Answered step by step

Verified Expert Solution

Question

1 Approved Answer

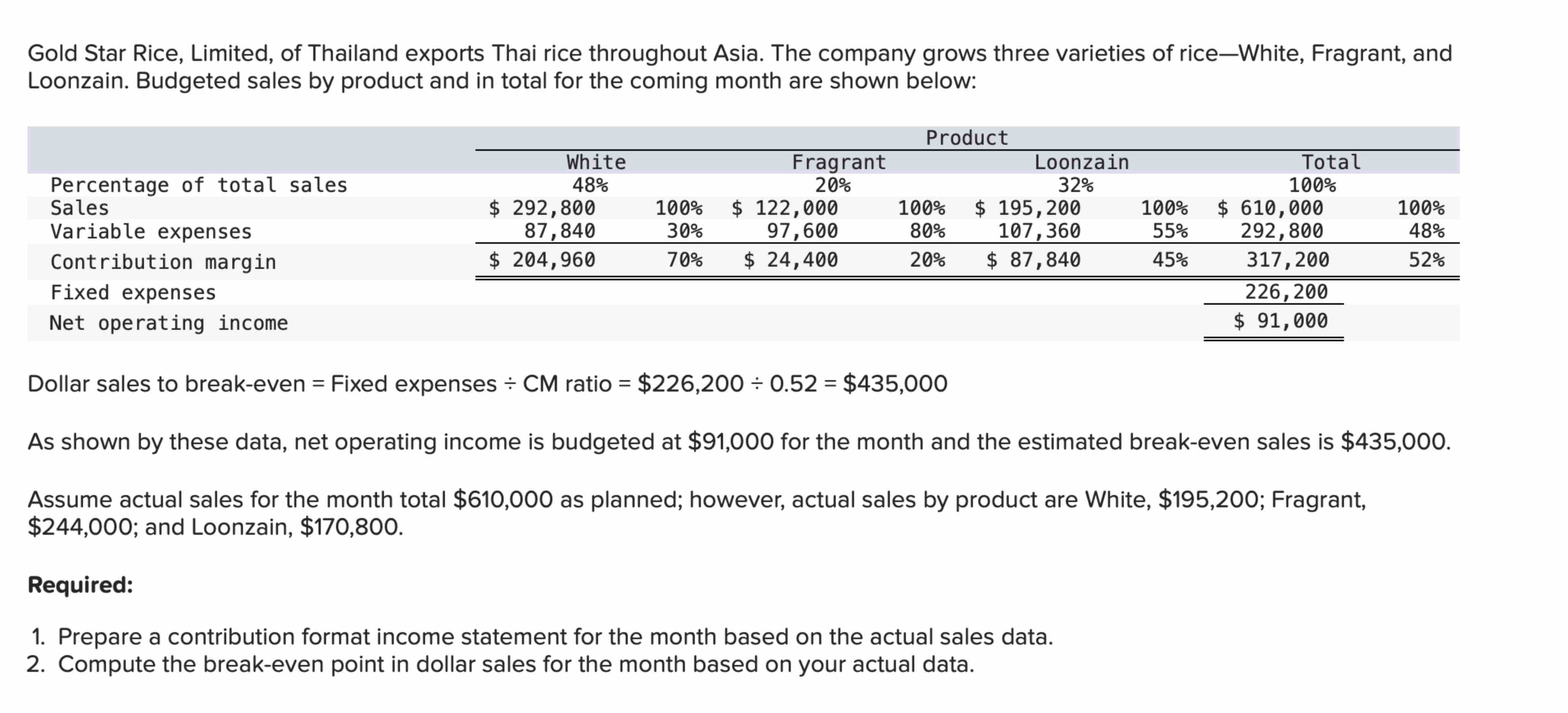

Gold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by

Gold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Product Percentage of total sales White 48% Fragrant 20% Loonzain 32% Total 100% Sales Variable expenses $ 292,800 87,840 100% 30% Contribution margin Fixed expenses Net operating income Dollar sales to break-even = Fixed expenses CM ratio = $226,200 0.52 = $435,000 $ 204,960 $ 122,000 97,600 70% $ 24,400 100% 80% $ 195,200 107,360 100% 55% $ 610,000 292,800 100% 48% 20% $ 87,840 45% 317,200 52% 226,200 $ 91,000 As shown by these data, net operating income is budgeted at $91,000 for the month and the estimated break-even sales is $435,000. Assume actual sales for the month total $610,000 as planned; however, actual sales by product are White, $195,200; Fragrant, $244,000; and Loonzain, $170,800. Required: 1. Prepare a contribution format income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Contribution format income statement based on actual sales data Product White Fragrant Loon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started