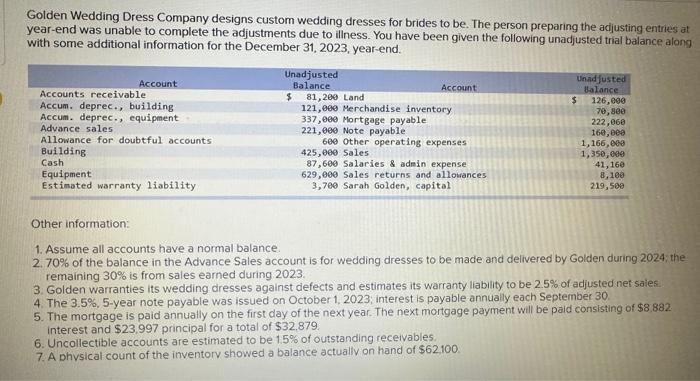

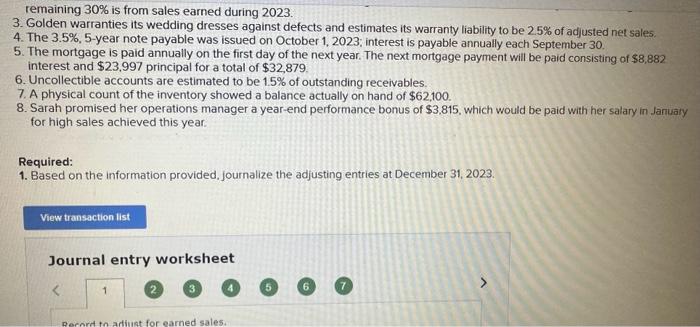

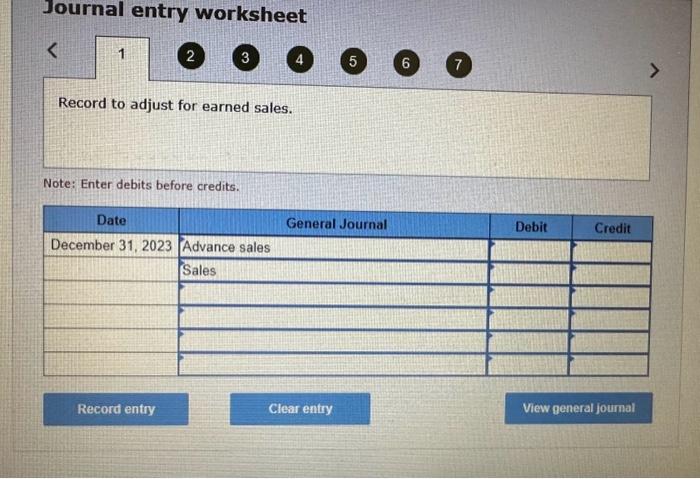

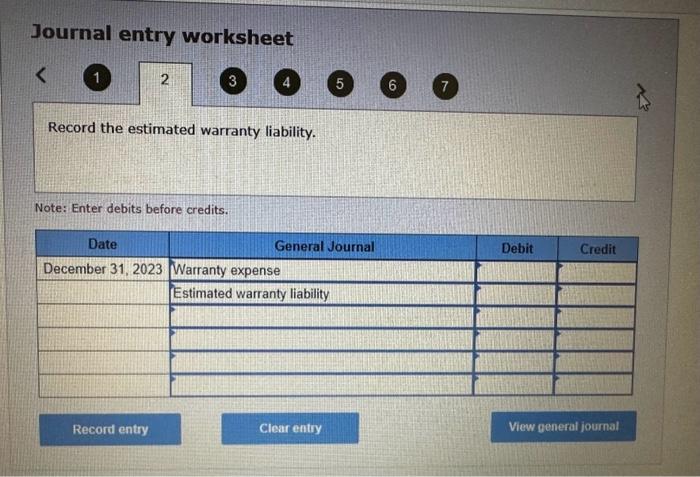

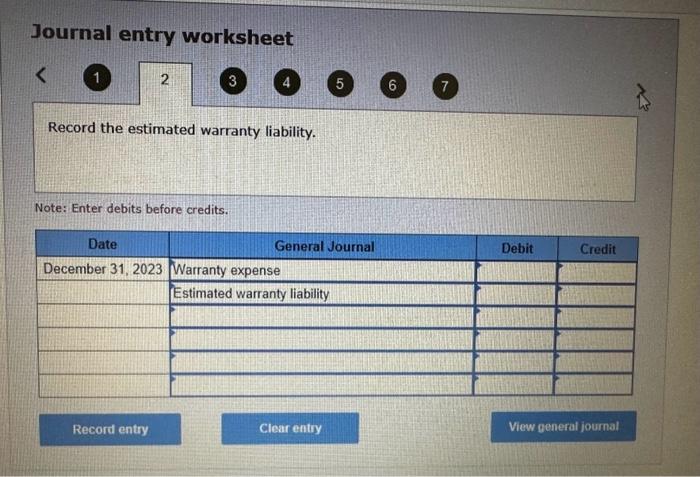

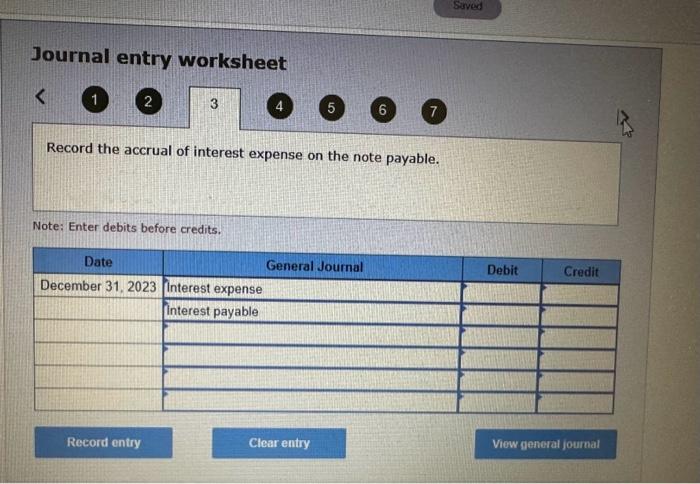

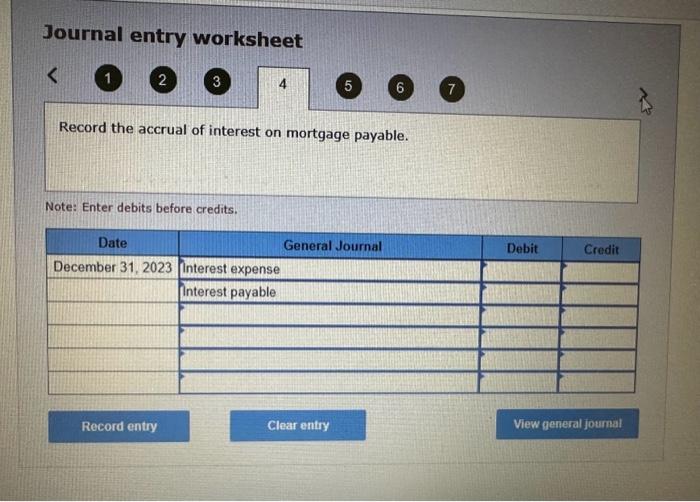

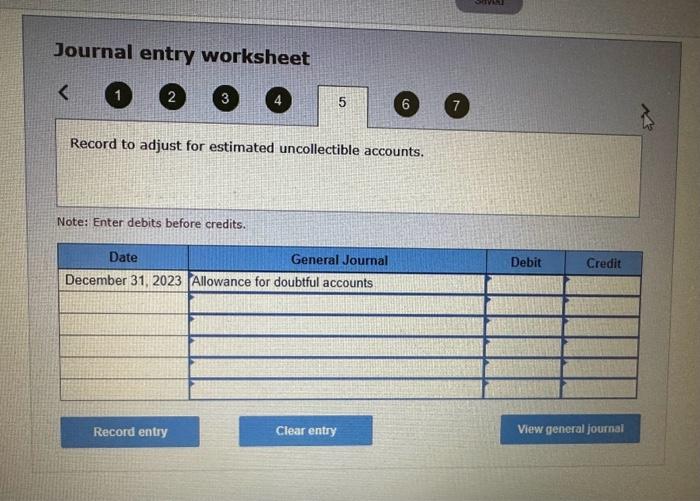

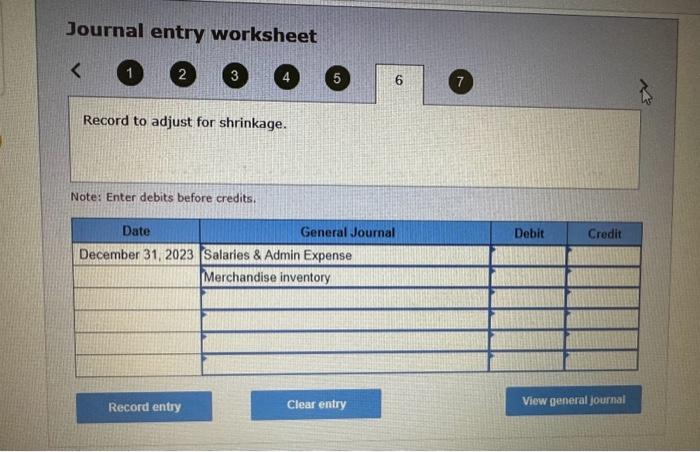

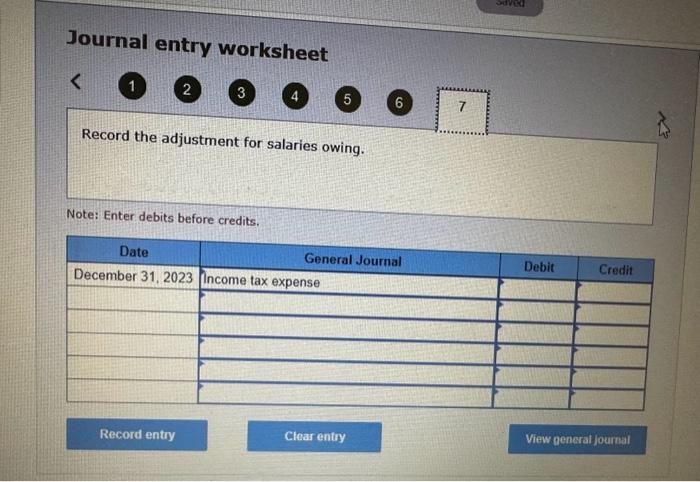

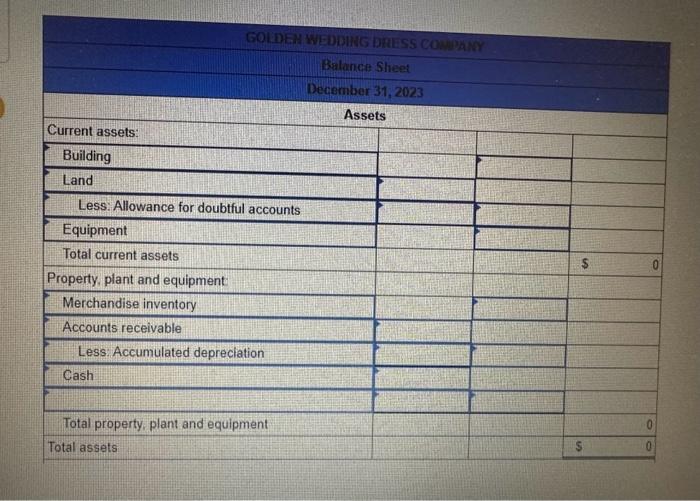

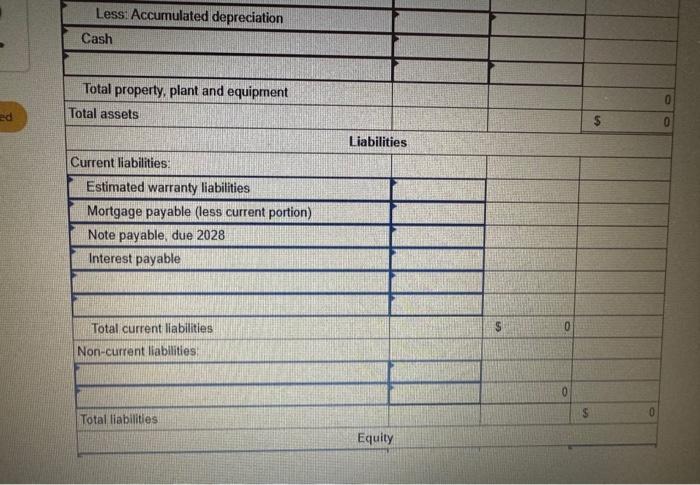

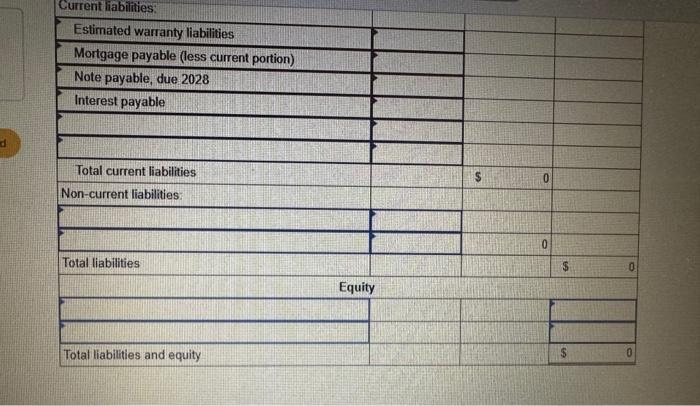

Golden Wedding Dress Company designs custom wedding dresses for brides to be. The person preparing the adjusting entries at year-end was unable to complete the adjustments due to illness. You have been given the following unadjusted trial balance alons with some