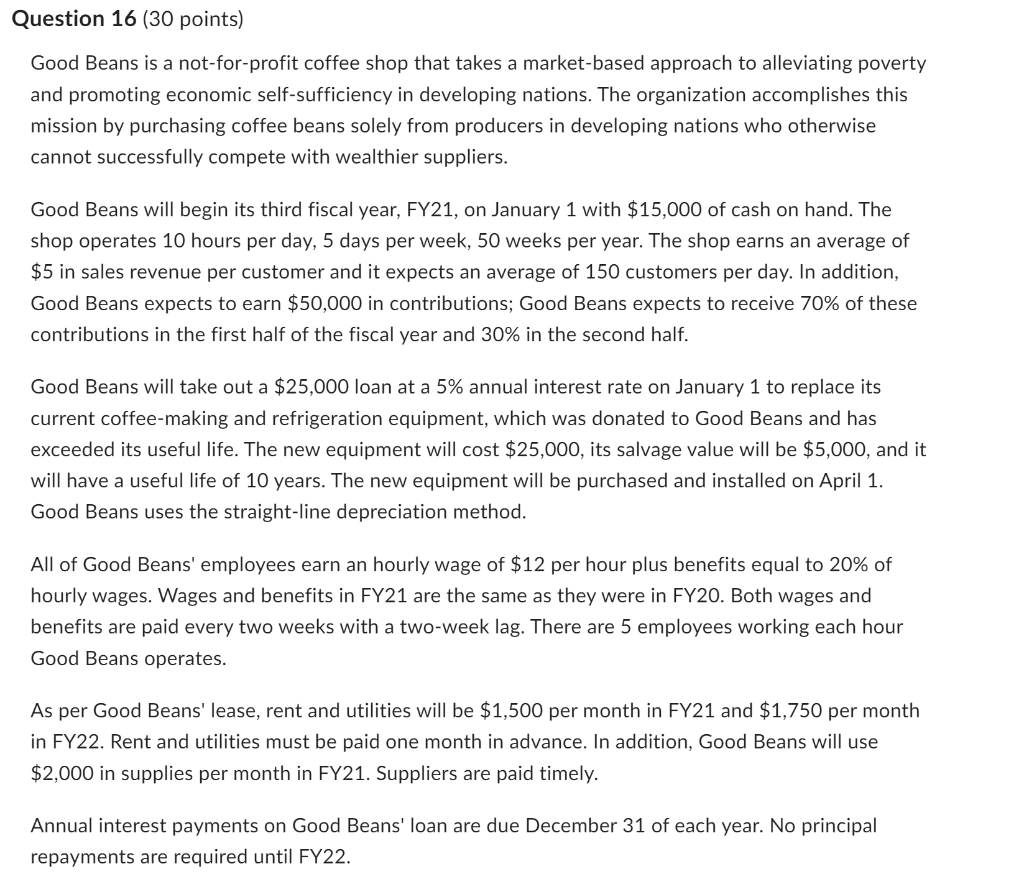

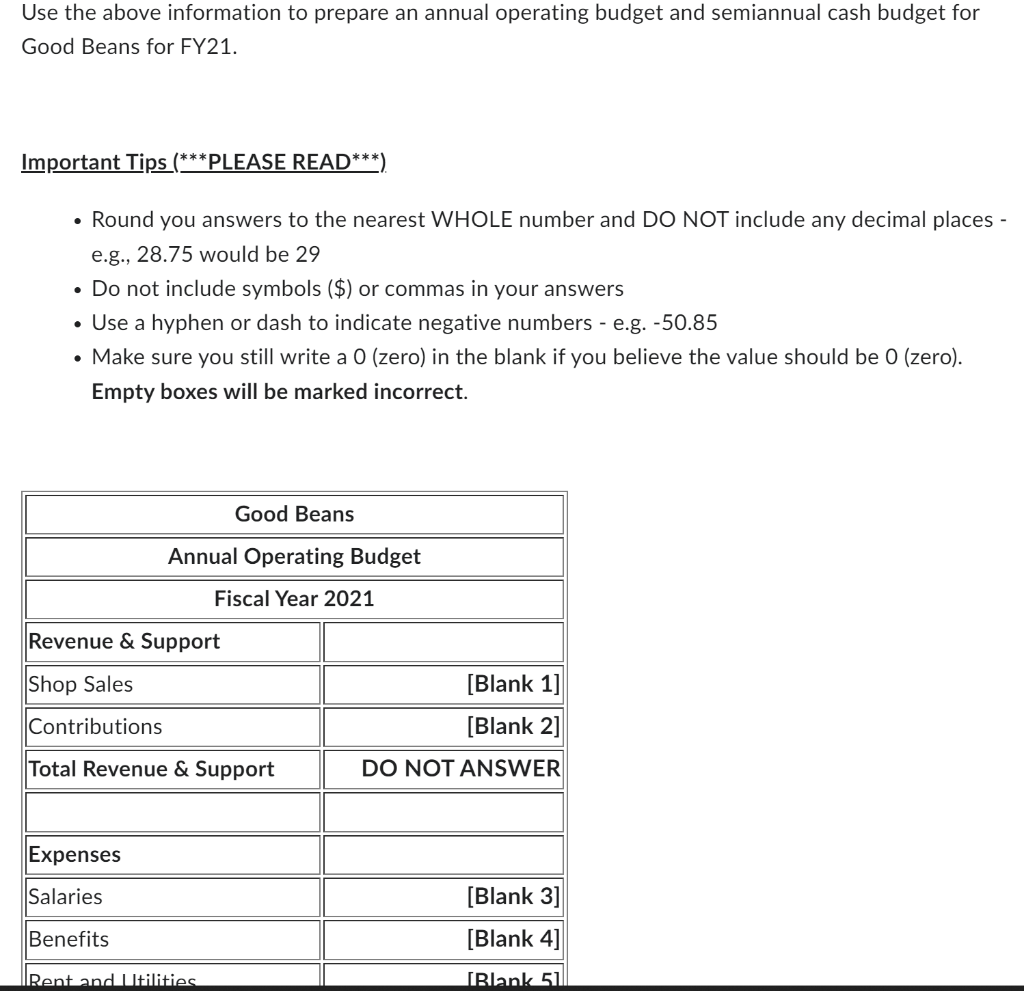

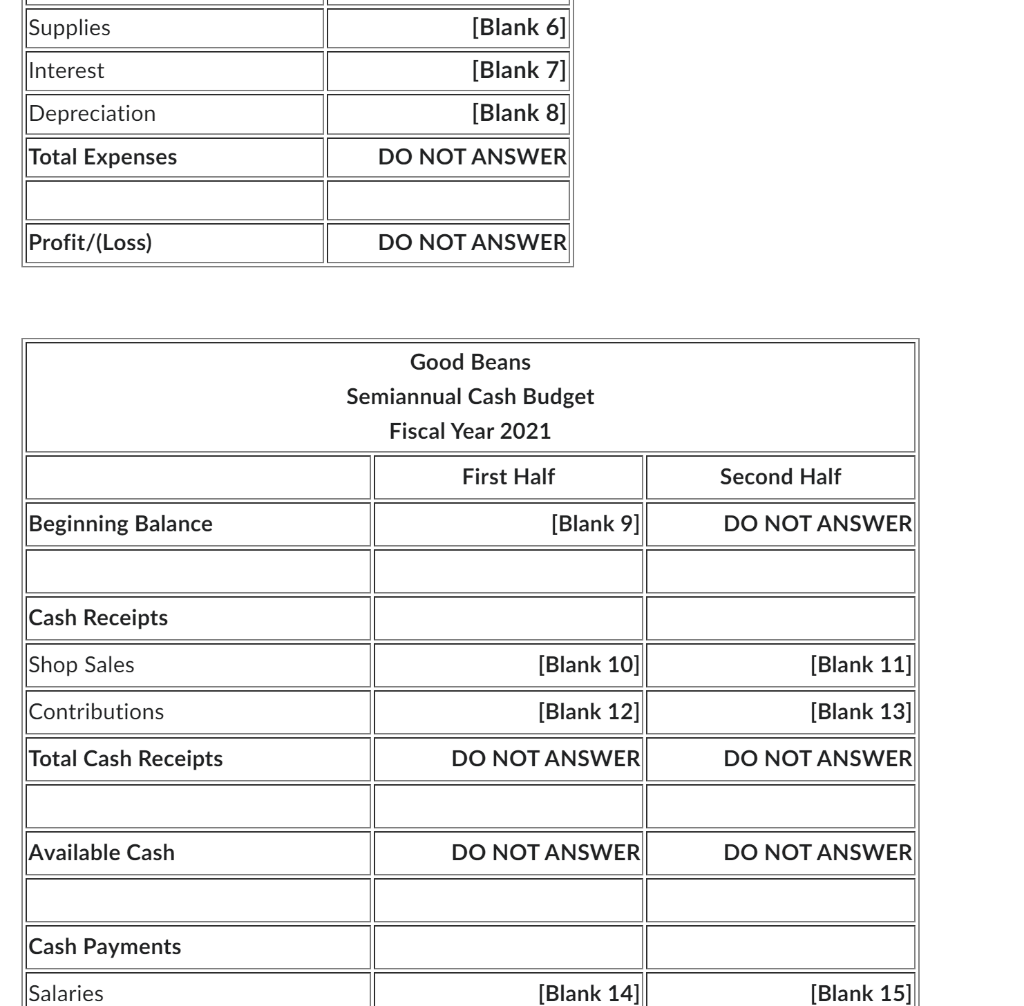

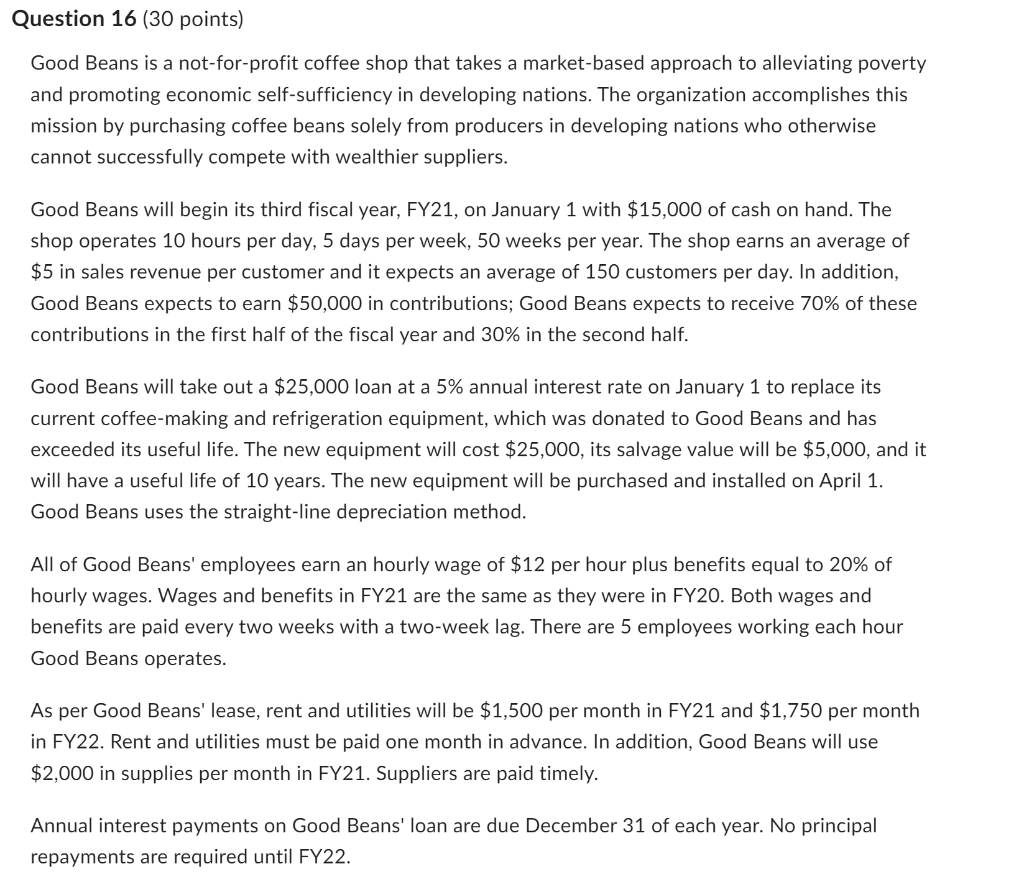

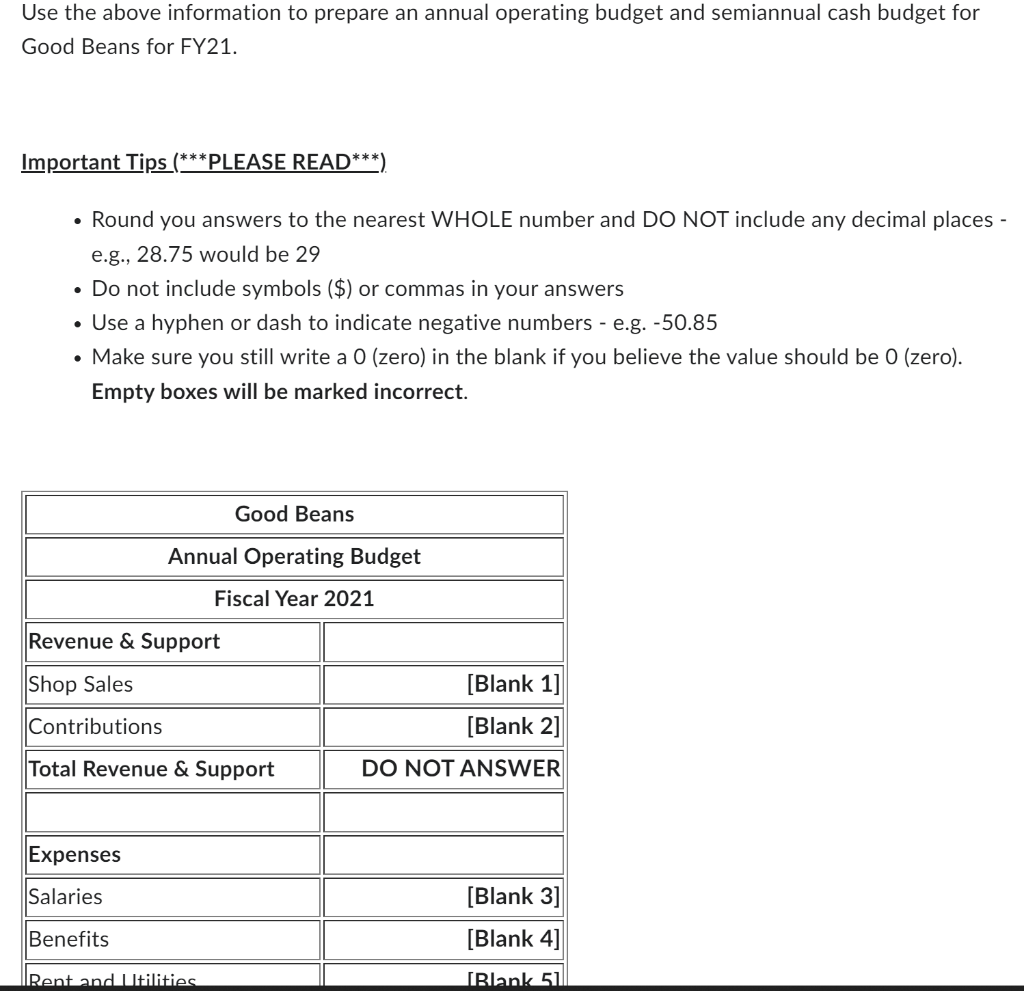

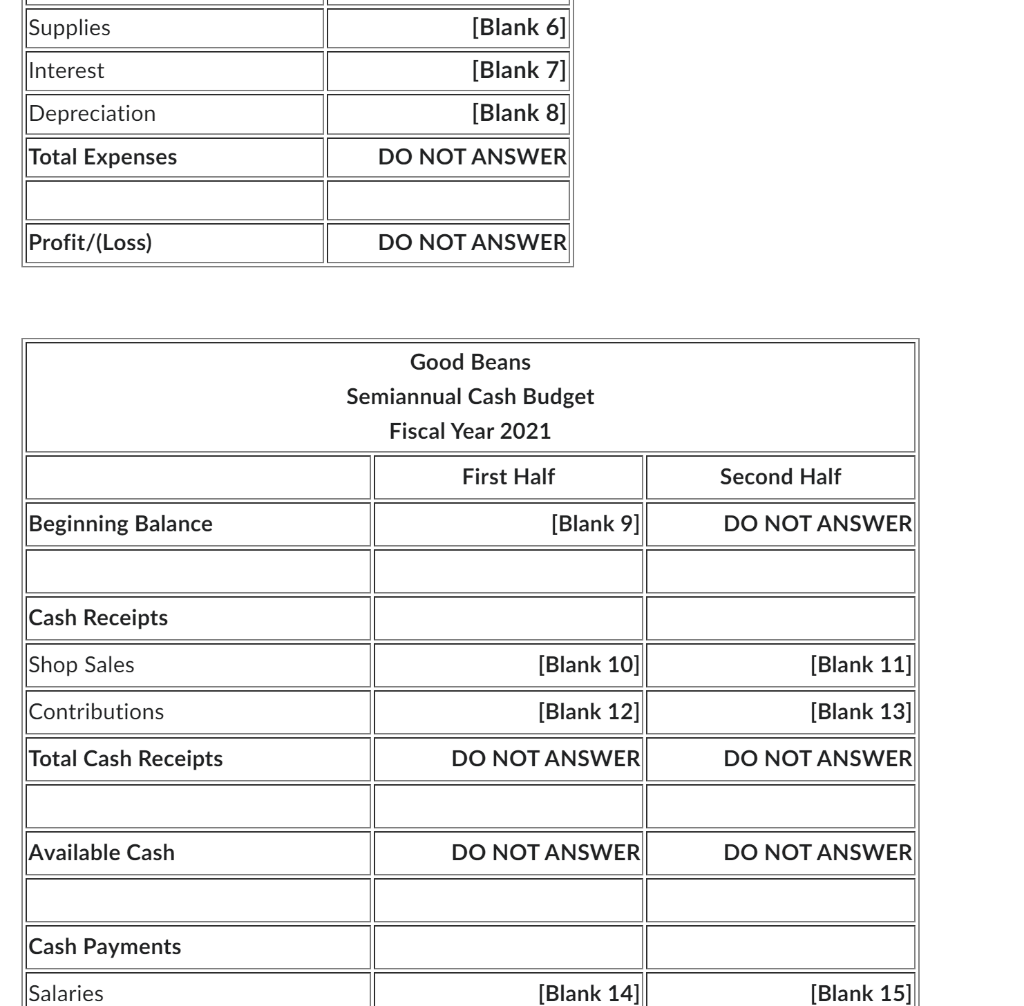

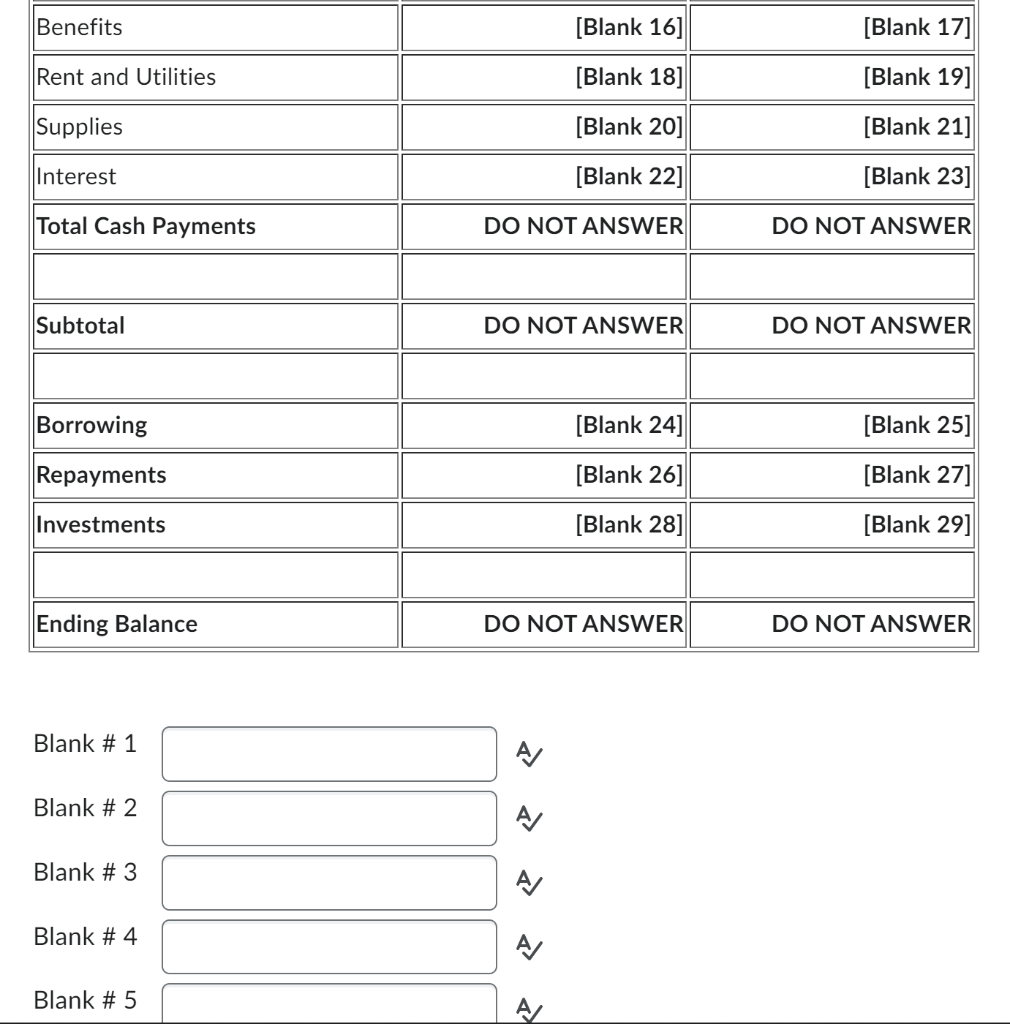

Good Beans is a not-for-profit coffee shop that takes a market-based approach to alleviating poverty and promoting economic self-sufficiency in developing nations. The organization accomplishes this mission by purchasing coffee beans solely from producers in developing nations who otherwise cannot successfully compete with wealthier suppliers. Good Beans will begin its third fiscal year, FY21, on January 1 with $15,000 of cash on hand. The shop operates 10 hours per day, 5 days per week, 50 weeks per year. The shop earns an average of $5 in sales revenue per customer and it expects an average of 150 customers per day. In addition, Good Beans expects to earn $50,000 in contributions; Good Beans expects to receive 70% of these contributions in the first half of the fiscal year and 30% in the second half. Good Beans will take out a $25,000 loan at a 5% annual interest rate on January 1 to replace its current coffee-making and refrigeration equipment, which was donated to Good Beans and has exceeded its useful life. The new equipment will cost $25,000, its salvage value will be $5,000, and it will have a useful life of 10 years. The new equipment will be purchased and installed on April 1. Good Beans uses the straight-line depreciation method. All of Good Beans' employees earn an hourly wage of $12 per hour plus benefits equal to 20% of hourly wages. Wages and benefits in FY21 are the same as they were in FY20. Both wages and benefits are paid every two weeks with a two-week lag. There are 5 employees working each hour Good Beans operates. As per Good Beans' lease, rent and utilities will be $1,500 per month in FY21 and $1,750 per month in FY22. Rent and utilities must be paid one month in advance. In addition, Good Beans will use $2,000 in supplies per month in FY21. Suppliers are paid timely. Annual interest payments on Good Beans' loan are due December 31 of each year. No principal repayments are required until FY22. Use the above information to prepare an annual operating budget and semiannual cash budget for Good Beans for FY21. Important Tips ( *** PLEASE READ ) - Round you answers to the nearest WHOLE number and DO NOT include any decimal places e.g., 28.75 would be 