Question

Golden Fall, Inc., develops and runs senior living facilities throughout the United States. Golden Fall is a private company, so its stock is not traded

Golden Fall, Inc., develops and runs senior living facilities throughout the United States. Golden Fall is a private company, so its stock is not traded in the market. It is entirely equity-financed, with no plans to borrow in the future.

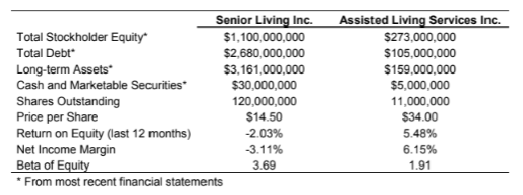

Francine Liu, Golden Falls CFO, has been examining a proposal to build a new senior centre outside of Boston. Liu has correctly concluded that the project will have a positive NPV only if the applicable discount rate is below 13.0%. Her project manager has argued that, because current risk- free interest rates are 3.95% for all maturities, the appropriate discount rate cannot be above 13.0%. Liu is not sure whether her project manager is correct. She has gathered information about two of Golden Falls publicly-traded competitors, which is shown below. The two competitors leverage ratios have been stable in recent years.

Liu has called a few of her contacts in the investment banking community and has determined that 6% is the current consensus opinion on the market risk premium. Assume that the CAPM holds. Based on the information that Liu has collected, can she reasonably conclude that the Boston opportunity is a positive NPV project? Show all your work and clearly state any additional assumptions you need to make.

\\begin{tabular}{lcc} \\hline & Senior Living Inc. & Assisted Living Services Inc. \\\\ \\cline { 2 - 3 } Total Stockholder Equity* & \\( \\$ 1,100,000,000 \\) & \\( \\$ 273,000,000 \\) \\\\ Total Debt* & \\( \\$ 2,680,000,000 \\) & \\( \\$ 105,000,000 \\) \\\\ Long-term Assets* \\( ^{*} \\) & \\( \\$ 3,161,000,000 \\) & \\( \\$ 159,000,000 \\) \\\\ Cash and Marketable Securities* & \\( \\$ 30,000,000 \\) & \\( \\$ 5,000,000 \\) \\\\ Shares Outstanding & \\( 120,000,000 \\) & \\( 11,000,000 \\) \\\\ Price per Share & \\( \\$ 14.50 \\) & \\( \\$ 34.00 \\) \\\\ Return on Equity (last 12 months) & \2.03 & \5.48 \\\\ Net Income Margin & \3.11 & \6.15 \\\\ Beta of Equity & 3.69 & 1.91 \\\\ \\hline \\end{tabular} * From most recent financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started