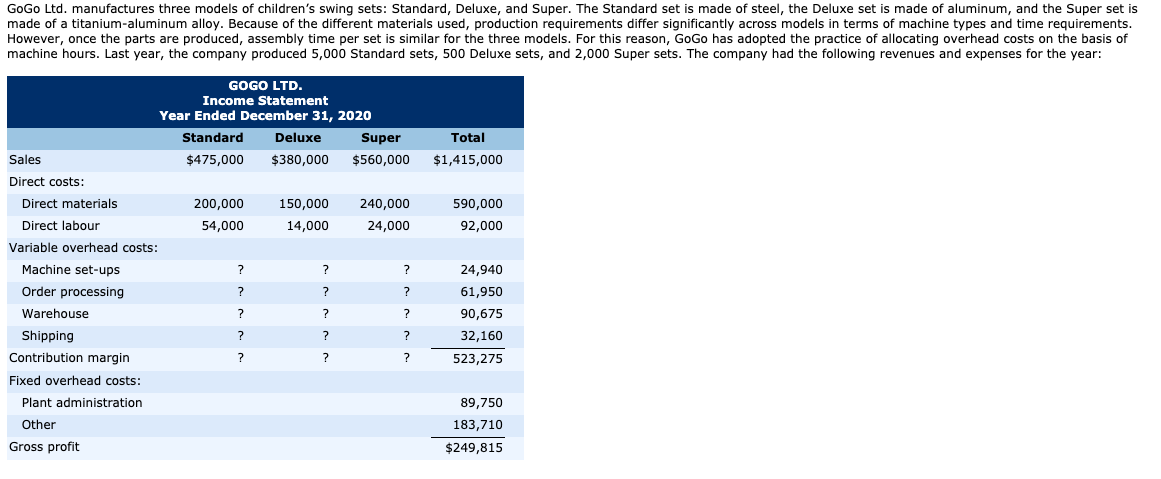

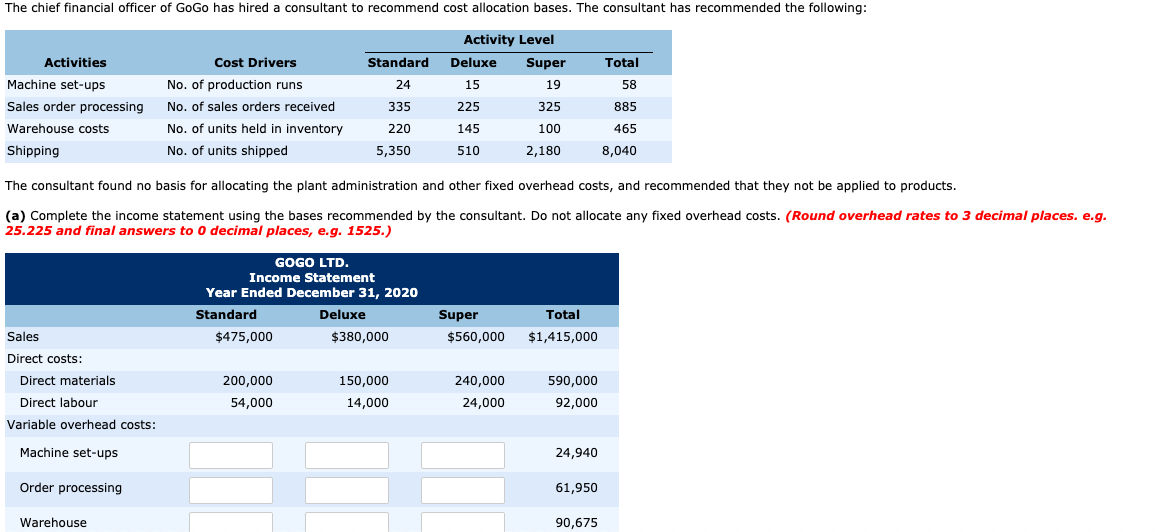

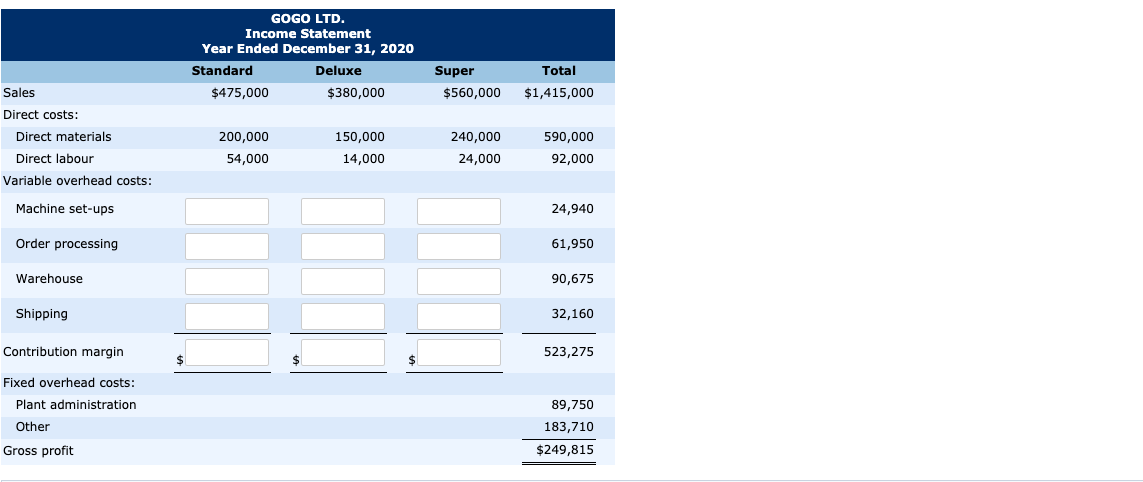

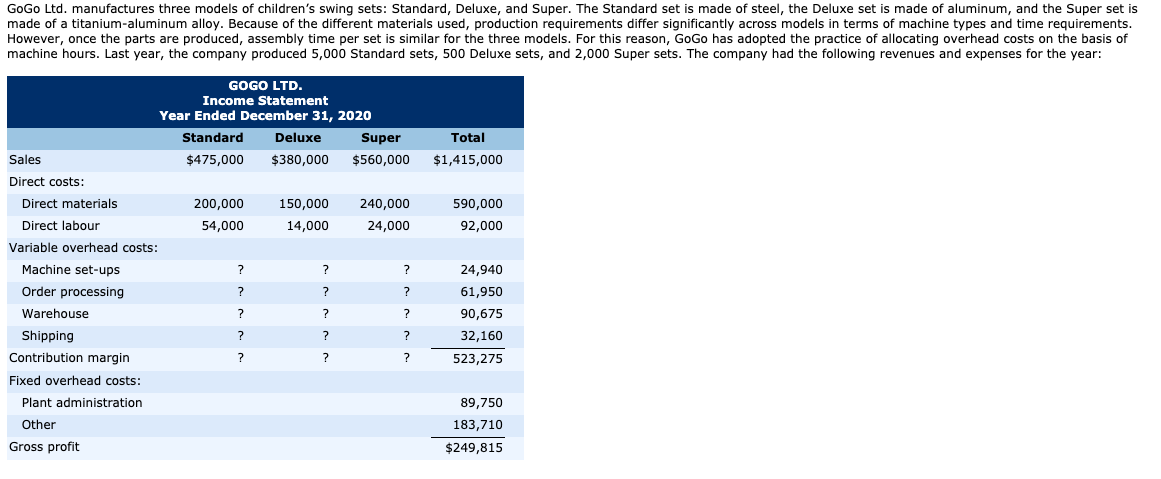

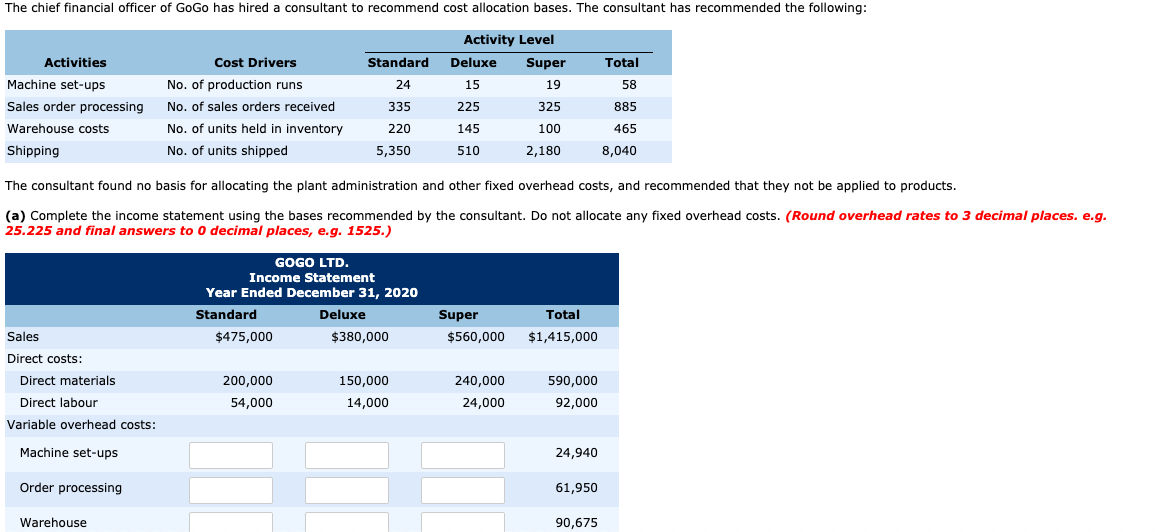

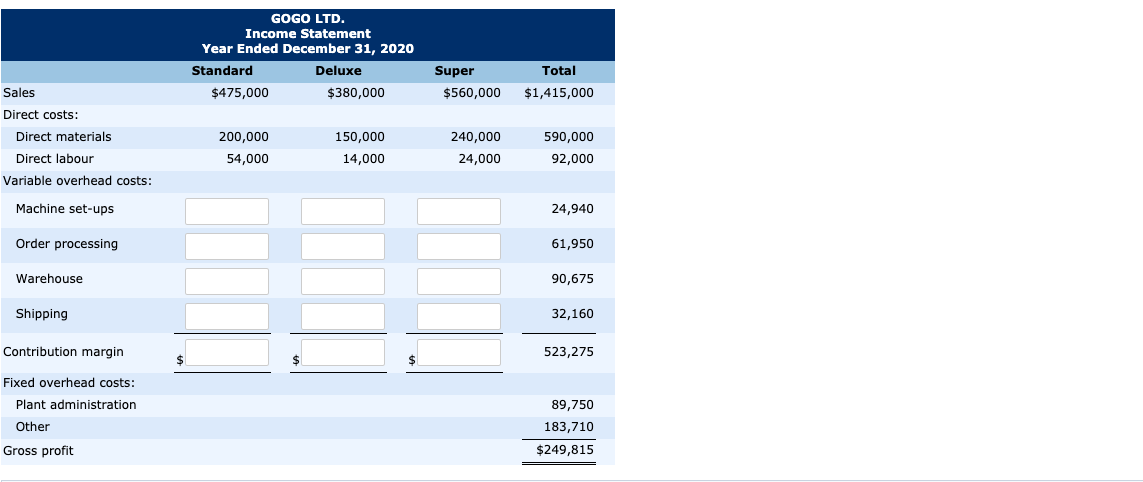

GoGo Ltd. manufactures three models of children's swing sets: Standard, Deluxe, and Super. The Standard set is made of steel, the Deluxe set is made of aluminum, and the Super set is made of a titanium-aluminum alloy. Because of the different materials used, production requirements differ significantly across models in terms of machine types and time requirements. However, once the parts are produced, assembly time per set is similar for the three models. For this reason, GoGo has adopted the practice of allocating overhead costs on the basis of machine hours. Last year, the company produced 5,000 Standard sets, 500 Deluxe sets, and 2,000 Super sets. The company had the following revenues and expenses for the year: Total $1,415,000 590,000 92,000 