29 - Do not include symbols (\$) or commas in your answers - Use a hyphen or dash to indicate negative numbers - e.g. 50.85 - Make sure you still write a 0 (zero) in the blank if you believe the value should be 0 (zero). Empty boxes will be marked incorrect. \begin{tabular}{||l||r|} \hline \hline Supplies & [Blank 6] \\ \hline \hline Interest & [Blank 7] \\ \hline \hline Depreciation & [Blank 8] \\ \hline Total Expenses & DO NOT ANSWER \\ \hline \hline & \\ \hline Profit/(Loss) & DO NOT ANSWER \\ \hline \end{tabular} Blank # 2 Blank # 3 Blank # 4 Blank # 5 Good Beans is a not-for-profit coffee shop that takes a market-based approach to alleviating poverty and promoting economic self-sufficiency in developing nations. The organization accomplishes this mission by purchasing coffee beans solely from producers in developing nations who otherwise cannot successfully compete with wealthier suppliers. Good Beans will begin its third fiscal year, FY21, on January 1 with $15,000 of cash on hand. The shop operates 10 hours per day, 5 days per week, 50 weeks per year. The shop earns an average of $5 in sales revenue per customer and it expects an average of 150 customers per day. In addition, Good Beans expects to earn $50,000 in contributions; Good Beans expects to receive 70% of these contributions in the first half of the fiscal year and 30% in the second half. Good Beans will take out a $25,000 loan at a 5% annual interest rate on January 1 to replace its current coffee-making and refrigeration equipment, which was donated to Good Beans and has exceeded its useful life. The new equipment will cost $25,000, its salvage value will be $5,000, and