Question

Gold Coast Hips Gold Coast Hips is a division of Gold Coast Marine, a manufacturer stainless steel component for leisure cruisers on the Gold Coast.

Gold Coast Hips

Gold Coast Hips is a division of Gold Coast Marine, a manufacturer stainless steel component for leisure cruisers on the Gold Coast.

Five years ago Gold Coast Marine's owner, Bill Moir, was looking to expand geographically and into other products. He came across the opportunity to make titanium hips joints for the local hospital. The hips started to sell quite well with the rapidly growing number of aged people in Queensland.

This year Gold Coast Hips developed and patented a new hyperbolic self-adjusting hip product that has achieved acclaim in the medical literature and provided a strong foundation for growth of the Division in Australia and overseas.

Following newspaper publicity about the new hip, Phil Jeans of Bull Private Equity approached Bill to invest in the Gold Coast Marine with its eight coastal branches and high growth hip business. Phil foresees that new capital and management will make Gold Coast a national brand and the hip business provides additional upside.

Bill, who is now 60 years old, says he will sell 60% of Gold Coast Marine to Bull at a Price to Earnings Ratio of 6 times. However, Bill has two conditions. The first is that he remains Chief Executive Officer. The second condition is that the Hips Division is sold to the Division Manager, Jim Sanders, who is Bill's 26 year old son-in-law. Jim invented the new hyperbolic hip.

Bill says that he intends to sell the Hip Division to Jim for the nominal value of $1 because the Division has not yet become profitable, all the machinery belongs to the parent company and the Division needs $5 million for equipment. Bill knows the $1 price-tag is a discount but feels that Jim should have this opportunity to growth the business as Bill did with Gold Coast Marine, because Jim invented the new hip and he is young without much money.

Before responding to Bill, Phil Jeans has consulted you about the value of Gold Coast Hips. Phil says he is prepared to agree that Bill has the right to remain Chief Executive Officer while he owns the remaining 40% of Gold Coast Marine. Phil also knows that Bill is entitled to give away anything he wants to Jim while Bill owns all of the business.

Yet Phil is concerned. The reason he approached Gold Coast Marine in the first place was the success of the hip. Also, Phil's gut feel is that Gold Coast Hips is worth a huge amount of money because it can export and be listed on the Australian Stock Exchange as a biotechnology company with a finished product and demonstrated performance

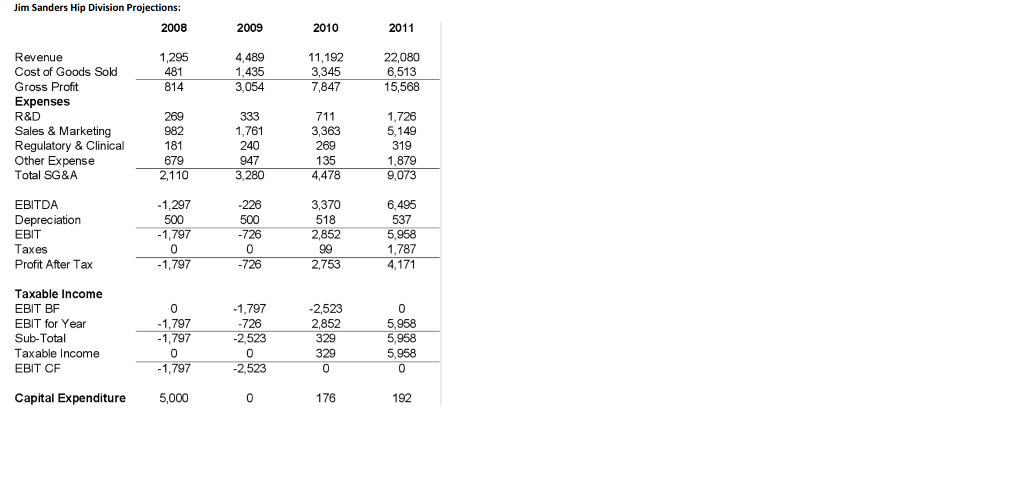

Phil has asked you to value Gold Coast Hips on the basis of giving Jim a free 20% carried interest in the company, Bull subscribing in $5m for 40% leaving Bill with 40%, and taking Hips to IPO when it is profitable. He has given you Jim's projections based on actual contracts for 2008 and says that Bull's hurdle rate is 40%pa. However, you heard Bill say venture capital should receive 25%pa.

Ever resourceful, you have found the following method for valuing fast growing companies:

1. Forecast cash flows to equity up until the time at which the Investor will exit the investment (typically through an IPO or sale to strategic buyer).

2. Value the exit price based on an assumed multiple of earnings or sales or customers, etc. The multiple is typically based on comparable public companies or comparable transactions (for example, assume that after a listing the price rises to 15x Profit After Tax)

3. Discount interim cash flows and the exit value at rates ranging from 25% - 80% to obtain the pre-money company value note particularly the value at the Investor's hurdle rate.

4. Determine whether the Investor's stake in the company is fairly priced. If the Investor subscribes $Xm for Y%, then 100% of the company is worth $Xm/Y%. The price is fair if it equals the pre-money company value plus the Investor's new money.

Required: 1. Calculate the Cash Flow to Equity

2. Calculate the Terminal Value assuming a price earnings ratio of 15x after listing assume that the full tax rate of 30% applies to create a Normalised Profit After Tax.

3. What is: (a) NPV at 40% discount factor of Cash Flow to Equity?

(b) NPV at 40% discount factor of Terminal Value?

(c) Total pre-money value? (Sum of NPV of Cash Flow to Equity & Terminal Value)

(d) Total Enterprise Value including Bull's $5 million? (Pre-Money + Bull's $5million)

(e) Bull's Fair Share (Bull's Investment / Total Enterprise Value)

4. What proportion of the company would Bull get for $5m at discount rates of 25%, 40%, 55% and 80%?

5. If Phil is a hard negotiator and Bull gets 40% for $5 million as he has specified, what is the rate of return he expects? Inspect the Table you calculated above for the answer. 6. Bill said 25% should be the discount rate for venture capital. What should Phil say is the probability discount to be applied to Jim's projections? Why didn't Phil say to apply this discount before calculating the NPVs?

7. Phil has to look at his downside. What is the terminal value of Gold Coast Hips if Bull is unable to list it as planned and continues to trade into perpetuity? What percentage of the company should Bull get for $5 million if Bill still wants his 40% pa return?

8. Would you do the deal Phil has specified of 40% of Gold Coast Hips for $5 million?

Jim Sanders Hip Division Projections: 1,295 Cost of Goods Sold Sales & Marketing Regulatory & Clinical Other Expense 2 4 3 ax Taxable Income 7 8 ear 2 Capital Expenditure 5,000 176

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started