additional information for the December 31, 2023, year-end. Other information: 1. Assume all accounts have a normal balance. 2. 70% of the balance in the Advance Sales account is for wedding dresses to be made and delivered by Golden during 2024 ; the remaining 30% is from sales earned during 2023. 3. Golden warrantles its wedding dresses against defects and estimates its warranty liability to be 2.5% of adjusted net sales. 4. The 3.5\%, 5-year note payable was issued on October 1, 2023; interest is payable annually each September 30. 5. The mortgage is paid annually on the first day of the next year. The next mortgage payment will be paid consisting of $8.882. interest and $23.997 principal for a total of $32.879. 6. Uncollectible accounts are estimated to be 1.5% of outstanding receivables. 7. A physical count of the inventorv showed a balance actuallv on hand of $62.100 remaining 30% is from sales earned during 2023. 3. Golden warranties its wedding dresses against defects and estimates its warranty liability to be 2.5% of adjusted net sales. 4. The 3.5\%, 5-year note payable was issued on October 1, 2023; interest is payable annually each September 30. 5. The mortgage is paid annually on the first day of the next year. The next mortgage payment will be paid consisting of $8,882 interest and $23.997 principal for a total of $32,879. 6. Uncollectible accounts are estimated to be 1.5% of outstanding receivables. 7. A physical count of the inventory showed a balance actually on hand of $62,100. 8. Sarah promised her operations manager a year-end performance bonus of $3,815, which would be paid with her salary in Janualy for high sales achieved this year. Required: 1. Based on the information provided, journalize the adjusting entries at December 31,2023. Journal entry worksheet wote: Enter aebits before credits. Journal entry worksheet Journal entry worksheet Journal entry worksheet (5) 6 Record the accrual of interest expense on the note payable. Note: Enter debits before credits. Journal entry worksheet (5) 6 Record the accrual of interest on mortgage payable. Note: Enter debits before credits. Journal entry worksheet Record to adjust for estimated uncollectible accounts. Note: Enter debits before credits. Journal entry worksheat Journal entry worksheet Record the adjustment for salaries owing. Record the adjustiment for Note: Enter debits before credits. Current liabilities