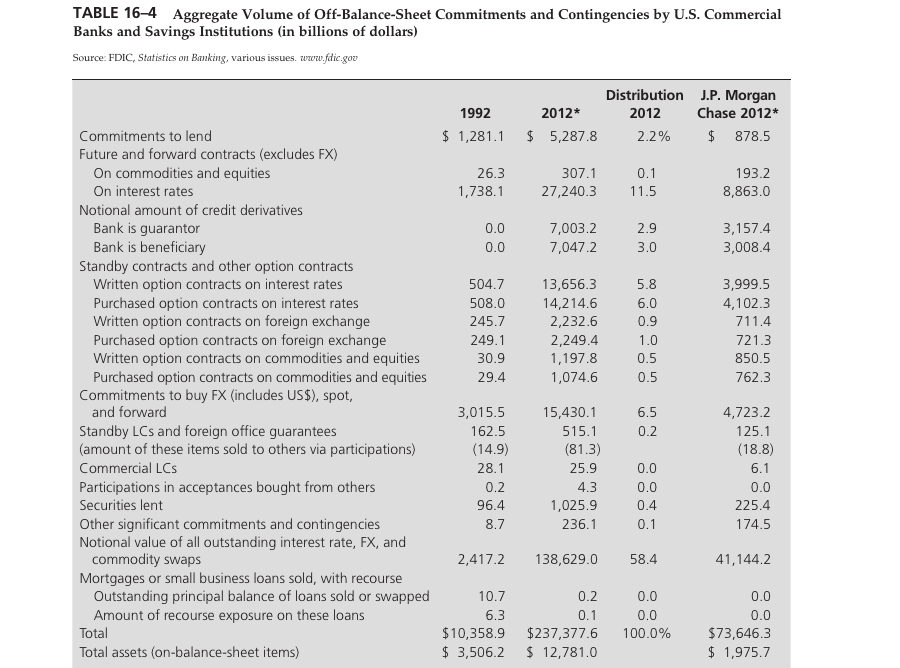

Go to the FDIC website at www.fdic.gov and find the total amount of unused commitments and letters of credit and the notional value of interest rate swaps of FDIC-insured commercial banks for the most recent quarter available using the following steps. Click on Analysts. From there click on Statistics on Banking. Next click on Assets and Liabilities and Run Report. Select Total Unused Commitments, then Letters of Credit, and finally Derivatives to get the relevant data. This will bring the three files onto your computer that contain the relevant data. What is the dollar value increase in these amounts over the first-quarter 2012 values reported in Table 164?

TABLE 16-4 Aggregate Volume of Off-Balance-Sheet Commitments and Contingencies by U.S. Commercial Banks and Savings Institutions (in billions of dollars) Source: FDIC, Statistics on Banking, various issues. www.fdic,gov Distribution J. P. Morgan Chase 2012 2012 1992 2012 Commitments to lend 1,281.1 5,287.8 2.2% 878.5 Future and forward contracts (excludes FX) On commodities and equities 193.2 8,863.0 On interest rates 27,240.3 Notional amount of credit derivatives Bank is guarantor 7,003.2 3.157.4 3,008.4 Bank is beneficiary Standby contracts and other option contracts Written option contracts on interest rates 504.7 13,656.3 3,999.5 5.8 Purchased option contracts on interest rates 508.0 14,214.6 6.0 4,102.3 Written option contracts on foreign exchange 2,232.6 245.7 0.9 Purchased option contracts on foreign exchange 249.1 2,249.4 1.0 721.3 Written option contracts on commodities and equities 30.9 1,197.8 0.5 850.5 Purchased option contracts on commodities and equities 29.4 1.074.6 0.5 762.3 Commitments to buy FX (includes US$), spot, and forward 15,430.1 3,015.5 6.5 4,723.2 Standby LCs and foreign office guarantees 162.5 515.1 0.2 125.1 (amount of these items sold to others via participations (14.9) (81.3) (18.8) Commercial LCs 28.1 25.9 6.1 0.0 Participations in acceptances bought from others 0.2 4.3 0.0 0.0 Securities lent 96.4. 1,025.9 0.4 225.4 Other significant commitments and contingencies 8.7 236.1 0.1 174.5 Notional value of all outstanding interest rate, FX, and 2,417.2 138,629.0 commodity swaps 58.4 41,144.2 Mortgages or small business loans sold, with recourse Outstanding principal balance of loans sold or swapped 10.7 0.2 0.0 0.0 Amount of recourse exposure on these loans 6.3 0.1 0.0 0.0 10,358.9 $237,377.6 100.0% $73,646.3 Tota Total assets (on-balance-sheet items) 3,506.2 12,781.0 1,975.7 TABLE 16-4 Aggregate Volume of Off-Balance-Sheet Commitments and Contingencies by U.S. Commercial Banks and Savings Institutions (in billions of dollars) Source: FDIC, Statistics on Banking, various issues. www.fdic,gov Distribution J. P. Morgan Chase 2012 2012 1992 2012 Commitments to lend 1,281.1 5,287.8 2.2% 878.5 Future and forward contracts (excludes FX) On commodities and equities 193.2 8,863.0 On interest rates 27,240.3 Notional amount of credit derivatives Bank is guarantor 7,003.2 3.157.4 3,008.4 Bank is beneficiary Standby contracts and other option contracts Written option contracts on interest rates 504.7 13,656.3 3,999.5 5.8 Purchased option contracts on interest rates 508.0 14,214.6 6.0 4,102.3 Written option contracts on foreign exchange 2,232.6 245.7 0.9 Purchased option contracts on foreign exchange 249.1 2,249.4 1.0 721.3 Written option contracts on commodities and equities 30.9 1,197.8 0.5 850.5 Purchased option contracts on commodities and equities 29.4 1.074.6 0.5 762.3 Commitments to buy FX (includes US$), spot, and forward 15,430.1 3,015.5 6.5 4,723.2 Standby LCs and foreign office guarantees 162.5 515.1 0.2 125.1 (amount of these items sold to others via participations (14.9) (81.3) (18.8) Commercial LCs 28.1 25.9 6.1 0.0 Participations in acceptances bought from others 0.2 4.3 0.0 0.0 Securities lent 96.4. 1,025.9 0.4 225.4 Other significant commitments and contingencies 8.7 236.1 0.1 174.5 Notional value of all outstanding interest rate, FX, and 2,417.2 138,629.0 commodity swaps 58.4 41,144.2 Mortgages or small business loans sold, with recourse Outstanding principal balance of loans sold or swapped 10.7 0.2 0.0 0.0 Amount of recourse exposure on these loans 6.3 0.1 0.0 0.0 10,358.9 $237,377.6 100.0% $73,646.3 Tota Total assets (on-balance-sheet items) 3,506.2 12,781.0 1,975.7