it will have a useful life of 10 years. The new equipment will be purchased and installed on April 1. Good Beans uses the straight-line depreciation method. All of Good Beans' employees earn an hourly wage of $12 per hour plus benefits equal to 20% of hourly wages. Wages and benefits in FY21 are the same as they were in FY20. Both wages and benefits are paid every two weeks with a two-week lag. There are 5 employees working each hour Good Beans operates. As per Good Beans' lease, rent and utilities will be $1,500 per month in FY21 and $1,750 per month in FY22. Rent and utilities must be paid one month in advance. In addition, Good Beans will use $2,000 in supplies per month in FY21. Suppliers are paid timely. Annual interest payments on Good Beans' loan are due December 31 of each year. No principal repayments are required until FY22. Use the above information to prepare an annual operating budget and semiannual cash budget for Good Beans for FY21. Important Tips ( *** PLEASE READ ) - Round you answers to the nearest WHOLE number and DO NOT include any decimal places e.g., 28.75 would be 29 - Do not include symbols (\$) or commas in your answers - Use a hyphen or dash to indicate negative numbers - e.g. 50.85 - Make sure you still write a 0 (zero) in the blank if you believe the value should be 0 (zero). Empty boxes will be marked incorrect. \begin{tabular}{||l||r|} \hline \hline Supplies & [Blank 6] \\ \hline \hline Interest & [Blank 7] \\ \hline \hline Depreciation & [Blank 8] \\ \hline Total Expenses & DO NOT ANSWER \\ \hline \hline & \\ \hline Profit/(Loss) & DO NOT ANSWER \\ \hline \end{tabular} Blank # 2 Blank # 3 Blank # 4 Blank # 5