GOGO LTD. Income Statement Year Ended December 31, 2020 Standard Deluxe Super Sales $475,000 $380,000 $560,000 Direct costs: Direct materials 200,000 150,000 240,000 Direct labour 54,000 14,000 24,000 Variable overhead costs: Machine set-ups Order processing Warehouse Shipping Contribution margin Fixed overhead costs: Plant administration Other Gross profit 24,940 61,950 90,675 32,160 523,275 89,750 183,710 $249,815 The chief financial officer of GoGo has hired a consultant to recommend cost allocation bases. The consultant has recommended the following: Activities Machine set-ups Sales order processing Warehouse costs Shipping Cost Drivers No. of production runs No. of sales orders received No. of units held in inventory No. of units shipped Standard 24 335 220 5,350 Activity Level Deluxe Super Total 15 1958 325 885 145 100 465 510 2,180 8,040 The consultant found no basis for allocating the plant administration and other fixed overhead costs, and recommended that they not be applied to products. (a) Complete the income statement using the bases recommended by the consultant. Do not allocate any fixed overhead costs. (Round overhead rates to 3 decimal places. e.g. 25.225 and final answers to 0 decimal places, e.g. 1525.) GOGO LTD. Income Statement Year Ended December 31, 2020 Standard Deluxe $475,000 $380,000 Super $560,000 Total $1,415,000 Sales Direct costs: Direct materials Direct labour Variable overhead costs: 200,000 54,000 150,000 14,000 240,000 24,000 590,000 92,000 Machine set-ups 24,940 Order processing 61,950 Warehouse 90,675 GOGO LTD. Income Statement Year Ended December 31, 2020 Standard Deluxe $475,000 $380,000 Super $560,000 Total $1,415,000 Sales Direct costs: Direct materials Direct labour Variable overhead costs: 200,000 54,000 150,000 14,000 240,000 24,000 590,000 92,000 92,0 Machine set-ups 24,940 Order processing 61,950 Warehouse 90,675 Shipping 32,160 Contribution margin 523,275 Fixed overhead costs: Plant administration Other Gross profit 89,750 183,710 $249,815