Question

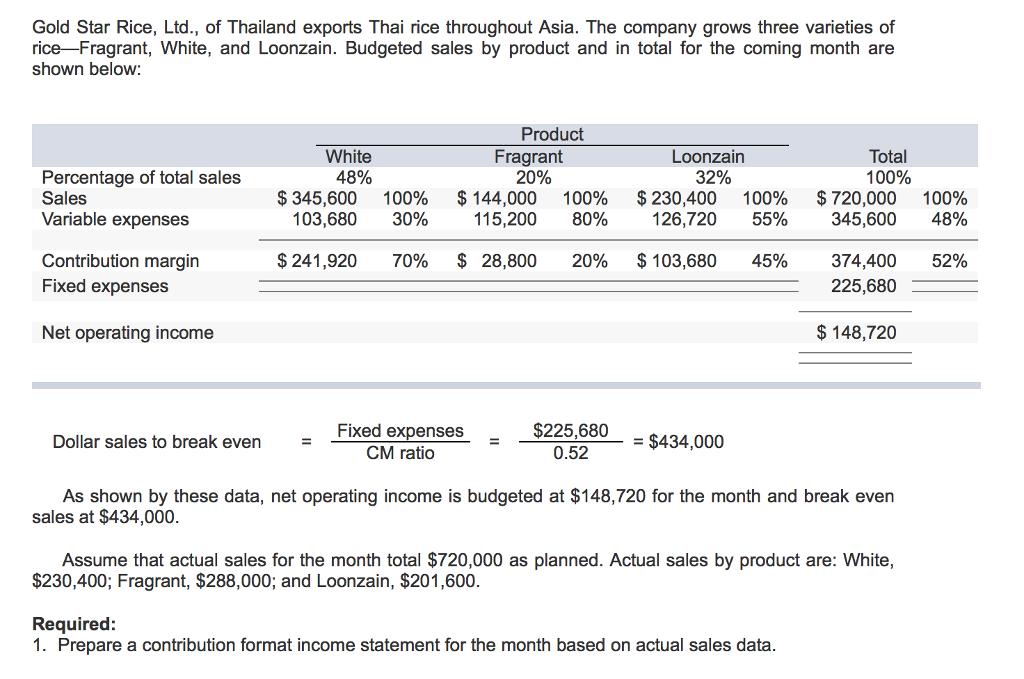

Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of riceFragrant, White, and Loonzain. Budgeted sales by product

| Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of riceFragrant, White, and Loonzain. Budgeted sales by product and in total for the coming month are shown below (in order): (White) (Fragrant) (Loonzain) (Total)

Dollar sales to break even = (fixed expenses/CM ratio) = ($225,680/0.52) = $434,000 As shown by these data, net operating income is budgeted at $148,720 for the month and break even sales at $434,000. Assume that actual sales for the month total $720,000 as planned. Actual sales by product are: White, $230,400; Fragrant, $288,000; and Loonzain, $201,600. Required: 1. Prepare a contribution format income statement for the month based on actual sales data. (X% stands for percentage unknown and $X stands for dollar amount unkown). |

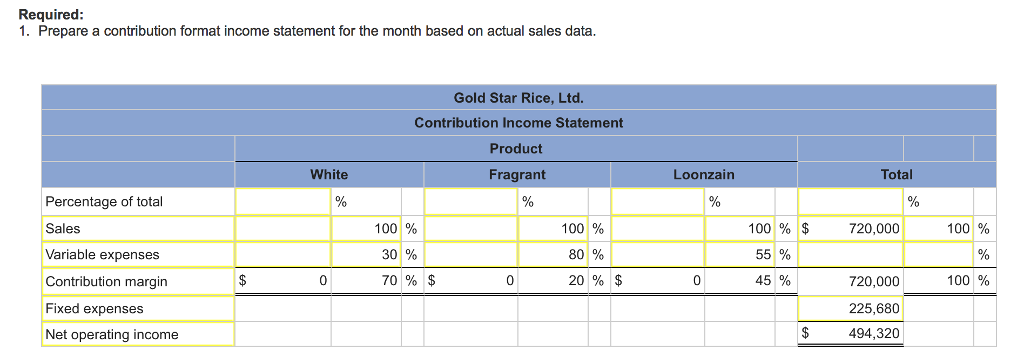

| Gold Star Rice, Ltd. | ||||||||

| Contribution Income Statement | ||||||||

| Product | ||||||||

| White | Fragrant | Loonzain | Total | |||||

| Percentage of total | X% | X% | X% | X% | ||||

| Sales | $X | 100% | $X | 100% | $X | 100% | $720,000 | 100% |

| Variable Expenses | $X | 30% | $X | 80% | $X | 55% | $ | X% |

| Contribution Margin | $X | 70% | $X | 20% | $X | 45% | ||

| Fixed Expenses | $225,680 | |||||||

| Net Operating Income |

2. Compute the break-even point in dollar sales for the month based on your actual data. (Round your final answer to the nearest whole dollar).

Break-even point in sales dollars = X

Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-Fragrant, White, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Product Total Fragrant White Loonzain 100% Percentage of total sales 48% 20% 32% 345,600 100% 144,000 100% 230,400 100% 720,000 100% Sales Variable expenses 103,680 30% 115,200 80% 126,720 55% 345,600 48% 241,920 70% 28,800 20% 103,680 45% 374,400 52% Contribution margin 225,680 Fixed expenses 148,720 Net operating income $225,680 Fixed expenses $434,000 0.52 Dollar sales to break even CM ratio As shown by these data, net operating income is budgeted at $148,720 for the month and break even sales at $434,000. Assume that actual sales for the month total $720,000 as planned. Actual sales by product are: White, $230,400; Fragrant, $288,000; and Loonzain, $201,600. Required: 1. Prepare a contribution format income statement for the month based on actual sales dataStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started